Can you really live in Colombo on LKR 100,000?

The honest answer: yes, but only with a very disciplined, no-frills lifestyle and usually by making a few trade-offs on housing, social life, and comfort.

Most international cost-of-living trackers estimate that a single person in Colombo needs well over LKR 300,000 a month for a “typical” lifestyle including rent, eating out, and some entertainment. That means LKR 100,000 is roughly a bare-bones, survival-level budget, not a comfortable one.

To make it work, you will almost certainly need to:

- Live in a cheaper suburb or shared accommodation rather than in central Colombo, to keep rent below ~LKR 35,000–40,000.

- Rely mainly on home-cooked meals and local markets instead of supermarkets and restaurants.

- Use public transport (bus/train) and limit ride-hailing or owning a car.

- Cut “lifestyle” spending (cafés, bars, shopping, subscriptions) to a minimal, planned amount.

- Avoid debt and big-ticket purchases; even small loan payments can break this budget.

On this income, you are unlikely to:

- Save meaningful amounts consistently (beyond perhaps 5–10% in a good month).

- Afford private healthcare, frequent dining out, or regular paid entertainment.

- Live alone in a modern apartment in a prime Colombo neighborhood.

Where LKR 100,000 can be enough is if you:

- Have support from family (e.g., living in a family home or paying below-market rent).

- Share costs with a roommate or partner, effectively doubling household income.

- Supplement your salary with side gigs or freelance work, turning 100,000 into your “base,” not your ceiling.

In short, surviving in Colombo on LKR 100,000 is possible with strict budgeting and smart hacks, but thriving usually requires either a higher income or additional support.

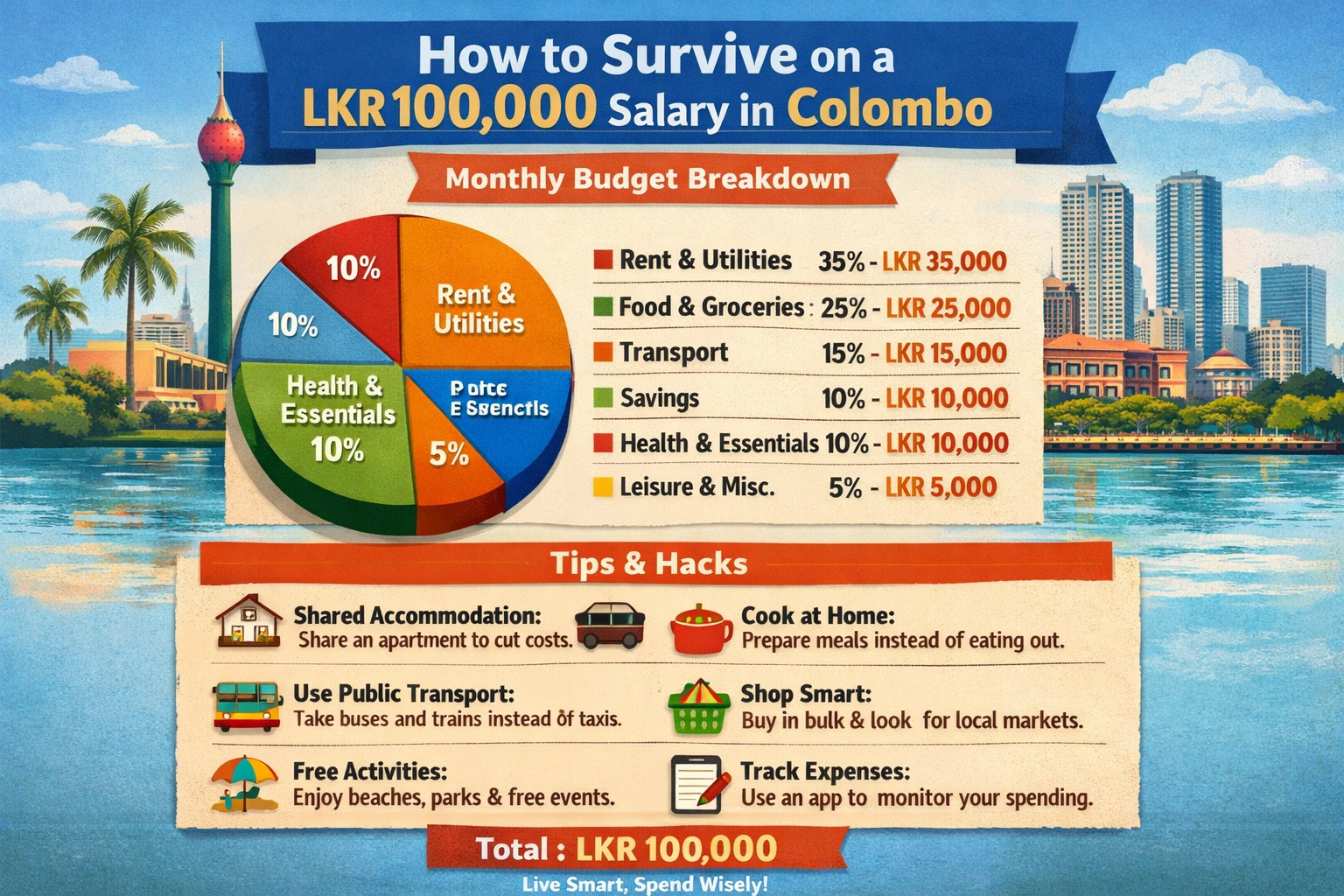

Sample budget breakdown for a LKR 100,000 salary

Here is a lean monthly budget for a single person in Colombo living on a LKR 100,000 take-home salary. Adjust up or down based on your priorities and whether you live with family/roommates.

| Category | Suggested Amount (LKR) | Notes / Hacks |

|---|---|---|

| Rent & utilities | 30,000 | Room in shared apartment or annex in suburbs; keep electricity low (fan instead of AC, LED bulbs), basic internet split with roommates. |

| Groceries & cooking | 22,000 | Cook most meals at home, buy rice, dhal, veggies in bulk, use weekly pola, carry lunch to work 3–4 days a week. |

| Transport | 10,000 | Use buses/trains as default, ride-share only at night or when late, plan routes to avoid multiple changes. |

| Mobile & internet | 3,000 | Use budget data packs, rely on office/home Wi‑Fi, avoid auto-renewing add-ons you don’t need. |

| Healthcare & meds | 3,000 | Keep a basic monthly buffer for prescriptions, over-the-counter meds, and occasional doctor visits. |

| Personal care & household | 5,000 | Toiletries, cleaning supplies, laundry, haircuts; buy store brands and bulk when discounted. |

| Debt payments | 5,000 | Minimum on credit cards/loans; if you have no debt, redirect this to savings or an emergency fund. |

| Savings / emergency fund | 10,000 | Automate a transfer on payday; aim for at least one month of expenses, then build toward three. |

| Social life & misc. | 12,000 | Occasional café/fast food, streaming, gifts, small treats – when it’s gone, stop discretionary spending. |

This sample totals LKR 100,000 and assumes a no-frills lifestyle: shared housing, home-cooked food most days, and strict control over impulse spending. If your rent or commuting costs are higher, the first places to trim are eating out and non-essential subscriptions.

Everyday hacks to stretch your rupees

Living on LKR 100,000 in Colombo means every small saving adds up. These practical tweaks can free up several thousand rupees a month without feeling deprived.

Food & groceries

- Cook in batches: Plan 2–3 base curries for the week (dhal, potato, lentil soup) and rotate sides. You cut gas, electricity, and impulse orders.

- Buy where restaurants buy: Use Pettah/wholesale markets for rice, dhal, spices, and onions instead of small supermarkets.

- Local over imported: Choose local rice, seasonal veg, and Sri Lankan brands; avoid imported snacks, cheese, cereal, and soft drinks.

- Pack your lunch: Taking lunch from home even 3 days a week can save more than a few thousand rupees monthly.

- Use “price per 100g” logic: Bigger pack ≠ cheaper; compare unit prices on shelf labels before buying.

Transport & commuting

- Pick one main mode: Commit to bus/train for work and reserve tuk-tuks for late nights or emergencies.

- Cluster your errands: Do banking, shopping, and visits in one trip to cut multiple tuk rides.

- Share rides: Split taxis or app rides with colleagues living along your route.

Rent & utilities

- Look just outside hot zones: Areas slightly away from central Colombo (or sharing with a roommate) can slash rent.

- Beat the AC habit: Use fans, cross-ventilation, and curtains; set AC to 26–28°C and limit to sleeping hours.

- Electricity discipline: Turn off plugs, use LED bulbs, microwave instead of oven, and pressure cooker for rice/curries.

Lifestyle & subscriptions

- One paid entertainment at a time: Keep only one streaming service; rotate monthly if needed.

- Free fun first: Galle Face, public beaches, free events, and meetups before cafés, bars, and malls.

- Cash envelope for “fun money”: Withdraw a fixed amount for eating out/entertainment; when it’s gone, you stop.

- Side income mindset: Offer tuition, freelancing, baking, or reselling online to add even LKR 10,000–20,000 to your budget.

Staying afloat: debt, savings, and side income

1. Deal with debt strategically

- List all debts (credit cards, loans, buy-now-pay-later) with amounts, interest rates, and minimum payments.

- Cap total monthly debt payments at about LKR 10,000–15,000 on a 100,000 salary. If you are above this, call banks and negotiate longer tenures or lower interest.

- Use either:

- Snowball: pay off the smallest balance first to free cash quickly.

- Avalanche: pay the highest interest first to save more overall.

- Avoid new EMIs for phones, furniture, or appliances; buy second-hand or delay until you can pay cash.

2. Build a tiny but consistent safety net

- Start with LKR 5,000–7,500 per month for savings, even if you have debt. Treat it like a fixed bill.

- Keep your emergency fund in a separate savings account or micro-savings app so you are not tempted to spend it.

- Aim first for LKR 50,000 (1–2 weeks of expenses), then slowly grow towards 2–3 months of bare-bones costs.

- Channel any bonus, OT, or unexpected income: 50% to debt, 50% to savings.

3. Create side income that fits Colombo life

- Skills you already use at work: freelance design, writing, tutoring (English, ICT, commerce), basic accounting, or admin tasks for small businesses.

- Location-based gigs: food delivery, ride-hailing, part-time cashiering or barista work on weekends.

- Home-based micro-gigs: home-cooked lunch packs for offices, baking, sewing/alterations, phone repairs, selling curated thrift clothing.

- Target an extra LKR 15,000–25,000 monthly. Direct most of this to:

- Clearing high-interest debt quickly.

- Reaching your first emergency-fund milestone.

4. Simple cash-flow rules to stay above water

- Split each salary as soon as it hits: e.g. 60% essentials, 15% debt, 10% savings, 15% flex/transport.

- Use cash envelopes for food and travel so you see money leaving.

- If you cannot save or pay extra toward debt, your rent or lifestyle is too high for 100,000 – adjust housing, sharing, or commute first.

References

- Expatistan. “Cost of Living in Colombo. Updated Prices Jan 2026.” Expatistan cost of living database for Colombo, including estimated monthly expenses and typical price levels for housing, food, and transport.

- Numbeo. “Cost of Living in Colombo.” Crowdsourced cost-of-living data for Colombo, with detailed breakdowns for rent, groceries, utilities, transportation, and restaurant prices.

- Sri Lanka eVisa Info. “Living Expenses in Colombo in 2026: Complete Cost Guide.” Overview of average living costs in Colombo, covering housing, food, transportation, healthcare, and daily expenses for residents and expats.

- Wise. “Cost of Living in Sri Lanka in 2025.” Guide to typical monthly budgets in Sri Lanka, explaining average costs for accommodation, food, bills, and everyday spending, with context for local incomes.

- MyLifeElsewhere. “Cost of Living in Sri Lanka Compared to United States.” Comparative cost-of-living data highlighting differences in housing, groceries, restaurants, and transportation between Sri Lanka and the U.S., useful for benchmarking a Colombo budget.