Vehicle Leasing vs. Personal Loans: The Core Differences

While both vehicle leasing and personal loans can get you behind the wheel of a new car in Sri Lanka, they work in fundamentally different ways. Understanding these core distinctions is the first step in deciding which financial path is right for you.

- Ownership of the Vehicle: This is the most crucial difference. With a lease, the financial institution (the lessor) legally owns the vehicle for the entire lease period. You are essentially paying a monthly rental for the right to use it. In contrast, when you take a personal loan, you use the borrowed money to buy the car outright. The vehicle is registered in your name from day one, making you the legal owner.

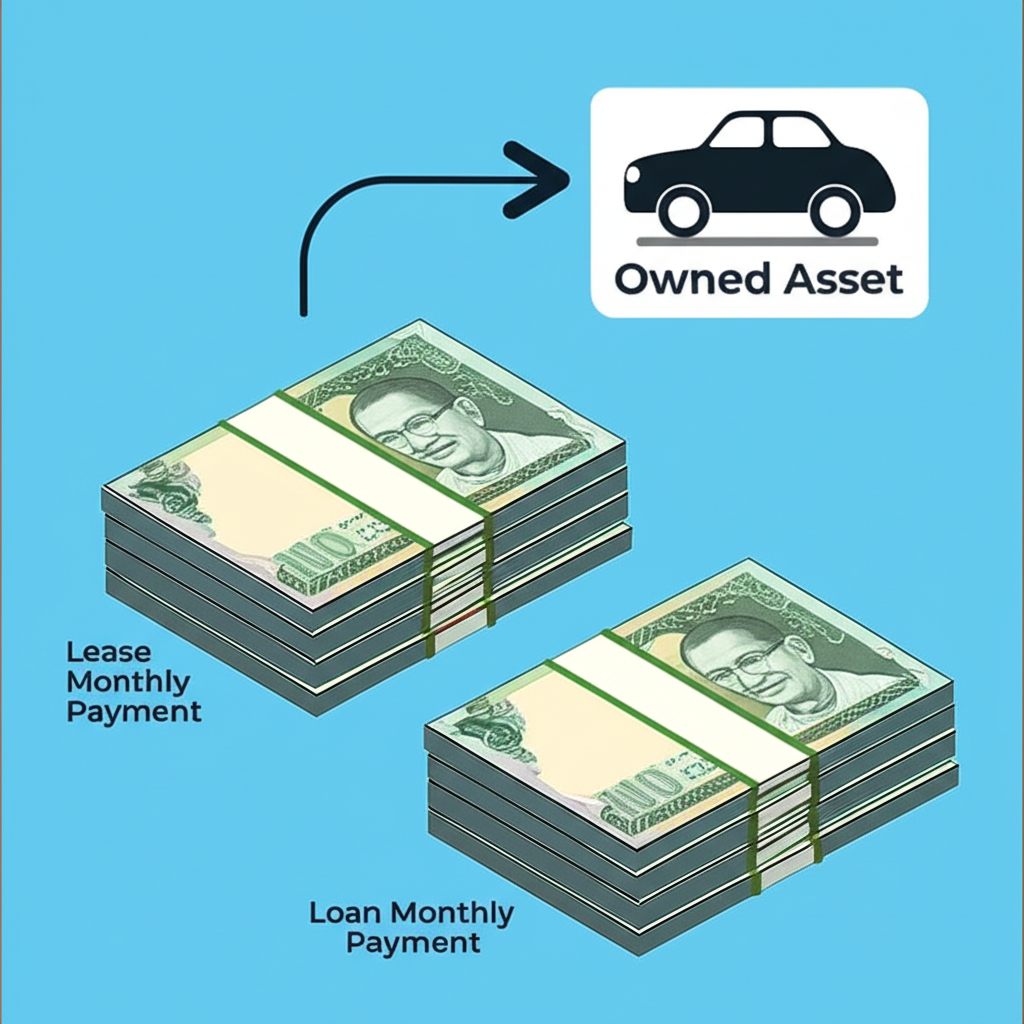

- Payment Structure and Cost: Lease payments are often lower than loan installments. This is because you are financing the vehicle’s depreciation during the lease term, not its full market value. A personal loan, however, finances the entire cost of the car, plus interest. This typically results in higher monthly payments but builds equity faster.

- End-of-Term Options: At the end of a lease term, you have flexibility. You can usually return the vehicle, start a new lease on a newer model, or buy the car by paying its remaining “residual value.” With a personal loan, the process is simpler: once you make the final payment, the loan is complete, and you own the vehicle with no further obligations or decisions to make.

- Freedom and Restrictions: Since you don’t own a leased vehicle, there are often restrictions. You may be limited in making modifications, and you must maintain the vehicle according to the leasing company’s standards. With a personal loan, the car is yours to do with as you please—modify it, sell it, or drive it as much as you want without answering to a lender.

The Financial Breakdown: Costs and Commitments

When financing a vehicle in Sri Lanka, the numbers tell different stories for leasing and personal loans. A lease is structured like a long-term rental where you pay for the use of the vehicle, while a loan is a direct path to ownership. Understanding their unique cost structures is key to making a sound financial decision.

Vehicle Leasing

Leasing typically requires a smaller initial down payment, making it more accessible upfront. Your monthly payments, often called ‘rentals’, are also generally lower. This is because you are primarily paying for the vehicle’s depreciation during the lease term, not its full market value.

However, be mindful of the end-of-term commitments. You don’t own the car when the lease ends. To purchase it, you must pay a final lump sum known as the residual value. Furthermore, exceeding pre-agreed mileage limits or returning the car with significant wear and tear can result in hefty penalties.

Personal Loan

A personal loan demands a more substantial upfront down payment, often a significant percentage of the vehicle’s price. Consequently, your monthly loan instalments will be higher than lease rentals, as you are repaying the entire vehicle cost plus interest over the loan period.

The primary advantage is clear: ownership. Once you make the final payment, the vehicle is yours. It becomes a tangible asset you can sell, modify, or drive without restrictions. While the initial and monthly costs are higher, you are building equity, and the payments eventually end, leaving you with no further vehicle-related debt.

In summary, the choice hinges on your financial priorities. Leasing offers lower upfront and monthly costs, ideal for those seeking affordability and the ability to drive a newer car every few years. A personal loan requires a larger financial commitment but results in full ownership and potentially a lower total cost over the long term.

Lifestyle and Practicality: Which Fits Your Needs?

Choosing between a lease and a personal loan goes beyond the numbers; it’s about how a vehicle fits into your life. Your driving habits, long-term goals, and desire for ownership are key factors in this very personal decision.

The Case for a Personal Loan: The Path to Ownership

A personal loan is for those who view a car as a long-term asset. If the pride of owning your vehicle is important, this is your path. It offers complete freedom:

- No Restrictions: Drive as many kilometres as you wish, from Colombo to Jaffna and back, without worrying about penalties.

- Full Control: You can modify your vehicle, sell it whenever you choose, or even use it as collateral for another loan in the future.

- Long-Term Value: Once the loan is paid off, the car is 100% yours. It becomes a valuable asset, which holds significant appeal in the Sri Lankan market.

This option best suits those who plan to keep their car for many years or have unpredictable, high-mileage driving needs.

The Case for Leasing: The Path of Flexibility

Leasing is ideal for individuals who prioritise lower monthly payments and enjoy driving a new vehicle every few years. It’s about convenience and predictable costs.

- Lower Outgoings: Monthly lease payments are often lower than loan repayments, freeing up cash for other priorities.

- Stay Modern: Enjoy the latest technology, safety features, and fuel efficiency by upgrading to a new model at the end of your lease term.

- Fewer Hassles: You avoid the long-term worries of maintenance and the challenges of reselling an older vehicle in a competitive market.

This is perfect for the urban professional, a family that values having a new, reliable car, or anyone who prefers not to be tied down to a long-term asset.

Ultimately, the best choice depends on you. Consider whether you value the freedom and long-term equity of ownership (personal loan) or the flexibility and lower monthly costs of driving a newer car more often (leasing).

The Verdict: A Checklist for Sri Lankan Car Buyers

Choosing between a lease and a personal loan isn’t about which is definitively better—it’s about what’s better for you. Your financial standing, driving habits, and long-term goals will determine the right path. Use this quick checklist to see which option aligns with your needs.

Choose a Vehicle Lease if…

- Lower Monthly Payments are Your Priority: You need a more manageable monthly commitment and are comfortable not owning the vehicle at the end of the term.

- You Love Driving a New Car: You prefer to upgrade your vehicle every three to five years to enjoy the latest models and technology.

- A Large Down Payment is a Hurdle: You have limited funds for an initial payment. Leases often require less money upfront than a traditional loan.

- You Value Simplicity: You appreciate the convenience of a package where the leasing company handles registration and often bundles insurance, simplifying the process.

- You Won’t Customise: You are happy with the car as it is and have no plans for major modifications, which are typically restricted under a lease agreement.

Opt for a Personal Loan if…

- Ownership is the Ultimate Goal: You want the vehicle title in your name. Once the loan is paid, the car is 100% yours to keep or sell.

- You’re in it for the Long Haul: You plan to keep your car for many years, well beyond the typical loan period, making your investment worthwhile.

- You Have a Solid Down Payment: You have saved a substantial amount to put down, which will reduce your loan amount and overall interest costs.

- Freedom and Flexibility are Key: You want the unrestricted right to sell, trade, or modify your vehicle at any time, without seeking permission or facing penalties.

- You Want to Build Equity: Each payment brings you closer to owning a valuable asset. This equity can be used towards your next vehicle purchase.

References

- Leasing vs. Bank Loan for your Vehicle – Ikman.lk

- Understanding the ins and outs of vehicle leasing in Sri Lanka – Lanka Business Online

- Vehicle Loans – Sampath Bank PLC

- HNB Leasing | Vehicle & Equipment Leasing Facilities in Sri Lanka

- Personal Loans – Commercial Bank of Ceylon

- Leasing – LOLC Finance

- Loan to Value Ratios for Credit Facilities for Motor Vehicles – Central Bank of Sri Lanka