The first step in managing your taxes is to figure out your Australian tax residency status. This is crucial because it is not the same as your citizenship or visa. The Australian Taxation Office (ATO) has its own rules to decide if you are an “Australian resident for tax purposes,” which directly impacts your take-home pay and the overall [cost of living breakdown](https://www.lankawebsites.com/home-and-life-style/immigration/cost-of-living-breakdown-is-migrating-from-sri-lanka-to-aus-nz-worth-the-sacrifice/).

Why is this so important? If you are an Australian tax resident, you must pay tax on your worldwide income. This includes your salary in Australia, rental income from a property in Sri Lanka, and interest from bank accounts back home. However, if you are a foreign resident for tax purposes, you generally only pay tax on your Australian-sourced income.

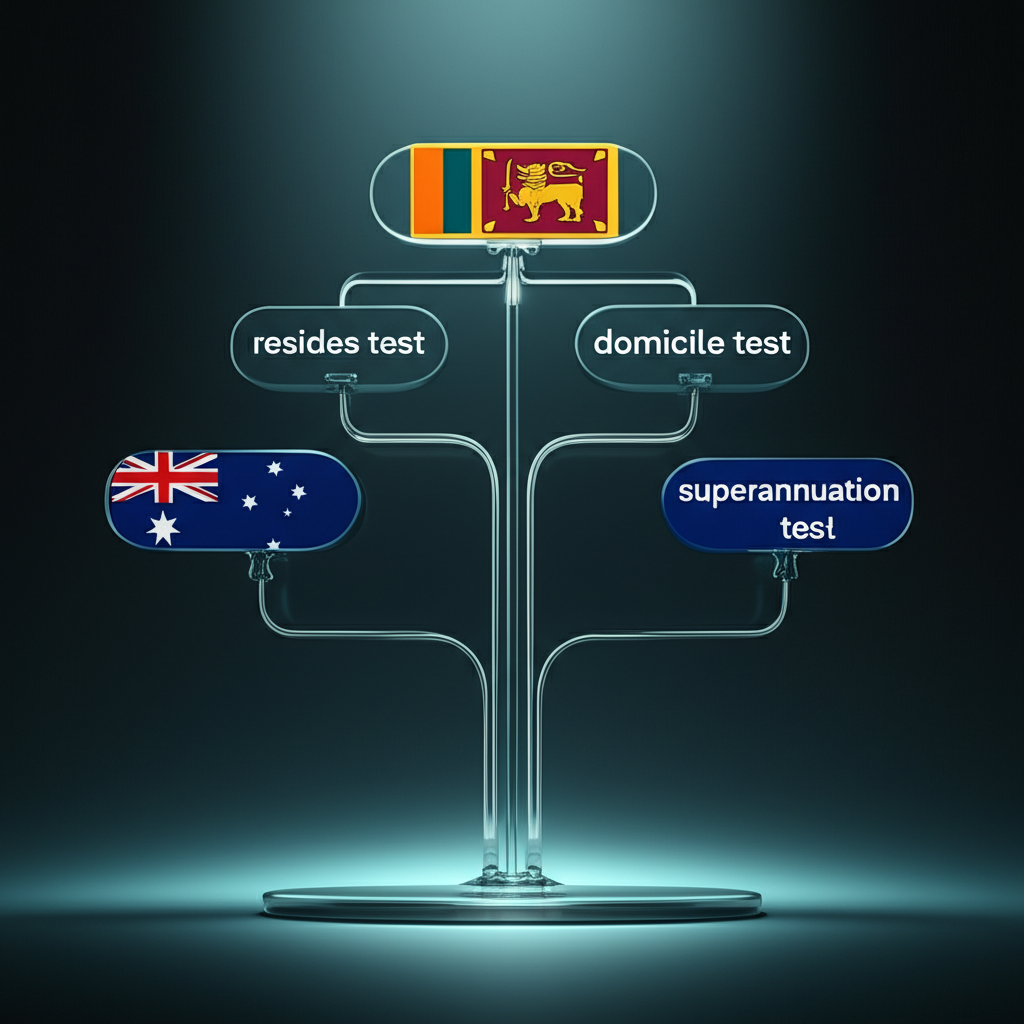

The ATO uses a few tests to decide your status. The main one is the resides test, which looks at your behaviour and connections to see if you genuinely live in Australia. The ATO considers factors like:

* Where your family and home are located.

* Your daily life and social connections in Australia.

* Your intention to make Australia your long-term home.

A simpler rule is the 183-day test. If you are physically present in Australia for more than half the financial year (183 days or more), you are usually considered a tax resident. This often applies to Sri Lankans on work or student visas, even if they plan to return home later. For example, a fly-in, fly-out (FIFO) worker might have their family in Colombo but spend over 200 days a year in Western Australia, making them a tax resident in the eyes of the ATO.

Because every situation is different, it is wise to use the ATO’s online tools or speak with a tax professional. Understanding your tax residency is very different from the rules that govern [2026 Aus visa changes for Sri Lankans](https://www.lankawebsites.com/home-and-life-style/immigration/2026-aus-visa-changes-for-sri-lankans-level-2-risks-partner-visa-pitfalls-employer-sponsorship/).

If you are an Australian resident for tax purposes, the Australian Taxation Office (ATO) needs to know about all your income. This doesn’t just mean the money you earn in Australia. It includes any income you get from overseas, including from Sri Lanka. It’s a common mistake to think that money earned and kept in Sri Lanka does not need to be declared in Australia, but the rules are clear.

You must report various types of foreign income on your Australian tax return. This often includes:

* Rental income: Money you earn from a property you own back home. Knowing the rules on how to buy property in Sri Lanka from abroad is the first step, but declaring the rent is key for compliance.

* Bank interest: Interest from Sri Lankan bank accounts, including fixed deposits. Even if you reinvest it, it’s still considered income.

* Dividends: Payments from shares you own in Sri Lankan companies.

* Capital gains: Profit you make from selling an asset, like land or shares, in Sri Lanka.

Declaring this income doesn’t always mean you’ll be taxed twice. Australia has tax treaties to prevent this. If you have already paid tax on your income in Sri Lanka, you can usually claim a Foreign Income Tax Offset (FITO). This credit reduces the amount of tax you have to pay in Australia. To claim this, you need proof that you paid tax in Sri Lanka, so keeping good records is very important.

The ATO shares data with tax offices in other countries, so it’s best to declare everything honestly. Keeping track of your earnings from different sources, such as comparing the best fixed deposit rates in Sri Lanka, will help you stay organised for tax time. Proper declaration ensures you meet your legal duties and avoid penalties.

Specific Tax Advice for FIFO Workers

Fly-In, Fly-Out (FIFO) work offers high pay but comes with a unique lifestyle. Smart tax planning can help you make the most of your earnings. Because you travel for work and often need special gear, you may be able to claim several expenses to lower your taxable income and get a larger refund.

The key to a good tax return is keeping excellent records. Use a diary or app to track your expenses and keep all your receipts. For FIFO workers, some common tax deductions include:

- Travel Costs: You can often claim the cost of driving your car between your home and the airport. You may also claim travel between the remote airport and your work site if it’s not paid for by your employer. A logbook is essential to prove your car use.

- Work Clothing and Laundry: The cost of buying and cleaning uniforms with a company logo is deductible. You can also claim protective gear like steel-cap boots, safety glasses, and high-vis clothing.

- Tools and Equipment: If you buy your own tools or equipment for the job, you can claim the cost. For expensive items, you may claim the value over several years.

- Phone and Internet: You can claim the portion of your phone and internet bills that directly relates to your work.

A significant tax refund can boost your savings and help you reach your financial goals faster. Many Sri Lankan expats use this money to invest back home. For example, a refund could become a down payment on a property. Learning how to buy property in Sri Lanka from abroad can turn your FIFO work into a long-term asset for your family.

Always consult with a registered tax agent who has experience with FIFO workers to ensure you are claiming everything you are entitled to.

Ensuring ATO Compliance and Avoiding Common Pitfalls

The Australian Taxation Office (ATO) requires all Australian residents for tax purposes to declare their worldwide income. This includes the salary you earn in Australia as well as any money you make in Sri Lanka. Staying compliant is crucial to avoid fines and legal issues. The key is honesty and good record-keeping.

One of the most common mistakes is failing to report foreign income. Many expats believe that if tax was already paid in Sri Lanka, they do not need to mention it in their Australian tax return. This is incorrect. You must declare income from all sources, such as:

- Rental income from a property in Colombo or Kandy.

- Interest earned from a Sri Lankan fixed deposit or savings account.

- Dividends from shares on the Colombo Stock Exchange.

- Salary or wages from a job you worked while visiting Sri Lanka.

The ATO has information-sharing agreements with many countries, making it easier for them to identify undeclared foreign income. To avoid problems, keep detailed records of all your earnings and the foreign tax you’ve paid. These documents are essential for correctly calculating your Foreign Income Tax Offset (FIFO) and reducing your Australian tax bill.

Managing finances across two countries can be complex. Whether you are using the best remittance apps to send money home or managing investments, clear records are vital. If you earn rent from an investment property, for example, it’s not enough to follow the rules on how to buy property in Sri Lanka from abroad; you must also report the income it generates. When in doubt, it is always best to consult a tax professional who specialises in expat tax affairs. Their guidance can save you from costly mistakes and ensure you meet all your obligations.

- Australian Taxation Office (ATO) – Your tax residency: Official guidance from the ATO to help determine if you are an Australian resident for tax purposes, a critical first step for any expat.

- Australian Taxation Office (ATO) – Foreign and worldwide income: The ATO’s detailed page on the requirement for Australian tax residents to declare income from all sources, both within and outside Australia.

- The Treasury – Australia & Sri Lanka Tax Treaty: The full text of the Double Taxation Agreement between Australia and Sri Lanka, which helps prevent double taxation and provides clarity on taxing rights between the two nations.

- PwC Tax Summaries – Australia: A comprehensive overview of Australia’s personal tax system, including rules on residence and foreign income, from a leading global professional services firm.