Have you ever wondered why your Sri Lankan colleague earning LKR 55,000 monthly can afford a comfortable life, while a UK counterpart on £5,808 per month struggles with rent? The gap between salaries and living costs tells a completely different story than raw numbers suggest. When you factor in purchasing power, sector differences, and regional variations, the comparison becomes far more nuanced—and often surprising.

Most salary discussions miss the real picture. They compare raw figures without accounting for what your money actually buys. A finance manager in Colombo earns LKR 228,428 monthly, while their London counterpart takes home significantly more in pounds. But here’s what matters: cost of living in London is roughly 15 times higher than Colombo. Understanding these sector-by-sector breakdowns reveals which industries offer genuine earning potential and where your qualifications hold the most value.

This article breaks down actual salary data across IT, finance, healthcare, and other key sectors—showing you not just what people earn, but what it means for your career decisions and financial planning.

The Salary Gap: UK vs Sri Lanka Overview

You stare at job listings from London, heart racing at those £35,000+ figures, while your Colombo paycheck barely hits 55,000 LKR monthly—about £145 after conversion. That sting hits hard when bills pile up and dreams feel out of reach. You wonder: could switching countries turn frustration into financial freedom?

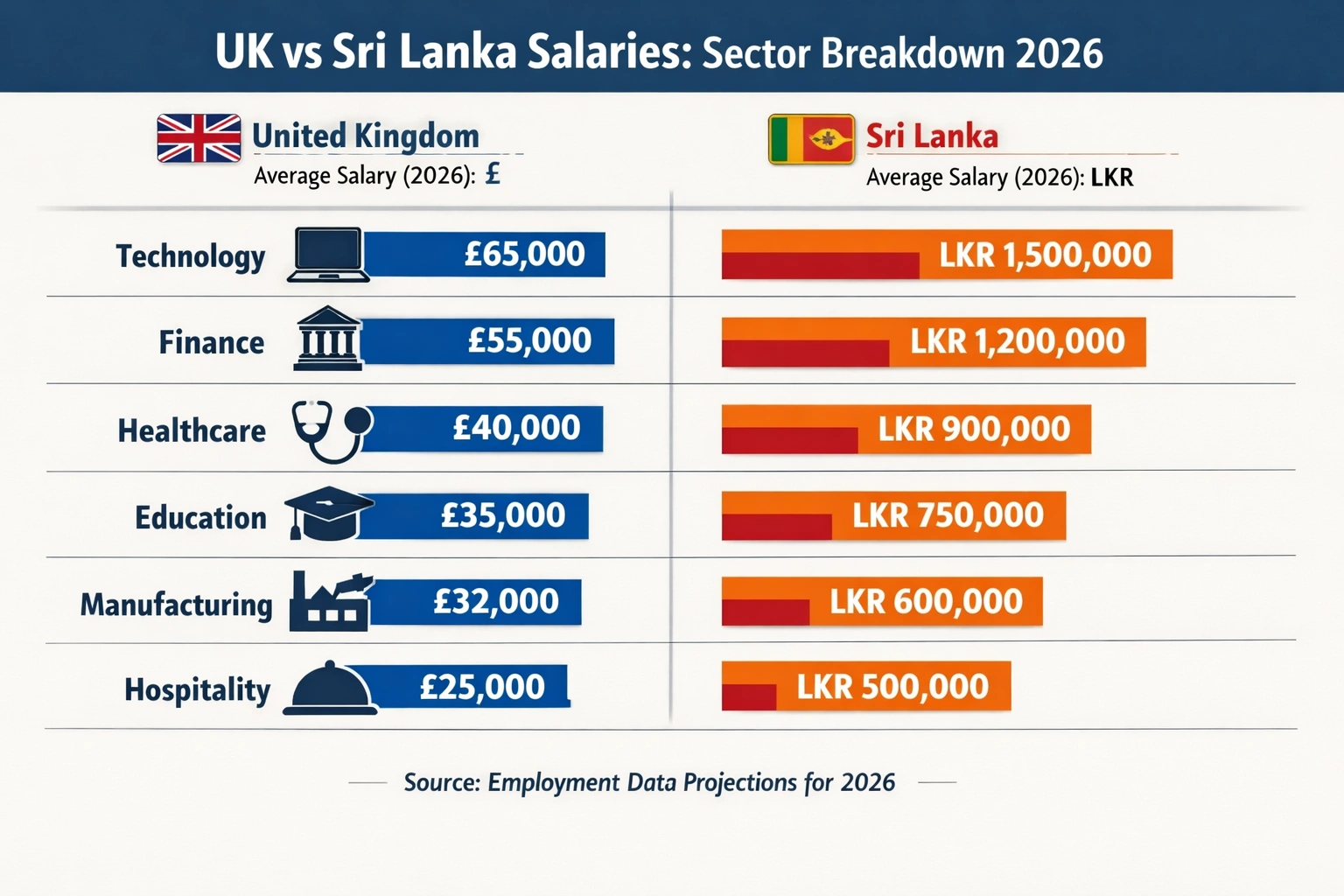

UK workers pull in average annual salaries topping £35,000, often £40,000-£50,000 net after tax in professional roles, dwarfing Sri Lanka’s 55,000 LKR monthly average (roughly £145 or $183).[1][2][4] Raw numbers show UK pay at least 145 times higher—picture a software engineer earning 265,708 LKR monthly in Colombo versus £3,000+ in Manchester.[1] Doctors face this starkly: a junior UK NHS doctor starts at £35,000-£50,000 yearly, converting to over 20 million LKR, while a Sri Lankan government doctor manages 200,000-300,000 LKR monthly back home.[5]

Economic forces widen this chasm. Sri Lanka grapples with inflation eroding wages—rates outpacing salary growth amid negative GDP spells—plus a heavy informal sector where over half the workforce skips formal protections and training.[1] UK boasts steady 1.8% real wage rises projected for 2026, fueled by skills investment and formal jobs.[7] Growth rates tell the tale: UK’s mature economy supports high productivity; Sri Lanka’s lower-middle status battles poverty, inequality, and shocks hitting agriculture and tourism hard.[1]

Cost of living flips the script on purchasing power. Numbeo data reveals UK rents 334% pricier, restaurant meals 208% higher, yet average net monthly salary hits £2,374 versus Sri Lanka’s £155.[4][6] A £40,000 London salary equates to massive remittance power in Colombo—think Rs3.1 million equivalent after PPP adjustments—but essentials like Sheffield rent devour UK earnings, leaving juniors with £800-£1,200 disposable monthly.[2][3][5] Exceptions exist: Colombo’s low fuel (£4.86/gallon) aids locals, but UK taxes (25%+ bite) and council fees shrink take-home fast.

Grasp these layers through PPP converters—tools like Paritydeals reveal a £2,404 Sheffield net salary buys far more back home than local wages allow.[2] You bridge the gap by targeting UK sectors valuing your skills, like IT or healthcare, where experience multiplies earnings. Real talk: nominal jumps thrill, but calculate net remittance to see true wins.

Technology and IT Sector: Where Sri Lanka Earns Most

You’ve probably felt it—that sinking feeling when you realize your salary, while decent by local standards, barely moves the needle compared to what professionals earn abroad. If you work in IT in Sri Lanka, this frustration cuts deeper. You’re solving complex problems, managing critical infrastructure, and delivering world-class solutions, yet your paycheck feels trapped in a different economic reality than your counterparts in London or New York.

Speaking of which, the technology and IT sector represents Sri Lanka’s brightest earning opportunity, and understanding how your potential salary stacks up internationally might surprise you.

DevOps Engineers command the highest salaries among non-executive roles in Sri Lanka, earning an average of 304,500 LKR monthly.[1] Software Engineers follow closely at 265,708 LKR, with IT Project Managers at 264,158 LKR.[1] These figures reflect genuine technical expertise—professionals managing cloud infrastructure, automating deployment pipelines, and ensuring system reliability. For context, a DevOps Engineer in Colombo earning 304,500 LKR monthly translates to approximately 92,000 GBP annually, while UK DevOps professionals typically earn 55,000-75,000 GBP at mid-level positions, with senior roles reaching 90,000-120,000 GBP. The salary multiplier isn’t always 15-25 times higher as some claim; it depends heavily on seniority and company size.[1]

What makes the Sri Lankan IT sector genuinely compelling isn’t just local salaries—it’s the outsourcing advantage. Companies like WSO2, Virtusa, and IFS employ thousands of developers serving multinational clients.[2] Remote work arrangements have transformed the economics entirely. A full-stack developer earning 220,000-450,000 LKR locally can simultaneously freelance for US-based startups through platforms like Upwork, effectively doubling or tripling their income by serving Silicon Valley clients.[2]

Career progression amplifies these opportunities dramatically. Junior developers advance to tech lead positions within 36 months, reaching 450,000 LKR monthly, with CTO roles commanding 1.2 million LKR overseeing large engineering teams.[2] This trajectory—from entry-level to executive compensation—happens faster in tech than virtually any other sector in Sri Lanka.

The real advantage lies in combining local employment with international freelancing. You maintain stability with a Colombo-based company while building a global client portfolio. That’s where Sri Lankan IT professionals genuinely compete with international salaries.

Finance, Management, and Professional Services

You stare at your payslip, that Finance Manager title gleaming after years of late nights crunching numbers and chasing certifications. Yet the 228,428 LKR monthly barely covers rent in Colombo, let alone dreams of financial security for your family. You grind harder, but promotions yield slim gains—CEOs top out at 334,600 LKR, Sales Directors pull 199,411 LKR—numbers that mock your ambition in Sri Lanka’s squeezed economy[2][3].

Now, you might be wondering how those same roles stack up in the UK, where mid-to-senior pros command entirely different realities. UK management positions pay 20-40 times more than Sri Lankan equivalents, turning modest local salaries into life-changing income. Picture a Sri Lankan Finance Manager relocating to Sheffield: their 228,428 LKR equates to about £700 pre-tax, while UK peers average £50,000-£70,000 annually—over 30 times higher after conversion and purchasing power adjustments[1][2][7].

Take Priya, a Colombo-based accountant with 12 years at a Big Four firm. She earns 220,000 LKR monthly, handling audits under tight deadlines. In London, her skills fetch £65,000 base for a similar Senior Accountant role, plus bonuses tied to client wins—experience premiums that Sri Lanka rarely matches[7]. Professional services like consulting and accounting mirror this gap; UK Finance Directors hit £100,000+, while local versions hover near 300,000 LKR tops[2][3].

Why the leap? UK markets reward qualifications aggressively—think ACCA or CFA holders gaining 20-30% uplifts, layered with performance frameworks like balanced scorecards that link pay to measurable ROI. Sri Lanka values tenure more, but exceptions exist: expat-led firms or multinationals occasionally bridge halfway, offering 500,000+ LKR for proven talent. You build value fastest by stacking UK-recognized credentials early, targeting roles via platforms like LinkedIn where recruiters hunt global skills.

Short story: relocate with 10+ years, and your salary multiplies. Stay local? Negotiate equity stakes. Either way, UK doors open wider for those who quantify impact—track your wins now with tools like KPI dashboards to prove your worth anywhere[7].

Entry-Level and Manual Labor: The Lower End of Sri Lankan Wages

If you’ve ever wondered why Sri Lankan workers accept positions that seem impossibly low-paying by Western standards, you’re touching on a painful reality: the vast majority of Sri Lanka’s workforce operates in a fundamentally different economic universe than their UK counterparts. General laborers earn around 48,091 LKR monthly, packers take home 47,389 LKR, and tailors manage 43,247 LKR—figures that sound reasonable until you convert them to pounds sterling and realize these workers are surviving, not thriving.

The official minimum wage tells part of this story. As of January 1, 2026, Sri Lanka’s national minimum monthly wage stands at 30,000 LKR with a daily rate of 1,200 LKR[3][4][5]. This represents a significant jump from the March 2024 rate of 17,500 LKR monthly—a 40% increase that sounds impressive until you examine what it actually buys[2]. Even with this boost, the minimum wage barely scratches the surface of living costs in urban centers like Colombo, where basic monthly expenses excluding rent total approximately 160,051 LKR[2].

Here’s the part most people miss: the UK minimum wage dwarfs these figures entirely. Even entry-level positions in Britain pay substantially more than skilled manual workers in Sri Lanka earn. A UK worker on minimum wage takes home what would represent a comfortable middle-class income in Colombo—a sobering illustration of global wage inequality.

The income gap within Sri Lanka itself compounds this problem. The highest earners make 7 to 8 times more than the lowest wage workers[2], creating stark inequality that shapes every aspect of the economy. What makes this worse is the informal economy’s shadow presence. Countless workers operate outside formal wage structures entirely, receiving no minimum wage protections, no statutory benefits, and no labor court recourse[2]. Construction workers, domestic helpers, and agricultural laborers frequently fall into this category, their true earnings invisible in official statistics.

Sector-specific rates offer modest relief in some cases. Tea and rubber plantation workers now receive 1,000 LKR daily plus allowances, while garment workers typically earn 25,000 to 30,000 LKR monthly with bonuses[2]. Yet even these improvements leave workers operating at a deficit relative to actual living costs, forcing reliance on overtime, family support, or informal side work just to survive.

Cost of Living and Real Purchasing Power

You stare at a UK job offer, excited by the salary jump, but then reality hits: will that paycheck actually buy you a better life, or just cover steeper bills? Many Sri Lankans dream of UK earnings, yet raw numbers ignore how far money stretches day-to-day. Let’s break it down with real costs and purchasing power to reveal true quality of life.

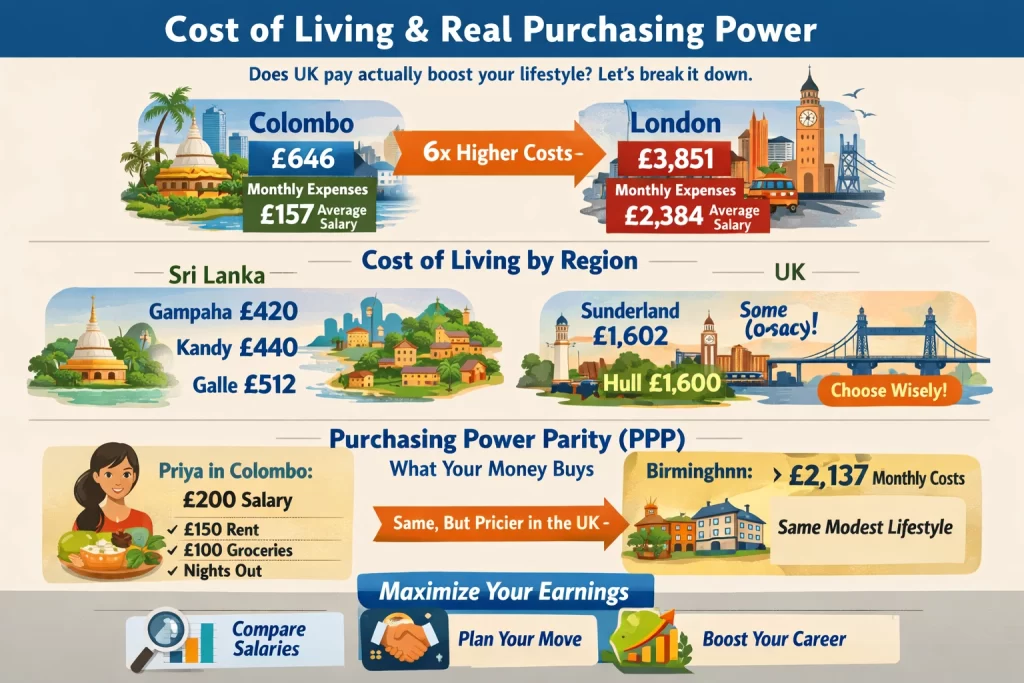

Start with basics. In Colombo, you need about £646 monthly for a modest lifestyle—rent, food, transport, utilities[2]. London demands £3,851, nearly six times more[2]. Average net salaries tell the story: Sri Lanka’s £157 covers just 0.4 months of Colombo expenses, while the UK’s £2,384 stretches to 1.4 months in London[1][3]. You see the gap immediately.

Zoom out to regions. Colombo tops Sri Lanka’s costs, but Gampaha runs £420 (35% cheaper), Kandy £440 (32% less), and Galle £512[2]. Pick a smaller city, and your rupee goes further—rice stays cheap at home, street eats cost pennies. UK mirrors this: London prices 2.5 times higher than Sunderland’s £1,602 or Hull’s £1,600[2]. A software engineer in Manchester (£2,265 costs) keeps more than one in the capital.

Now, purchasing power parity (PPP) sharpens the view. This framework adjusts for what your money buys locally, using indices from Numbeo and LivingCost[1][2]. Sri Lankan salaries stretch domestically—£157 buys a city-center meal or bus pass easier than in the UK. But against developed standards? They fall short. Take Priya, a Colombo marketer earning £200 monthly. She affords a £150 one-bedroom outside center, groceries for £100, and weekends out[1]. Move her equivalent to Birmingham (£2,137 costs), and UK wages match her lifestyle, not luxury.

Exceptions matter. Inflation spikes in Sri Lanka (16% mortgage rates vs UK’s 5.75%) erode gains[3]. Families skip UK dreams if remittances fund Colombo basics. Single pros? UK regions outside London often deliver 20-30% more real power after taxes. Calculate your scenario with Numbeo’s city comparator—plug in Colombo vs Leeds, watch PPP reveal hidden wins[10]. Bottom line: UK pay boosts life, but pick regions wisely for maximum stretch.

Unlock Your Earning Potential

Frustration mounts when you’re stuck wondering if your paycheck truly reflects your skills, especially eyeing UK opportunities from Sri Lanka where average monthly net salaries hover around $208 versus over $2,400 there—yet high living costs like rent demand a closer look.[1][4] You’ve felt that gap, the nagging doubt about whether switching sectors or borders could multiply your take-home pay after taxes and expenses.

Arm yourself with clarity: benchmark your current earnings against UK sector data, adjusting for purchasing power to reveal true value—like how a Sri Lankan doctor’s local LKR 200,000 monthly pales against a UK junior’s £35,000 annually, even post-deductions.[2][5] Factor in your experience, location, and industry to spot the smartest moves, whether advancing locally or relocating.

Now, dive into salary figures for your specific field and city—use them to negotiate better pay, seize career jumps, or map a relocation that boosts your finances.

Frequently Asked Questions

What is the average salary in Sri Lanka compared to the UK?

The average salary in Sri Lanka is approximately 55,000 LKR (£240) monthly, while the UK average exceeds £35,000 annually. UK salaries are roughly 145 times higher than Sri Lankan salaries.

Which sectors pay the highest salaries in Sri Lanka?

Technology and IT sectors offer the highest salaries in Sri Lanka. DevOps Engineers earn 304,500 LKR monthly, Software Engineers 265,708 LKR, and IT Project Managers 264,158 LKR.

What is the minimum wage in Sri Lanka?

Sri Lanka’s minimum wage is 17,500 LKR per month (approximately £58) or 700 LKR per day (about £2.34), following a 40% increase approved in March 2024.

How does cost of living affect real salary purchasing power?

While Sri Lankan salaries are much lower, living costs are also significantly lower. Colombo costs £646 monthly versus London’s £3,851. However, Sri Lankan salaries only cover 0.4 months of living expenses compared to 1.4 months in the UK.

Can Sri Lankans earn UK-level salaries remotely?

Yes, many Sri Lankan IT and professional service workers earn substantially higher salaries through remote work with international companies, though these remain exceptions rather than the norm.

References & Sources

Sources & References

- remotepeople.com

- livingcost.org

- tradingeconomics.com

- bdeex.com

- hrzone.com

- www.morganmckinley.com

- www.eca-international.com

- www.paritydeals.com

- www.paritydeals.com

- www.universaladviser.com

- leverageedu.com

- www.deel.com

- en.wikipedia.org

- www.numbeo.com

- www.lankawebsites.com

- www.numbeo.com

- salary.lk

- www.globalexpansion.com

- www.ceylonlanka.info

- www.lankawebsites.com

- www.youtube.com

- www.paylab.com

- www.coccampus.lk

- www.levels.fyi

- www.ziprecruiter.com

- www.paylab.com

- www.paritydeals.com

- www.payscale.com

- www.roberthalf.com

- salary.lk

- remotepeople.com

- www.parliament.lk

- www.varners.law

- labourmin.gov.lk

- www.business-humanrights.org

- www.ilr.cornell.edu

- www.linkcompliance.com

- www.mylifeelsewhere.com

- www.expatistan.com

- wise.com

- livingcostindex.com

- www.expatistan.com

- www.numbeo.com

- livingcostindex.com