There is a famous joke among newcomers: “In Canada, if you break your leg, the ambulance ride might cost you $200, but fixing the leg is free. If you need painkillers afterwards, that’s on you.” It’s funny because it’s true.

Canada’s public healthcare system, often called “Medicare,” is a massive point of national pride. The idea that you can walk into a hospital for major surgery and walk out without a bill is incredible, especially if you are looking north from the US system. But for immigrants arriving from Sri Lanka, where private consultations are relatively cheap and accessible, the Canadian system can be a shock.

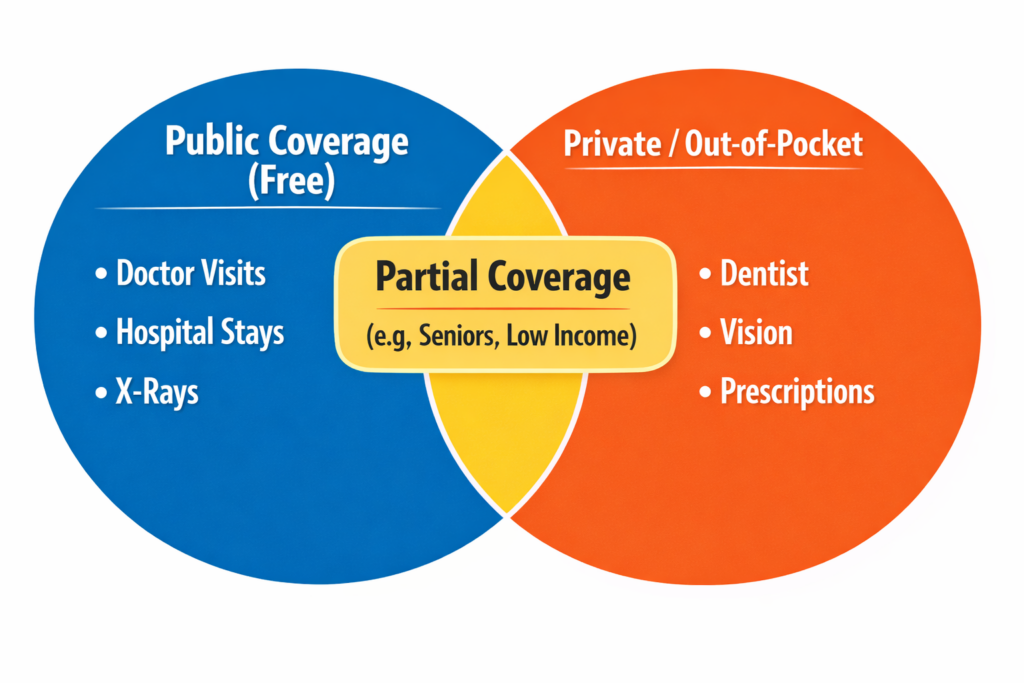

The reality is that Canadian healthcare is not fully “free”—it is publicly funded for medically necessary services. There are massive gaps in coverage that can drain your bank account if you aren’t prepared. Whether you are landing in Toronto or Vancouver, you need to understand exactly how the system works, where the holes are, and how to plug them with private insurance.

The Basics: How “Medicare” Actually Works

First, “Medicare” isn’t one single national plan. It is a collection of 13 separate provincial and territorial plans. When you live in Ontario, you deal with OHIP. In British Columbia, it’s MSP. In Alberta, it’s AHCIP.

These plans cover the big stuff:

• Doctor Visits: Walking into a walk-in clinic or seeing your family doctor.

• Hospital Stays: Surgery, nursing care, lab tests, and meals while you are admitted.

• Diagnostics: X-rays, blood tests, and MRIs (though the wait times for MRIs can be long).

You don’t pay cash at the counter. You show your provincial Health Card, and the government pays the doctor directly.

The “Newcomer Gap”: The 3-Month Waiting Period

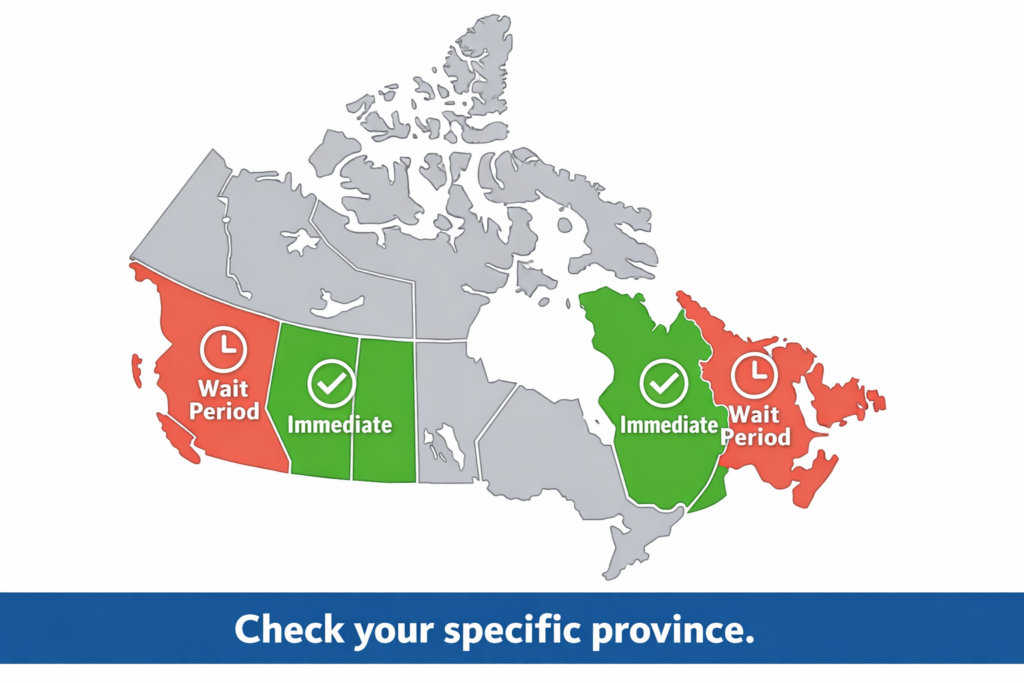

This is the most dangerous trap for new immigrants. Depending on which province you land in, you might not be covered immediately.

The “Wait” Provinces (e.g., British Columbia, Quebec)

If you move to BC, you generally have to wait for the balance of the month you arrive, plus two full months. If you arrive on January 15th, your coverage might not start until April 1st. During those ~75 days, if you slip on ice or catch a severe flu, you are paying 100% of the hospital bill out of pocket. A single night in a Canadian hospital can cost non-residents over $3,000.

The Strategy: You must buy private “Emergency Medical Insurance” (often called “Visitors to Canada” insurance) for your first 90 days. It costs a few dollars a day but saves you from financial ruin.

The “Immediate” Provinces (e.g., Ontario, Alberta)

The good news for those landing in Toronto or Calgary is that Ontario and Alberta currently offer coverage starting essentially from the day you establish residency (provided you meet the paperwork requirements). You still need to apply for your card immediately, but you aren’t left exposed for months.

The “Hidden” Costs: What Isn’t Free

Once you have your health card, you might think you are set. You aren’t. Canada’s public system generally stops at the neck and the ankles. Here is what you usually have to pay for yourself:

1. Prescription Drugs

If your doctor prescribes antibiotics or insulin, you take that paper to a pharmacy (like Shoppers Drug Mart or Rexall) and pay with your credit card.

Exception: If you are under 25 (in Ontario) or a senior, there are government programs to help, but for most working-age adults, drugs are an out-of-pocket expense.

2. Dental and Vision

Routine dental cleanings, fillings, root canals, and eye exams are not covered. A standard dental cleaning can cost $200; a root canal can be $1,500+.

New for 2025: The government has rolled out the Canadian Dental Care Plan (CDCP). If your family income is under $90,000 and you don’t have access to private insurance, you might qualify for coverage. This is a game-changer for many new immigrants working survival jobs.

3. The Ambulance Fee

This shocks everyone. If you call 911 and take an ambulance to the hospital, you get a bill in the mail weeks later.

In Ontario, if it’s a valid emergency, you pay a co-pay of about $45. If the doctor decides it wasn’t an emergency, you could pay $240. In other provinces, fees can range from $80 to over $500 depending on where you live.

Private Insurance: Work Benefits vs. Personal Plans

Since the public system has these gaps, how do Canadians cope? We use private insurance.

Employer-Sponsored Benefits (The Gold Standard)

When you are looking for a job in Canada, the salary is important, but the “Benefits Package” is equally vital. A good job will offer “Health and Dental” benefits where the employer pays most of the monthly premium.

These plans usually cover:

• 80%–100% of prescription drug costs.

• Dental cleanings and repairs (up to a yearly limit).

• Massage therapy, physiotherapy, and chiropractors.

• Vision care (e.g., $300 every two years for glasses).

Buying Your Own Plan

If you are freelancing, driving Uber, or working a contract job without benefits, you can buy an individual plan from providers like Blue Cross, Manulife, or Sun Life.

Warning: These can be expensive ($100–$300/month for a family). You need to do the math: if you have healthy teeth and rarely get sick, it might be cheaper to pay out-of-pocket and save the premiums. But if you have kids who need braces or glasses, the insurance is worth it.

Key Takeaways

Navigating Canadian healthcare is about knowing when to use your Health Card and when to pull out your wallet.

- Check the Wait: If you are moving to BC or Quebec, buy private emergency insurance for the first 3 months. Do not gamble on this.

- Apply Immediately: Go to ServiceOntario (or your province’s equivalent) the week you land. You need your Passport and COPR (Confirmation of Permanent Residence).

- Value the Benefits: When negotiating a job offer, ask about the health plan. A job paying $60k with full dental/drug coverage is often better than a job paying $63k with zero benefits.

- Know the Ambulance Rule: Don’t be afraid to call 911 in a real emergency, but don’t treat the ambulance like a taxi to the clinic. It will cost you.

Here is your immediate next step: Google “[Province Name] health card waiting period 2026” for your specific destination. Rules change, and being wrong by 24 hours can cost you thousands of dollars.

References

- Government of Canada. (2025). Canada Health Act – Overview.

- Government of Ontario. (2025). Apply for OHIP and get a health card.

- Government of British Columbia. (2025). MSP Coverage Wait Period.

- Government of Canada. (2025). Canadian Dental Care Plan (CDCP).

- Settlement.org. (2024). Do I need private health insurance?

- Ontario Ministry of Health. (2025). Ambulance Fees.