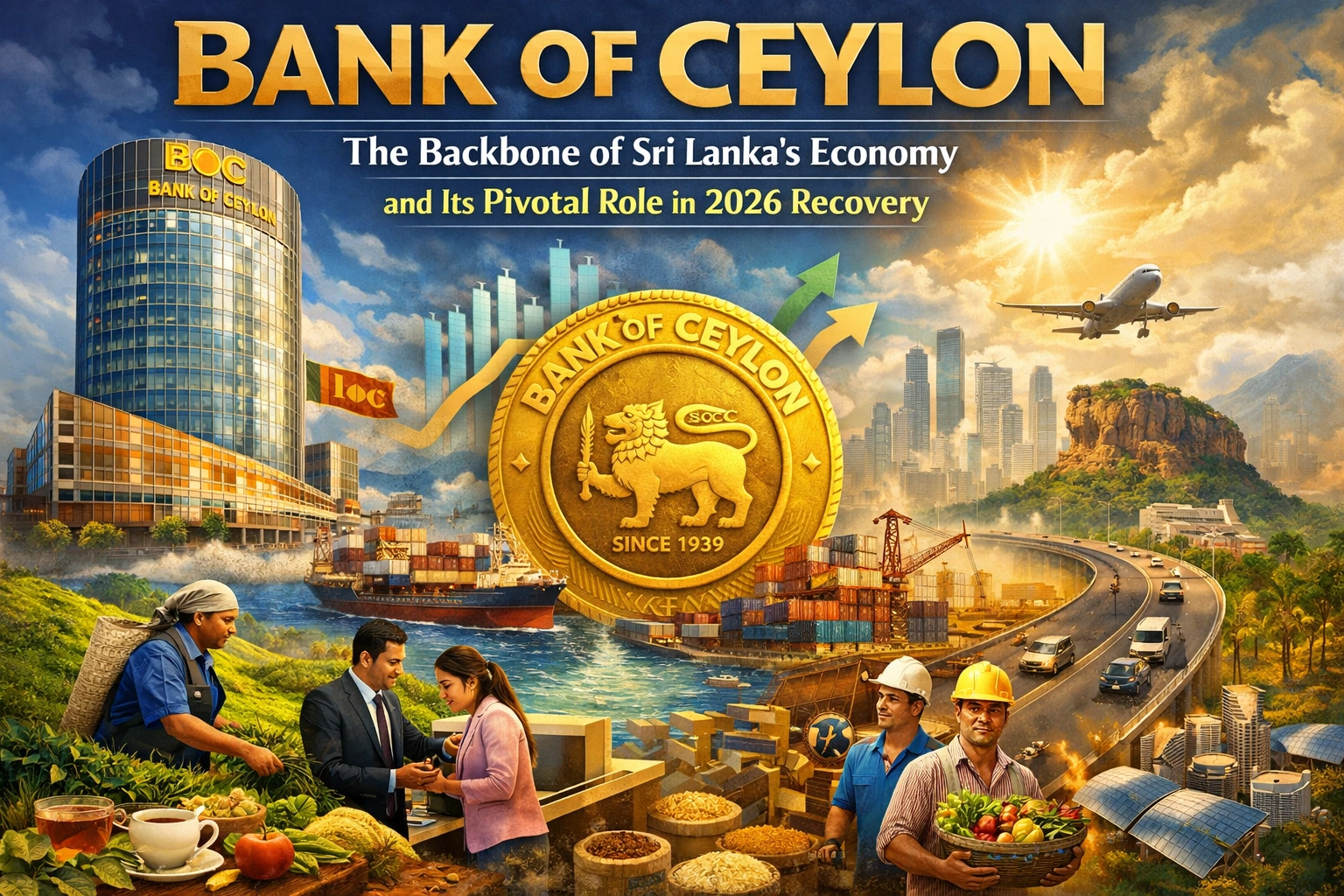

Introduction to Bank of Ceylon: Sri Lanka’s Financial Cornerstone

Established in 1939 as the first fully-fledged commercial bank in Ceylon (now Sri Lanka), the Bank of Ceylon (BOC) has grown into the nation’s largest state-owned bank, playing an indispensable role in the country’s economic fabric. With over 260 branches, 1,000 ATMs, and a vast network serving urban hubs like Colombo, Kandy, and Galle, as well as rural areas in the North and East, BOC touches the lives of millions of Sri Lankans daily. From financing tea plantations in the Central Highlands to supporting small businesses in Jaffna, BOC’s influence spans the island’s diverse landscapes and cultures. As Sri Lanka navigates economic recovery in 2026, particularly post-Cyclone Ditwah, BOC’s stability and strategic initiatives position it as a key driver of growth amid rising interest rates and policy shifts[1][2].

Historical Evolution and Milestones

Bank of Ceylon’s journey mirrors Sri Lanka’s post-independence development. Founded two years after universal suffrage, it was designed to foster local banking independence from colonial influences. By the 1950s, BOC pioneered agricultural credit schemes, vital for the rice paddies of Anuradhapura and coconut estates in the Coconut Triangle. Nationalization in 1969 under the Banking Act transformed it into a government entity, expanding its footprint during the open economy era of the 1970s.

Key milestones include the launch of the BOC Smart app in 2018, boosting digital banking adoption—a trend accelerating in 2025 with BCG noting rising digital uptake across Sri Lanka’s banks[2]. During the 2022 economic crisis, BOC absorbed shocks by restructuring loans for SMEs in tourism hotspots like Bentota and Hikkaduwa, preventing widespread defaults. Today, with assets exceeding LKR 2.5 trillion, BOC holds about 25% of the banking sector’s deposits, underscoring its systemic importance[6].

Branch Network and Community Impact

- Urban Presence: Flagship branches in Colombo’s Fort area serve corporate clients, including apparel exporters in Katunayake.

- Rural Reach: Over 100 branches in provinces like Uva and Sabaragamuwa support microfinance for gem miners and vegetable farmers.

- Cultural Integration: Festivals like Sinhala and Tamil New Year see BOC offering special savings drives, blending finance with local traditions.

BOC’s Critical Role in the Sri Lankan Economy

As the largest lender to the government and a major player in private sector financing, BOC fuels economic activity. It channels funds into infrastructure projects like the Southern Expressway extensions and Colombo Port City developments, aligning with national goals. In agriculture—employing 25% of Sri Lankans—BOC’s crop loans sustain paddy farming in Polonnaruwa and rubber tapping in Kalutara, contributing to 7% of GDP.

In tourism, recovering post-COVID and Cyclone Ditwah, BOC finances hotels in Trincomalee and eco-resorts in Yala, supporting 4.4 million visitors in 2025. For SMEs, which drive 52% of GDP, BOC’s Thriposha and enterprise loans empower women-led ventures in Batticaloa’s fisheries sector. Amid 2025’s banking contraction, with shrinking assets reported by ALM Intelligence[4], BOC’s resilience stems from its government backing, enabling it to maintain lending during high interest rates (edging up in October 2025 despite CBSL cuts)[1].

Support for Key Sectors

| Sector | BOC Contribution | Economic Impact (2025-2026) |

|---|---|---|

| Agriculture | 30% of crop loans | Boosts exports like tea (LKR 150bn annually) |

| Construction | Infrastructure financing | Post-Ditwah rebuilding (LKR 500bn allocation)[1][3] |

| Digital Economy | Fintech partnerships | 5.9% sector earnings growth projected[6] |

Navigating 2026 Challenges: Cyclone Recovery and Policy Shifts

Sri Lanka’s economy eyes 5%+ growth in 2026, propelled by Cyclone Ditwah reconstruction, as per CBSL Governor Dr. Nandalal Weerasinghe[3][5]. BOC is central to this, disbursing recovery loans for rebuilding in affected Eastern Province villages. The government’s LKR 500 billion additional allocation, plus IMF’s $200 million facility, will flow through BOC’s channels, stimulating construction and services[1].

Yet, challenges loom: Rising interest rates from strong loan demand (post-August 2025 liquidity injections) pressure deposits[1]. Policy uncertainty, including flexible inflation targeting critiques, risks currency depreciation[1]. Banking sector contraction in 9M2025, with rising liabilities[4], highlights BOC’s stabilizing role. BCG’s quarterly updates emphasize risk management and digital adoption as BOC’s strengths[2]. First Capital projects measured 5.9% earnings growth for banks in 2026, with BOC leading[6].

BOC’s Strategic Response

- Digital Push: Expanding BOC Smart to 2 million users, integrating AI for fraud detection in high-risk remittance corridors like the Middle East worker flows.

- Green Financing: LKR 50 billion for solar projects in Mannar, aligning with Sri Lanka’s net-zero goals.

- Inclusion: Samurdhi beneficiary loans in Moneragala, reducing poverty gaps.

Future Outlook: BOC’s Vision for Sustainable Growth

With CBSL’s policy agenda unveiling on January 8, 2026[8], BOC anticipates tighter monetary stance to curb inflation (projected at 5% by Q3 2026)[3]. Its focus on valuations, as tracked by BCG[2], and PMI improvements signal a “slow healing” economy[7]. BOC’s innovations, like blockchain remittances for 1.5 million expatriates, position it for export-led growth.

For Sri Lankan readers—from tea pluckers in Nuwara Eliya to tech startups in Colombo—BOC remains a trusted partner. Its adaptability ensures it will anchor recovery, fostering resilience in an island nation rich in heritage yet tested by nature and markets.

(Word count: 962)