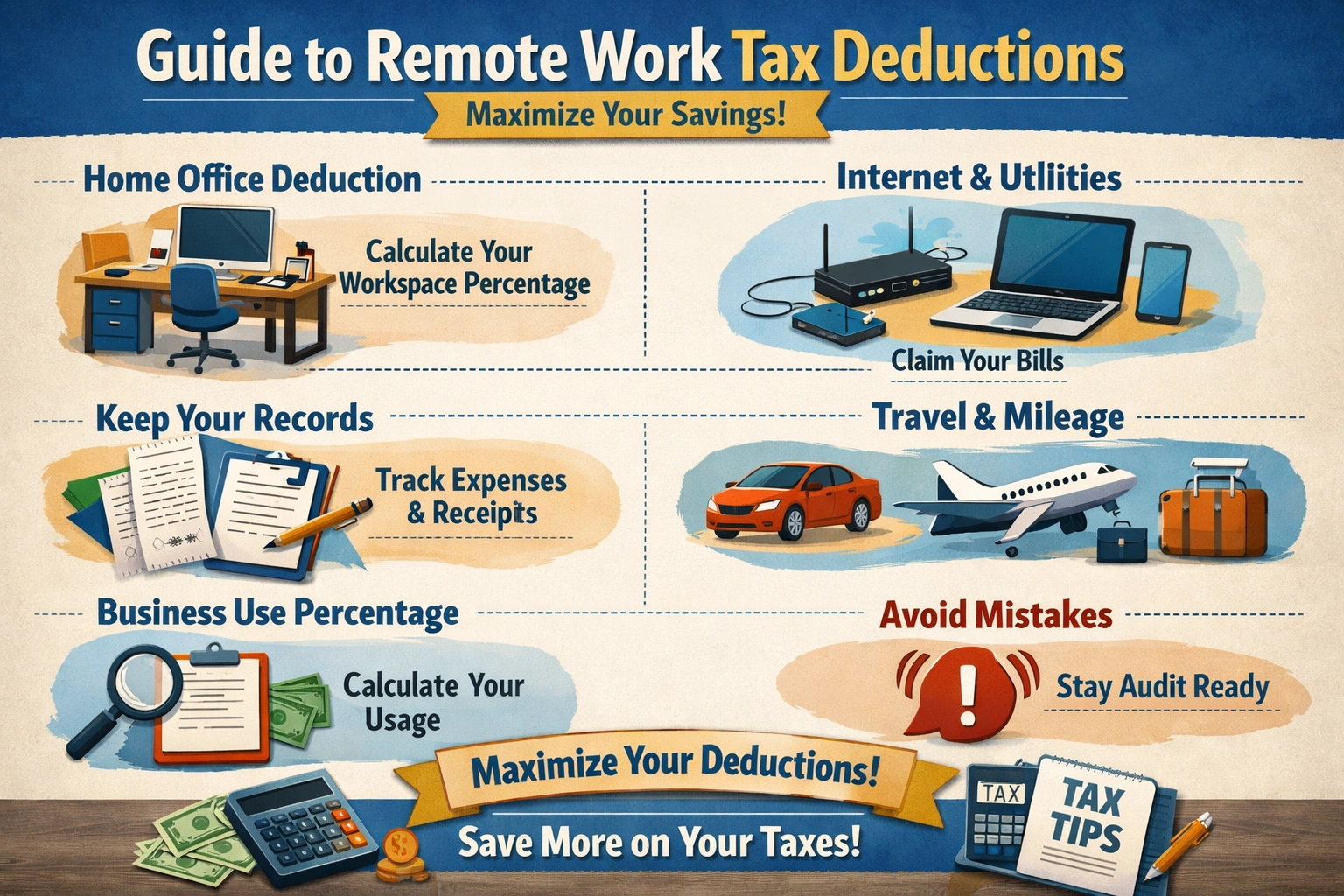

As a remote worker, you’re likely no stranger to the flexibility and freedom that comes with working from home. But with this freedom comes the responsibility of managing your own finances, including taking advantage of remote work tax deductions. You may have heard of the home office deduction, but do you know how to calculate it, or what other expenses you can claim? By understanding the ins and outs of remote work tax deductions, you can save yourself a significant amount of money come tax season. In this article, we’ll explore the world of remote work tax deductions, and provide you with the knowledge you need to make the most of your deductions.

From the home office deduction to business use percentage, internet expenses, and travel costs, we’ll cover it all. You’ll learn how to calculate your deductions, what records you need to keep, and how to avoid common mistakes that can lead to audits or missed deductions. By the end of this article, you’ll be equipped with the knowledge and confidence to take control of your remote work tax deductions and maximize your savings.

Introduction to Remote Work Tax Deductions

As a remote worker, you’re considered self-employed, and as such, you’re eligible for a range of tax deductions that can help reduce your taxable income. One of the most well-known deductions is the home office deduction, which allows you to claim a portion of your rent or mortgage interest as a business expense. But that’s not all – you can also deduct a range of other expenses, including internet and phone bills, travel costs, and professional fees.

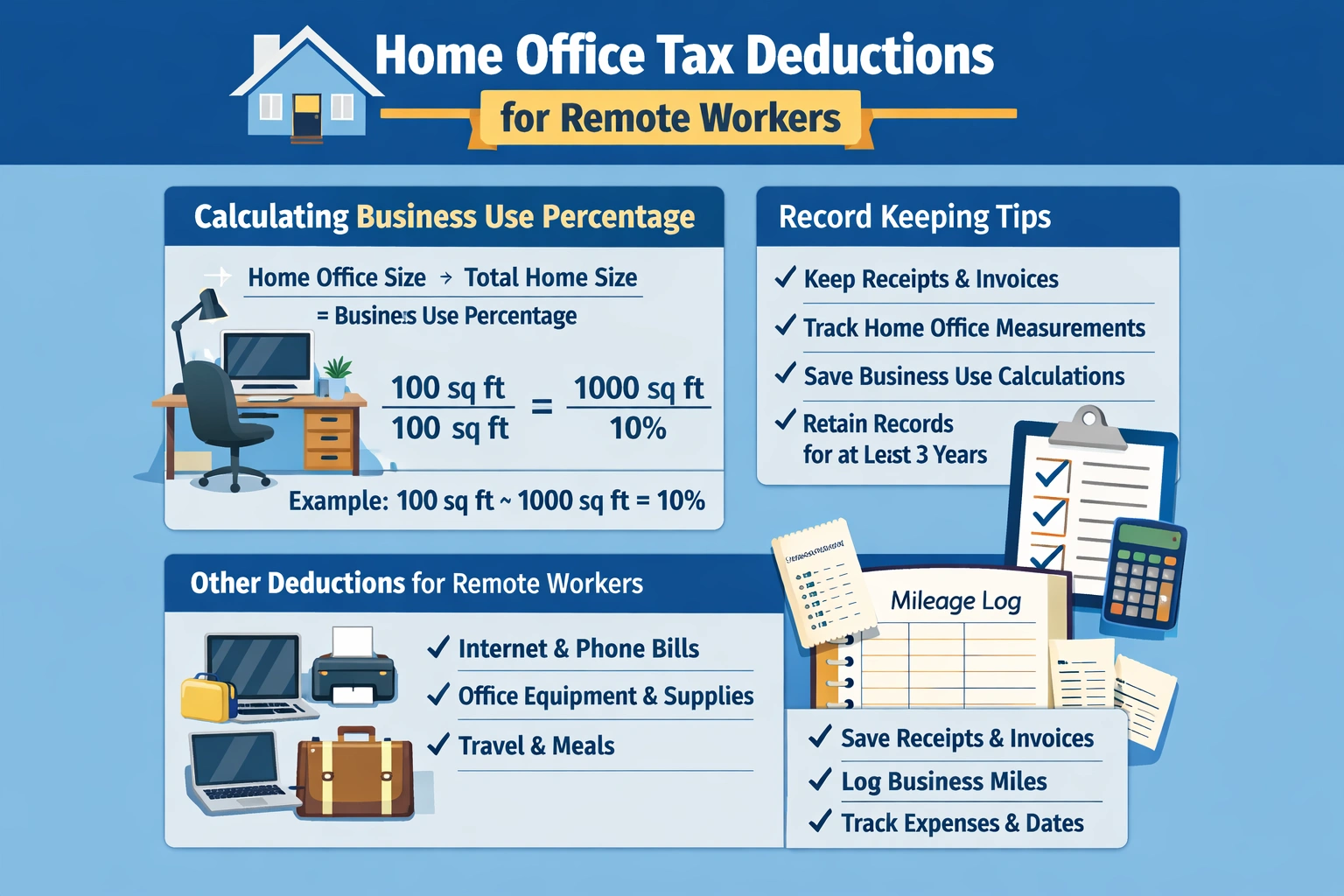

To take advantage of these deductions, you’ll need to calculate your business use percentage, which is the percentage of your home that’s used for business purposes. This can be a dedicated home office, or a corner of your living room that you use as a workspace. You’ll also need to keep accurate records of your expenses, including receipts, invoices, and bank statements. The IRS requires that you keep these records for at least three years in case of an audit.

For example, let’s say you’re a freelance writer who works from a dedicated home office that takes up 10% of your total living space. You can claim 10% of your rent or mortgage interest as a business expense, as well as 10% of your utility bills and other expenses. This can add up to a significant amount of money, especially if you’re working from a large or expensive home.

Home Office Deduction for Remote Workers

The home office deduction is one of the most valuable tax deductions available to remote workers. To qualify, you’ll need to use a dedicated space in your home regularly and exclusively for business purposes. This can be a room, a corner of a room, or even a outdoor shed or garage. You’ll also need to calculate the business use percentage of your home, which is the percentage of your home that’s used for business purposes.

There are two main methods for calculating the home office deduction: the simplified option and the regular method. The simplified option allows you to deduct $5 per square foot of home office space, up to a maximum of $1,500. The regular method requires you to calculate the actual expenses of your home office, including rent or mortgage interest, utilities, and other expenses.

For example, let’s say you have a dedicated home office that’s 100 square feet. Using the simplified option, you can deduct $500 (100 square feet x $5 per square foot). Alternatively, you can use the regular method to calculate your actual expenses. Let’s say your rent is $1,500 per month, and you use 10% of your home for business purposes. You can deduct 10% of your rent, which is $150 per month, or $1,800 per year.

Deductible Expenses

In addition to rent or mortgage interest, you can also deduct a range of other expenses related to your home office. These include utilities, such as electricity, gas, and water, as well as internet and phone bills. You can also deduct the cost of furniture, equipment, and supplies, such as a desk, chair, and computer.

Business Use Percentage and Tax Deductions

Calculating your business use percentage is a critical step in claiming remote work tax deductions. This percentage represents the amount of your home that’s used for business purposes, and it’s used to calculate your home office deduction. To calculate your business use percentage, you’ll need to measure the square footage of your home office and divide it by the total square footage of your home.

For example, let’s say you have a home office that’s 100 square feet, and your total home is 1,000 square feet. Your business use percentage would be 10% (100 square feet / 1,000 square feet). You can then use this percentage to calculate your home office deduction, as well as other expenses such as utilities and internet bills.

It’s also important to keep accurate records of your business use percentage, including measurements of your home office and calculations of your business use percentage. This will help you to support your deductions in case of an audit, and ensure that you’re taking advantage of all the deductions you’re eligible for.

Record Keeping Requirements

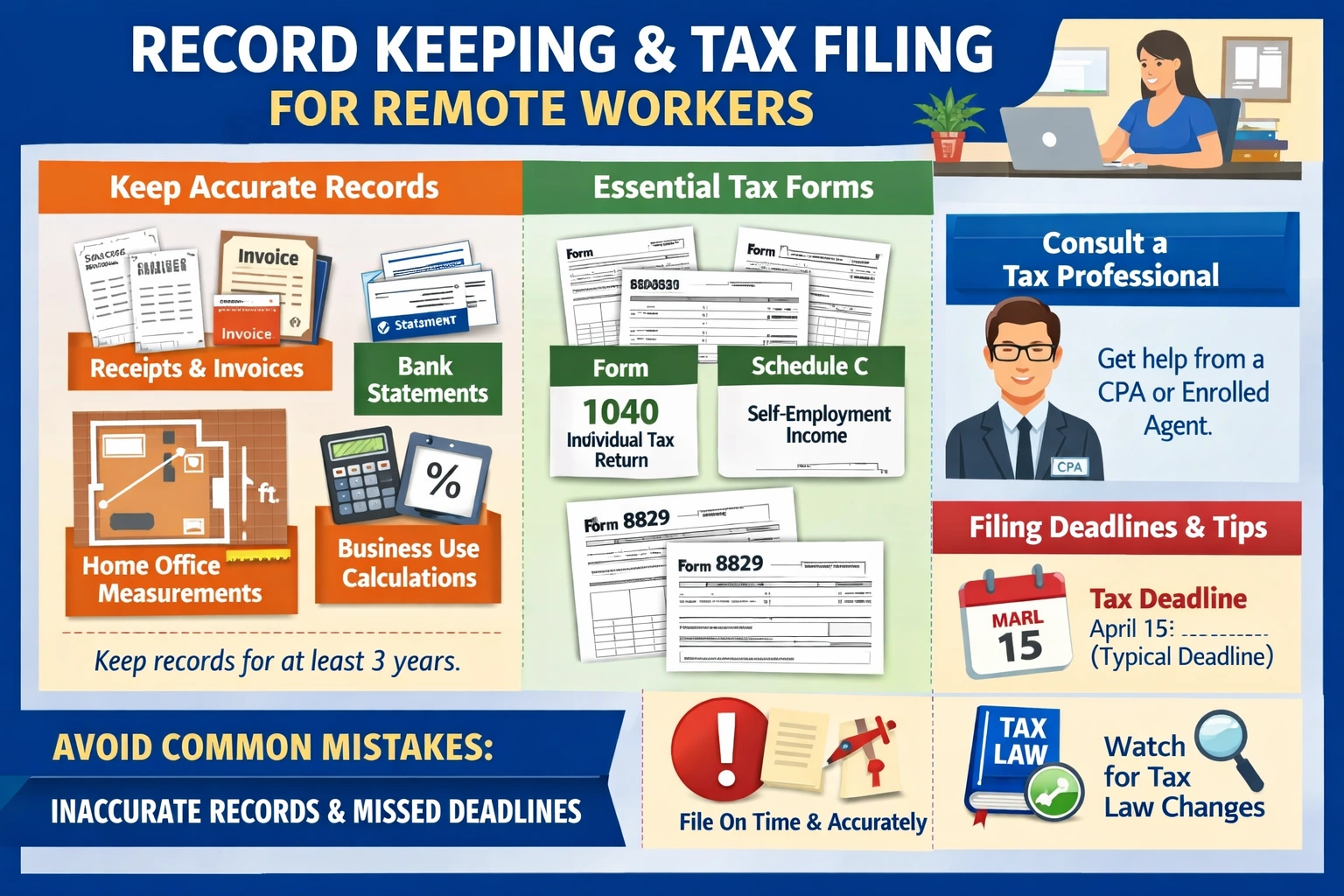

The IRS requires that you keep accurate records of your business expenses, including receipts, invoices, and bank statements. You should also keep records of your business use percentage, including measurements of your home office and calculations of your business use percentage. These records should be kept for at least three years in case of an audit.

Other Tax Deductions for Remote Workers

In addition to the home office deduction, there are a range of other tax deductions available to remote workers. These include internet and phone expenses, travel costs, and professional fees. You can also deduct the cost of equipment and supplies, such as a computer, printer, and paper.

For example, let’s say you’re a freelance writer who works from home and uses your computer and internet connection to complete projects. You can deduct the cost of your internet connection, as well as the depreciation of your computer and other equipment. You can also deduct the cost of travel to meetings and conferences, as well as any meals or accommodations related to your business.

It’s also important to keep accurate records of these expenses, including receipts and invoices. You should also keep a log of your business miles, including the date, location, and purpose of each trip. This will help you to support your deductions in case of an audit, and ensure that you’re taking advantage of all the deductions you’re eligible for.

Internet and Phone Expenses

You can deduct the cost of your internet and phone bills as a business expense, provided you use them regularly for business purposes. This can include the cost of a dedicated business phone line, as well as the cost of internet services such as DSL or cable.

Record Keeping and Tax Filing for Remote Workers

As a remote worker, it’s essential to keep accurate records of your business expenses, including receipts, invoices, and bank statements. You should also keep records of your business use percentage, including measurements of your home office and calculations of your business use percentage. These records should be kept for at least three years in case of an audit.

When it comes to tax filing, you’ll need to complete Form 1040 and Schedule C, which is the form for self-employment income. You’ll also need to complete Form 8829, which is the form for the home office deduction. You should also keep a copy of your tax return, including all supporting documentation, for at least three years in case of an audit.

It’s also a good idea to consult with a tax professional, such as a CPA or enrolled agent, to ensure that you’re taking advantage of all the deductions you’re eligible for. They can help you to navigate the complex world of tax deductions and ensure that you’re in compliance with all IRS regulations.

Tax Filing Deadlines

The tax filing deadline for remote workers is typically April 15th, although this can vary depending on your location and other factors. You should also be aware of any extensions or penalties that may apply, and plan accordingly.

Common Mistakes to Avoid in Remote Work Tax Deductions

There are a number of common mistakes that remote workers make when it comes to tax deductions. One of the most common is inaccurate record keeping, which can lead to missed deductions or audits. You should also be careful not to overstate your deductions, as this can lead to penalties and fines.

Another common mistake is missing deadlines, such as the tax filing deadline or the deadline for filing Form 8829. You should also be aware of any changes to tax laws or regulations, and plan accordingly. For example, the Tax Cuts and Jobs Act (TCJA) introduced a number of changes to tax deductions, including the limitation on state and local taxes (SALT).

It’s also a good idea to consult with a tax professional, such as a CPA or enrolled agent, to ensure that you’re taking advantage of all the deductions you’re eligible for. They can help you to navigate the complex world of tax deductions and ensure that you’re in compliance with all IRS regulations.

Inaccurate Record Keeping

Inaccurate record keeping is one of the most common mistakes that remote workers make when it comes to tax deductions. You should keep accurate records of your business expenses, including receipts, invoices, and bank statements. You should also keep records of your business use percentage, including measurements of your home office and calculations of your business use percentage.

Key Takeaways

In conclusion, remote work tax deductions can be a complex and nuanced topic, but by understanding the basics and taking the time to keep accurate records, you can save yourself a significant amount of money come tax season. Remember to calculate your business use percentage, keep records of your expenses, and consult with a tax professional if you’re unsure about anything.

So, what’s the next step for you? Take some time to review your expenses and calculate your business use percentage. Make sure you’re keeping accurate records, and consider consulting with a tax professional to ensure you’re taking advantage of all the deductions you’re eligible for. By taking control of your remote work tax deductions, you can maximize your savings and achieve financial freedom.

Frequently Asked Questions

What is the home office deduction?

The home office deduction is a tax deduction for the business use of a home office

How do I calculate my business use percentage?

You can calculate your business use percentage by tracking the time spent on business activities in your home office