Sri Lanka’s Cryptocurrency Market in 2026: Navigating Legal Ambiguity and Regulatory Evolution

Sri Lanka stands at a critical juncture in its relationship with cryptocurrency. While Bitcoin and other digital assets have captured the imagination of investors worldwide—with Bitcoin trading around $109,000 and analysts predicting it could reach $150,000 before the end of 2025—Sri Lanka remains caught between cautious regulation and practical reality. The country’s crypto market exists in a regulatory grey zone, unrecognised by law yet increasingly popular among Sri Lankan investors seeking alternative financial instruments amid economic uncertainty.

As the nation prepares for Budget 2026, policymakers face a pressing opportunity to address a critical gap: the absence of clear and enforceable tax laws for cryptocurrency transactions. Understanding Sri Lanka’s crypto landscape requires examining its current legal status, the emerging regulatory framework, tax implications, and what 2026 holds for this rapidly evolving sector.

The Current Legal Status of Cryptocurrency in Sri Lanka

Not Legal Tender, But Not Banned

One of the most significant sources of confusion surrounding cryptocurrency in Sri Lanka is its ambiguous legal status. The Central Bank of Sri Lanka (CBSL) has made clear that only the Sri Lankan rupee is legal tender. However, as Governor Nandalal Weerasinghe recently clarified, “We are not banning crypto holdings.” This distinction is crucial: while using cryptocurrency for everyday transactions is prohibited, investing in cryptocurrency is not against the law.

This regulatory grey zone means that Sri Lankans can legally own and hold cryptocurrency, but they operate without the protective safeguards afforded to traditional financial assets. If a digital wallet is hacked or an offshore exchange collapses, victims have little legal recourse under Sri Lankan law. As one financial lawyer cautioned, “If your crypto vanishes, you have no protection under Sri Lankan law.”

Banking Restrictions and Offshore Trading

The CBSL has imposed strict restrictions on financial institutions’ involvement with cryptocurrency. Banks are prohibited from processing crypto transactions, including card payments for cryptocurrency purchases. Under the Foreign Exchange Act, the use of debit and credit cards for cryptocurrency transactions is explicitly forbidden. This has forced most Sri Lankan crypto activity onto offshore exchanges and peer-to-peer trading platforms, as the country has yet to license any local crypto service providers.

This regulatory approach mirrors that of India, where cryptocurrency remains neither illegal nor regulated. Sri Lankans have adapted by conducting most transactions on international platforms, creating a thriving but largely invisible crypto ecosystem within the country.

The Regulatory Framework: Current and Emerging

Key Regulatory Authorities

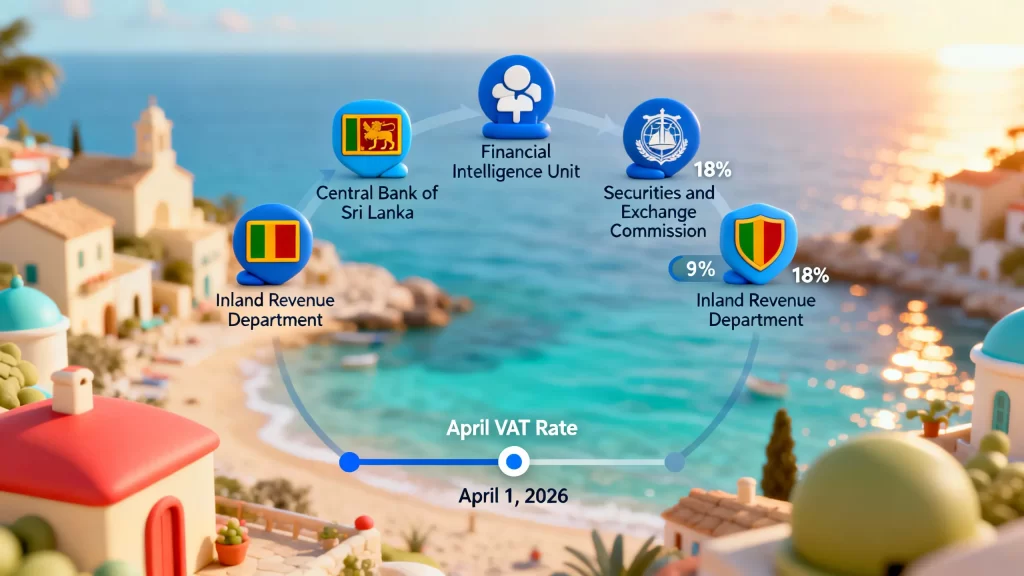

While Sri Lanka lacks a dedicated cryptocurrency regulatory framework, several government bodies oversee aspects of digital asset activity:

- Central Bank of Sri Lanka (CBSL): The primary financial regulator, responsible for issuing public warnings about cryptocurrency risks and prohibiting banks from processing crypto payments.

- Financial Intelligence Unit (FIU): Sri Lanka’s national authority for combating financial crime, responsible for monitoring suspicious transactions and enforcing Anti-Money Laundering (AML) compliance.

- Securities and Exchange Commission (SEC): Responsible for regulating the securities market and protecting investors. Its authority applies to digital assets classified as securities, including oversight of trading platforms and Initial Coin Offerings (ICOs).

- Inland Revenue Department (IRD): Increasingly involved in tax collection from digital service providers.

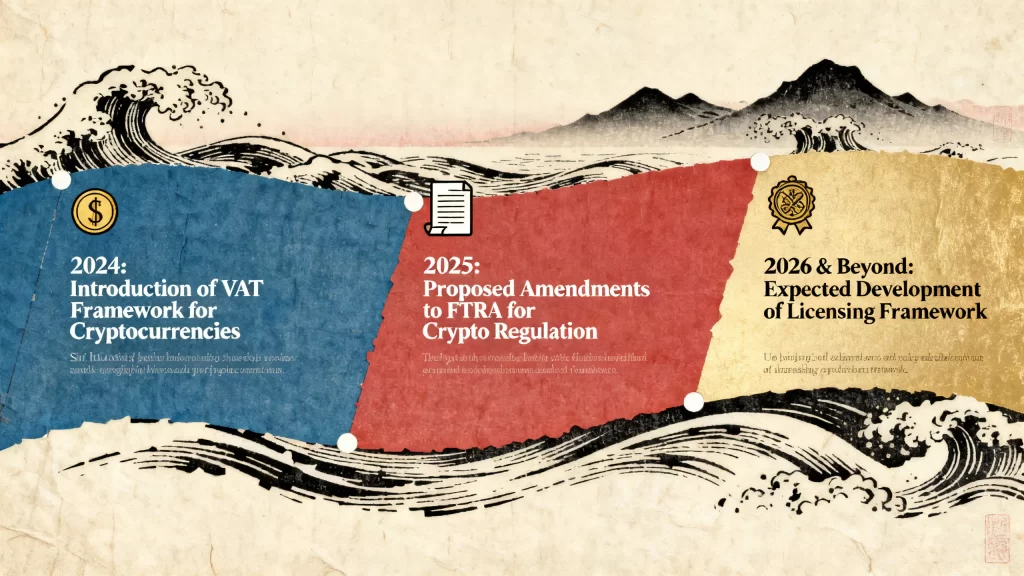

The VAT Framework: A Significant Development

In a landmark move, Sri Lanka introduced a Value Added Tax (VAT) framework for cryptocurrency services. According to Gazette Notification No. 2443/30, non-resident digital service providers—including crypto exchanges—are mandated to register for VAT, apply an 18 percent tax on relevant services, and remit this amount to the IRD. Though enforcement was initially postponed, it is now scheduled to take effect on April 1, 2026.

This regulation marks a significant development in taxing the digital economy. By requiring platforms to register and report user activities, the IRD gains access to crucial data—such as trading volumes, wallet addresses, and income generated by Sri Lankan users. This information can be cross-referenced with income tax declarations to identify evasion and enhance overall tax compliance.

Proposed AML/CFT Amendments

To strengthen oversight, the CBSL has proposed amendments to the Financial Transactions Reporting Act (FTRA). These amendments would require virtual asset service providers (VASPs) to register with the FIU, bringing crypto intermediaries under anti-money laundering and counter-terrorism financing (AML/CFT) supervision. Once approved, VASPs would be forced to report suspicious or large transactions just as banks do, creating a more transparent regulatory environment.

Taxation of Cryptocurrency: The 2026 Budget Gap

The Absence of Dedicated Crypto Tax Legislation

Despite the VAT framework, Sri Lanka’s 2026 national budget contains no dedicated provisions for taxing cryptocurrency transactions. According to tax experts at KPMG, this represents a significant oversight as the country prepares for Budget 2026. The absence of clear and enforceable tax laws for cryptocurrency creates uncertainty for both taxpayers and the government.

Policymakers face a critical opportunity to address this gap by implementing dedicated cryptocurrency tax legislation. Drawing from global best practices in countries like the UK, Australia, and India, such legislation should:

- Define what constitutes a taxable crypto transaction

- Establish valuation methods for digital assets

- Set clear record-keeping and reporting requirements

- Introduce penalties for non-compliance

Global Context and Best Practices

Other nations have moved ahead with comprehensive crypto taxation frameworks. Thailand, for example, established a licensing regime requiring cryptocurrency businesses to obtain relevant licences from its SEC, upholding integrity and enhancing consumer protection. Such frameworks provide clarity to taxpayers, strengthen enforcement, and demonstrate a country’s readiness to responsibly embrace digital finance.

Sri Lanka’s Digital Economy Ambitions and Blockchain Investment

Budget 2026 Digitalization Initiatives

While cryptocurrency regulation remains uncertain, Sri Lanka is investing heavily in broader digital infrastructure. The 2026 budget allocates 30 billion Sri Lankan rupees ($98 million) to a major digitalization initiative. The Unique Digital Identity project holds the lion’s share of allocations, while the e-Grama Niladhari and the Digital Economy Advancement Program are also heavily funded.

In early 2025, Sri Lankan authorities announced a $10 million investment to accelerate blockchain and artificial intelligence (AI) in key sectors of the local economy. In 2021, the government formed a committee to study the impact of widespread adoption of digital currencies and the prospects of a central bank digital currency (CBDC). This forward-thinking approach suggests that policymakers recognize blockchain technology’s potential, even as they remain cautious about unregulated cryptocurrency.

The Sri Lankan Crypto Investor: Profile and Challenges

Growing Interest Amid Uncertainty

Sri Lankans have increasingly turned to cryptocurrency amid regulatory uncertainty and economic pressures. The global crypto market surge—with Bitcoin up 62.7 percent since late 2024—has attracted local investors seeking alternative assets and potential returns. However, this enthusiasm is tempered by significant risks.

Without domestic legal recognition, Sri Lankan crypto investors face unique vulnerabilities. Victims of hacked wallets or collapsed offshore exchanges have little legal recourse. The regulatory grey zone means that investors operate without consumer protection guardrails that might deter fraud and financial crimes involving digital assets.

Predictions for Sri Lanka’s Crypto Market in 2026

Expected Regulatory Developments

Several developments are likely to shape Sri Lanka’s crypto landscape throughout 2026:

- VAT Implementation (April 1, 2026): The 18 percent VAT on digital services will take effect, requiring crypto exchanges and service providers to register and report user activities to the IRD.

- FTRA Amendments: Proposed amendments requiring VASPs to register with the FIU are expected to be approved, bringing crypto intermediaries under AML/CFT supervision.

- Dedicated Crypto Tax Legislation: As Budget 2026 discussions progress, there is growing pressure for dedicated cryptocurrency tax legislation to fill the current regulatory gap.

- Licensing Framework Development: Following global trends and the success of licensing regimes in other jurisdictions, Sri Lanka may move toward establishing a formal licensing framework for crypto businesses.

Market Outlook

If global cryptocurrency markets continue their upward trajectory—with Bitcoin potentially reaching $150,000 before the end of 2025—Sri Lankan investors will likely increase their participation. However, without clear domestic regulations, this growth will continue to occur primarily on offshore platforms.

The introduction of VAT and potential AML/CFT requirements will increase transparency and compliance costs, but they may also provide the foundation for a more mature, regulated crypto ecosystem. Sri Lanka has the opportunity to learn from other nations’ regulatory successes and failures, positioning itself as a responsible player in the global digital finance landscape.

Is Sri Lanka at a Crossroads?

Sri Lanka’s cryptocurrency market in 2026 stands at a crossroads. The country has the chance to move beyond regulatory ambiguity toward a clear, comprehensive framework that protects consumers while enabling innovation. The planned VAT implementation, proposed AML/CFT amendments, and significant blockchain investments suggest that policymakers recognize both the opportunities and risks of digital finance.

For Sri Lankan crypto investors, 2026 will likely bring both greater clarity and increased compliance requirements. The regulatory developments outlined above will shape how cryptocurrency is taxed, reported, and monitored. As the nation prepares its budget and considers new legislation, the decisions made will determine whether Sri Lanka becomes a leader in responsible crypto regulation or continues to operate in the shadows of the global digital economy.

The path forward requires balancing consumer protection with innovation, tax compliance with investor opportunity, and caution with progress. As Sri Lanka navigates these challenges in 2026, the outcomes will have implications not just for local investors, but for the country’s broader digital transformation and economic resilience.