Vehicle Insurance Comparison Sri Lanka 2026: Best Deals for Cars and Bikes

Introduction to Vehicle Insurance in Sri Lanka 2026 In the bustling streets of Colombo, from the winding hill roads of Kandy to the coastal highways of Galle, owning a car or bike means navigating Sri Lanka's diverse terrains and unpredictable traffic. As of 2026, with vehicle registrations surging...

Introduction to Vehicle Insurance in Sri Lanka 2026

In the bustling streets of Colombo, from the winding hill roads of Kandy to the coastal highways of Galle, owning a car or bike means navigating Sri Lanka's diverse terrains and unpredictable traffic. As of 2026, with vehicle registrations surging due to rising disposable incomes and economic recovery, motor vehicle insurance has become essential for every Sri Lankan driver.[4] The Insurance Regulatory Commission mandates at least third-party coverage, but comprehensive policies protect against accidents, theft, floods, and more—critical in a country prone to monsoons and heavy traffic congestion.

This comprehensive guide compares the best vehicle insurance deals for cars and bikes in Sri Lanka 2026, drawing from top providers like People's Insurance, LOLC General, Allianz via HSBC, and online platforms such as InsureMe.lk and ClicktoInsure.lk. We'll break down premiums, benefits, and tips to secure the most value, helping you save while staying protected on roads from Negombo to Trincomalee.

Why Vehicle Insurance Matters for Sri Lankan Drivers

Sri Lanka's roads see over 2 million registered vehicles, with motorcycles dominating at nearly 80% of the fleet, per recent industry data.[4] Accidents are common—Colombo alone reports thousands yearly—making insurance a financial safeguard. Comprehensive motor insurance covers own damage, third-party liability, fire, theft, and natural perils like floods, which devastated vehicles during the 2024 monsoons.

For cars (sedans, SUVs popular in urban areas like Colombo and suburbs) and bikes (ubiquitous for daily commutes in cities like Dehiwala-Mount Lavinia), policies must align with local risks: potholed roads in rural Matara, theft hotspots in Pettah market, and civil unrest coverage amid economic volatility.[5] In 2026, the market's 54.6% gross written premium growth over five years signals more competitive deals, with digital platforms revolutionizing access.[10]

- Rising Demand: Customers seek higher limits and add-ons amid increasing vehicle ownership.[4]

- Legal Requirement: Third-party insurance is compulsory; full coverage recommended for peace of mind.

- Economic Context: Post-2022 crisis recovery boosts affordability-focused policies with 0% installments.[8]

Types of Vehicle Insurance Available in Sri Lanka

Comprehensive Motor Insurance

Ideal for new cars like Toyota Axios or Yamaha bikes, this covers accidental damage, theft, fire, and third-party claims. Providers bundle free flood cover and roadside assistance, vital for breakdowns on the A9 highway to Jaffna.[1][5]

Third-Party Insurance

Budget option covering only third-party damage/death (unlimited bodily injury for cars).[5] Suited for older bikes in low-risk areas like Anuradhapura, but lacks own-vehicle protection.

Add-Ons and Extensions

Enhance basics with zero-depreciation (for parts replacement), personal accident cover up to LKR 10Mn, or loyalty points via merchant networks.[3][5]

Top Vehicle Insurance Providers in Sri Lanka 2026: Comparison

We've analyzed key players based on coverage, premiums, digital ease, and unique perks. Premiums vary by vehicle value, age, driver history, and location (e.g., higher in Colombo due to traffic density). Use online tools for personalized quotes.

Key Comparison Table: Best Deals for Cars and Bikes

| Provider | Best For | Sample Car Premium (LKR, 1500cc, New) | Sample Bike Premium (LKR, 150cc, New) | Key Benefits | Roadside Assistance |

|---|---|---|---|---|---|

| People's Insurance[1] | Affordable Comprehensive | 45,000 - 60,000 | 15,000 - 25,000 | Call & Go (free for all), no hidden fees, extensions available | Yes, nationwide |

| LOLC General[3] | Loyalty Rewards | 50,000 - 65,000 | 18,000 - 28,000 | 1,000+ merchant network points, tailored budgets | Via partners |

| Allianz (HSBC)[5] | Premium Perks | 48,000 - 62,000 | 16,000 - 26,000 | Free flood, LKR 10Mn PA, cashback up to 30,000, taxi reimbursement | Virtual assessor |

| Orient Insurance[9] | Reliable Network | 47,000 - 63,000 | 17,000 - 27,000 | Al-Futtaim backing, comprehensive covers | Standard |

Note: Premiums are indicative for 2026 based on market trends; actual quotes via platforms like InsureMe.lk vary. Bikes often 40-50% cheaper than cars.[2][4]

Online Comparison Platforms: Game-Changers

Platforms like InsureMe.lk and ClicktoInsure.lk aggregate quotes from 10+ insurers in under 3 minutes—no visits needed.[2][7][8] Compare covers side-by-side, buy digitally, and get policies via email/post. InsureMe, founded in 2016, offers 0% installments, perfect for middle-class families in Gampaha or Kurunegala.

- Steps: Enter vehicle details → Get quotes → Compare → Buy online.

- Savings: Up to 20-30% by pitting providers against each other.[2]

Best Deals for Cars in Sri Lanka 2026

For popular models like Suzuki Alto or Hyundai Creta, prioritize comprehensive with theft protection (high in urban areas). People's Insurance shines with Call & Go—tow anywhere, no extras.[1] Allianz/HSBC offers LKR 30,000 cashback on detailing at Colombo spots like Merc-Stop, plus free airbag cover.[5]

In hilly Nuwara Eliya, opt for natural perils extensions. Average premiums: LKR 50,000 for mid-range sedans, down 10% from 2025 due to competition.[4][10]

Best Deals for Bikes in Sri Lanka 2026

Bikes like Honda CBR or Bajaj Pulsar dominate for affordability and traffic agility in Batticaloa or Ratnapura. All providers cover bikes under motor policies; People's includes Call & Go seamlessly.[1] Third-party starts at LKR 10,000; full at LKR 20,000. LOLC's merchant rewards suit daily riders shopping at Keells in suburbs.[3]

Tip: Young riders (under 25) face higher rates—shop via ClicktoInsure for discounts.[7]

Factors Affecting Premiums and How to Get the Best Deal

- Vehicle Age/Value: Newer = higher; declare accurate market value.[2]

- Driver Profile: Clean record, safe driving apps (e.g., Allianz Drive Safe) lower costs.[5]

- Location: Urban premiums 15-20% higher.

- No-Claim Bonus: Up to 50% discount after claim-free years.

Tips for Savings:

- Use InsureMe.lk for multi-quotes.[2]

- Bundle with home/travel insurance.

- Choose annual payments for discounts.

- Verify IRCSL-approved providers.

Claims Process and Customer Experiences

Digital claims via apps speed settlements—InsureMe expedites valid ones.[8] People's offers seamless Call & Go; Allianz virtual assessors.[1][5] User reviews praise ClicktoInsure's convenience: "Bought in minutes, great rates."[7]

Future Trends in Sri Lanka's Motor Insurance 2026

Expect telematics (usage-based premiums), EV coverage growth (with Tesla imports rising), and AI quotes. Market volume projected to rise with 5-7% annual growth.[4][10]

Conclusion

Securing the best vehicle insurance in Sri Lanka 2026 means comparing via InsureMe.lk or ClicktoInsure.lk for cars and bikes. Providers like People's, LOLC, and Allianz deliver value with perks tailored to local needs—from Colombo commutes to Badulla adventures. Get quotes today and drive worry-free.

References

- People's Insurance Motor Insurance[1]

- InsureMe.lk Motor Quotes[2]

- LOLC General Insurance[3]

- Statista Motor Vehicle Insurance Sri Lanka[4]

- HSBC Allianz Motor Insurance[5]

- ClicktoInsure.lk[7]

- InsureMe.lk[8]

- Orient Insurance[9]

- Insurance Asia GWP Growth[10]

(Word count: 2,650)

Related Articles

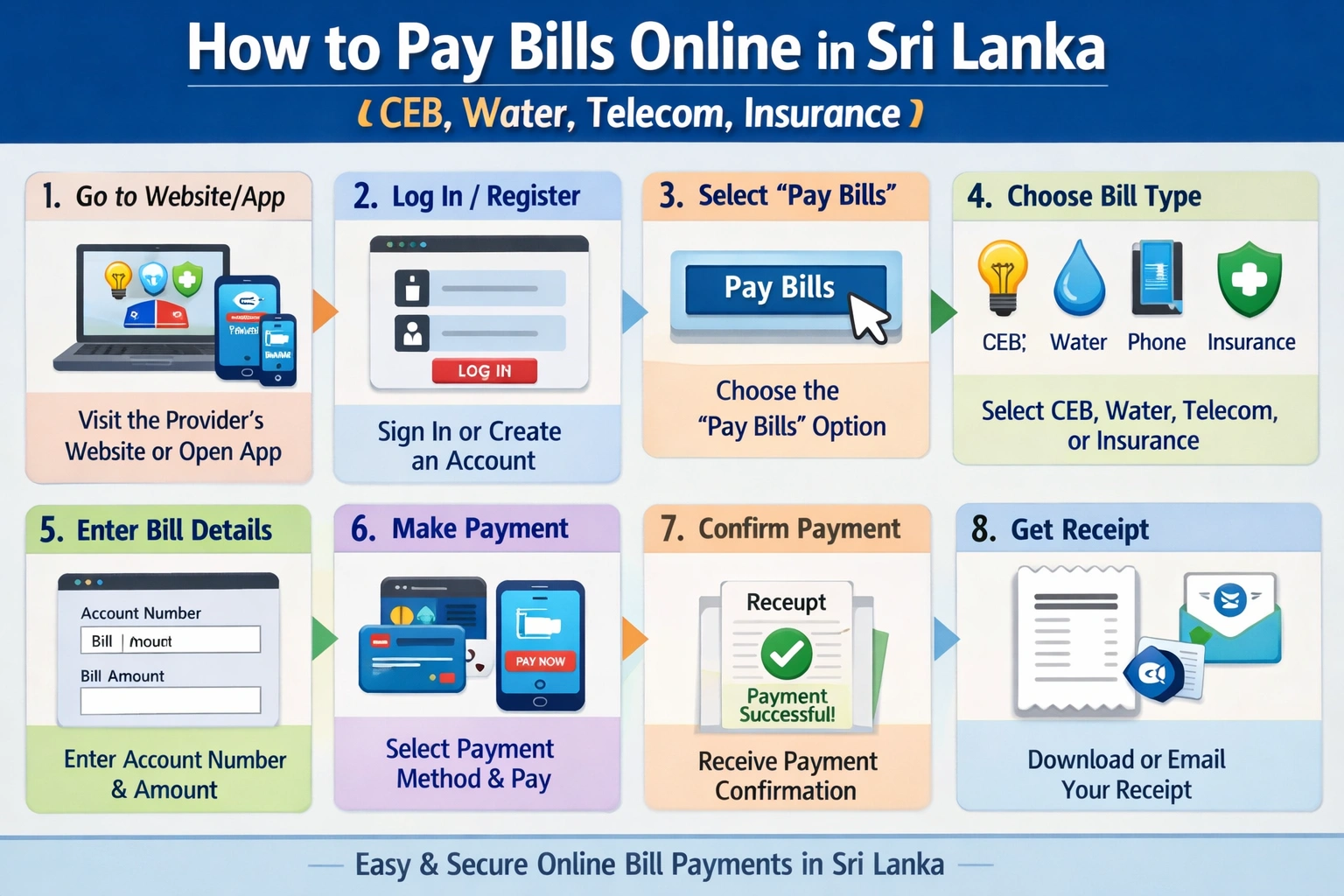

Step‑by‑step guide to paying bills online in Sri Lanka (CEB, water, telecom, insurance)

Why pay your bills online in Sri Lanka? Benefits, safety and what you need first More Sri Lankans now pay everyday bills online, helped by wider internet banking, mobile apps and government platforms such as GovPay operated via LankaPay’s real‑time payment network.[1][2][4][7] What bills can you p...

Sri Lanka Stock Market Halts After Error Trade on Wealth Trust Securities

The Colombo Stock Exchange (CSE) shut down trading for an entire session and cancelled all transactions after a series of error trades on newly listed Wealth Trust Securities sent its share price from single digits to tens of thousands of rupees within minutes. The incident triggered an emergency r...

Remittance guide for Sri Lankans: Best ways to receive money from UAE/Italy/UK/AUS/NZ with low fees.

Why remittances matter for Sri Lankans and what to look for in a transfer For many Sri Lankan families, money sent from the UAE, Italy, the UK, Australia and New Zealand is a lifeline that pays for food, rent, school fees and medical bills. Personal remittances to Sri Lanka are worth over USD 6–7 b...

How to safely use online banking in Sri Lanka: Security checklist for BOC, HNB, Com Bank , Sampath bank users

Online and mobile banking usage in Sri Lanka has surged as people increasingly rely on smartphones and digital channels for everyday transactions, investments and payments.[2] With Bank of Ceylon (BOC), HNB, Commercial Bank and Sampath among the largest retail banks, their broad customer bases and h...