Understanding Health Insurance Basics in Sri Lanka

Health insurance is a contract that protects you from high medical costs. You pay a regular fee, called a premium, to an insurance company. In return, the insurer agrees to pay for your eligible medical expenses. With the rising cost of private healthcare in Sri Lanka, a good health insurance policy provides a crucial financial safety net, giving you access to quality care without draining your savings.

Before choosing a policy, it’s essential to understand some fundamental terms:

Key Terms to Know

- Premium: The fixed amount you pay regularly (monthly or annually) to keep your policy active.

- Deductible / Co-payment: This is the portion of the medical bill you must pay yourself. A deductible is a fixed amount paid before the insurer starts paying, while a co-payment is a percentage of the bill you share with the insurer.

- Sum Insured: The maximum amount your insurance provider will pay for your medical claims within a policy year. A higher sum insured offers more protection.

- Waiting Period: A specific duration after purchasing your policy during which you cannot claim benefits for certain illnesses, such as pre-existing conditions.

Common Types of Coverage

Policies in Sri Lanka are generally built around these core components:

- Inpatient Cover: This is the most basic form of health insurance. It covers expenses when you are admitted to a hospital, such as room charges, surgery fees, medication, and nursing care.

- Outpatient (OPD) Cover: This covers medical expenses that do not require hospitalisation, like doctor consultations, diagnostic tests, and pharmacy bills. It is often available as an optional add-on.

- Critical Illness Cover: Provides a one-time lump-sum payment if you are diagnosed with a specific, life-threatening illness listed in the policy, like cancer or heart attack. This payment helps manage treatment costs and loss of income.

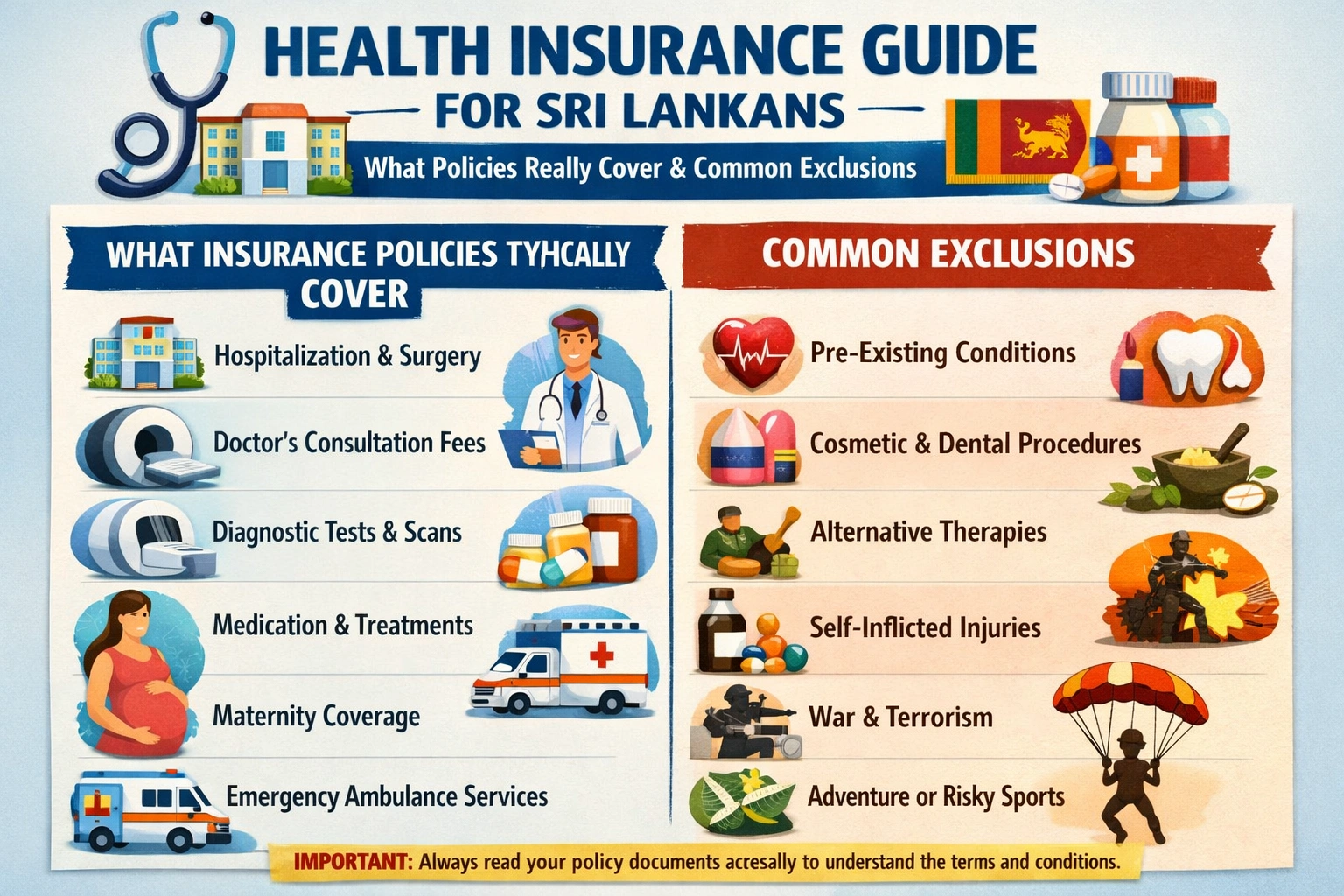

What Your Policy Actually Covers: A Deep Dive into Inclusions

When you buy a health insurance policy, you are buying a promise of financial protection. While every plan offered by insurers in Sri Lanka has its unique features, most standard policies provide a core set of benefits. Understanding these inclusions is the first step to using your policy effectively. Here’s a breakdown of what is typically covered.

Core Coverage Areas:

-

In-Patient Hospitalisation: This is the primary benefit of any health insurance plan. It covers expenses incurred when you are admitted to a hospital for 24 hours or more. This almost always includes:

- Room rent, boarding, and nursing expenses.

- Intensive Care Unit (ICU) charges.

- Fees for the surgeon, anaesthetist, and consulting specialists.

- Costs for the operating theatre, prescribed medicines, diagnostic tests (like X-rays and lab work), and medical supplies consumed during your stay.

- Pre- and Post-Hospitalisation Expenses: Your coverage extends beyond your hospital stay. Insurers typically cover medical expenses incurred for a specific period before admission (usually 30 days) and after discharge (often 60-90 days). This can include initial diagnostic tests, follow-up consultations, and rehabilitation like physiotherapy related to the reason for hospitalisation.

- Day-Care Procedures: Due to medical advancements, many surgeries and treatments no longer require an overnight stay. Policies cover these day-care procedures, which are completed within hours. Common examples include cataract surgery, dialysis, and certain minor surgeries.

- Surgical Benefits: The policy will cover a wide range of specified surgical procedures. These are often listed in the policy document with specific limits for each type of surgery.

- Emergency Ambulance Services: Most plans will reimburse the cost of using an ambulance to transport the patient to a hospital during a medical emergency.

Crucial Note: Always check your policy document for specific sub-limits (e.g., a cap on room rent), deductibles, and co-payments. These terms define the exact financial limits and your share of the cost for each covered benefit. Reading the fine print is non-negotiable.

The Fine Print: Common Exclusions You Must Know

While a health insurance policy is a vital safety net, it doesn’t cover everything. Understanding what is excluded from your policy is as crucial as knowing your benefits. Always read your policy document carefully, as specifics vary between insurers. However, here are some of the most common exclusions you will find in Sri Lankan health insurance plans.

- Pre-existing Conditions: Ailments you had before buying the policy, like diabetes or high blood pressure, are often not covered for a specific “waiting period,” typically ranging from 2 to 4 years. Full disclosure during application is essential to avoid claim rejection.

- Initial Waiting Periods: Most policies have a general waiting period of 30 days for all claims, except for accidental injuries. Furthermore, specific treatments like cataract surgery, hernia, or joint replacements may have a waiting period of one to two years.

- Maternity and Newborn Expenses: Standard plans usually exclude pregnancy and childbirth costs. This is often available as an optional add-on (a rider), but it comes with a long waiting period, often 24 months or more, before you can make a claim.

- Outpatient Department (OPD) Treatment: Many basic policies are “inpatient-only,” meaning they only cover costs if you are admitted to a hospital. Doctor consultations, diagnostic tests, and pharmacy bills without hospitalisation are frequently not covered unless you have a specific OPD benefit included in your plan.

- Dental and Vision Care: Routine dental check-ups, fillings, root canals, glasses, and contact lenses are generally excluded. Coverage may only apply if hospitalisation is required due to a severe accident.

- Cosmetic and Elective Procedures: Surgeries that are not medically necessary, such as plastic surgery for aesthetic enhancement, weight loss procedures, or similar elective treatments, are almost never covered.

- Alternative Therapies: Treatments outside of mainstream allopathic medicine, such as Ayurveda, homeopathy, or acupuncture, are typically excluded from coverage.

This list is not exhaustive. Your policy will also likely exclude expenses related to self-inflicted injuries, substance abuse, and injuries sustained during hazardous sports or illegal activities. The golden rule is to read and understand your policy wording before you commit, ensuring there are no surprises when you need support the most.

Choosing the Right Policy: A Practical Checklist for Sri Lankans

Navigating the world of health insurance can be overwhelming. Use this practical checklist to compare policies and select the one that best suits your needs and budget in Sri Lanka.

- Assess Your Personal and Family Needs: Consider your age, family size, lifestyle, and any pre-existing medical conditions. A young, single individual’s needs will differ greatly from a family with young children or dependent elderly parents. List your priorities before you start looking.

- Compare Core Coverage (Inclusions): Don’t just focus on the premium. Scrutinise what’s covered. Does it include in-patient hospitalisation, out-patient department (OPD) visits, surgical fees, and critical illness cover? Check which private hospitals are in the insurer’s network to ensure convenient, cashless access.

- Scrutinise the Exclusions: Understanding what is not covered is as important as knowing what is. Look for common exclusions like cosmetic procedures, certain dental/vision care, and specific treatments related to conditions that existed before you bought the policy.

- Check for Limits and Sub-Limits: Look beyond the overall policy value (sum insured). Insurers often place sub-limits on specific expenses like daily room rent, surgeon’s fees, or certain diagnostic tests. These caps can lead to significant out-of-pocket expenses if you’re not aware of them.

- Understand the Waiting Periods: Coverage is rarely immediate. Policies have mandatory waiting periods for specific illnesses (e.g., 1-2 years) and maternity benefits (often 10-12 months). Pre-existing conditions usually have the longest waiting periods before they are covered.

- Evaluate the Insurer’s Reputation: Research the insurance company. Look into their claim settlement ratio and read customer reviews about their service. A company with a smooth and fair claims process is invaluable during a stressful medical event.

References

- Insurance Regulatory Commission of Sri Lanka (IRCSL)

- AIA Sri Lanka – Health Insurance Solutions

- Ceylinco Life – Health & Protection Plans

- Allianz Lanka – Personal Health Insurance

- Softlogic Life – Health Insurance Plans

- Navigating the complexities of health insurance – Daily FT

- A Guide to Understanding Health Insurance in Sri Lanka – ReadMe Sri Lanka

- Ministry of Health, Sri Lanka – Public Healthcare Information