In Sri Lanka, the job market is relatively binary: you are either a permanent employee with EPF/ETF benefits, or you are doing “business.” In Canada, there is a massive middle ground that many skilled immigrants fall into, especially in IT, engineering, and consulting: Contracting.

You might see a job posting for a Senior Developer. The full-time salary is $110,000. But the contract rate is $90 per hour. You do the quick math ($90 x 2000 hours = $180,000) and think, “Why would anyone take the salary?”

The extra money is real, but it comes with a catch. When you become a contractor, you stop being an employee and start being a business. The government stops taking taxes out of your paycheck, which feels great until April rolls around and you owe the Canada Revenue Agency (CRA) $50,000. Here is the survival guide to the gig economy, tailored for those used to the Sri Lankan system.

The Fundamental Shift: Employee (T4) vs. Contractor (T4A/Invoice)

First, you need to understand the tax forms, because they dictate your life.

The Employee (T4)

If you are a permanent staff member, your employer handles everything. You get a paycheck with income tax, CPP (pension), and EI (employment insurance) already deducted. At the end of the year, you get a T4 Slip. You file it, and usually, you break even or get a small refund.

The Contractor (Self-Employed)

If you are a contractor, you are a “sole proprietor” or a corporation.

• You invoice the client (e.g., every two weeks).

• They pay you the full amount (plus HST, if applicable).

• Nothing is deducted.

This is where newcomers get in trouble. That $10,000 check isn’t yours. About 30-40% of it belongs to the government. If you spend it on a new Honda Civic, you will be in a world of pain at tax time.

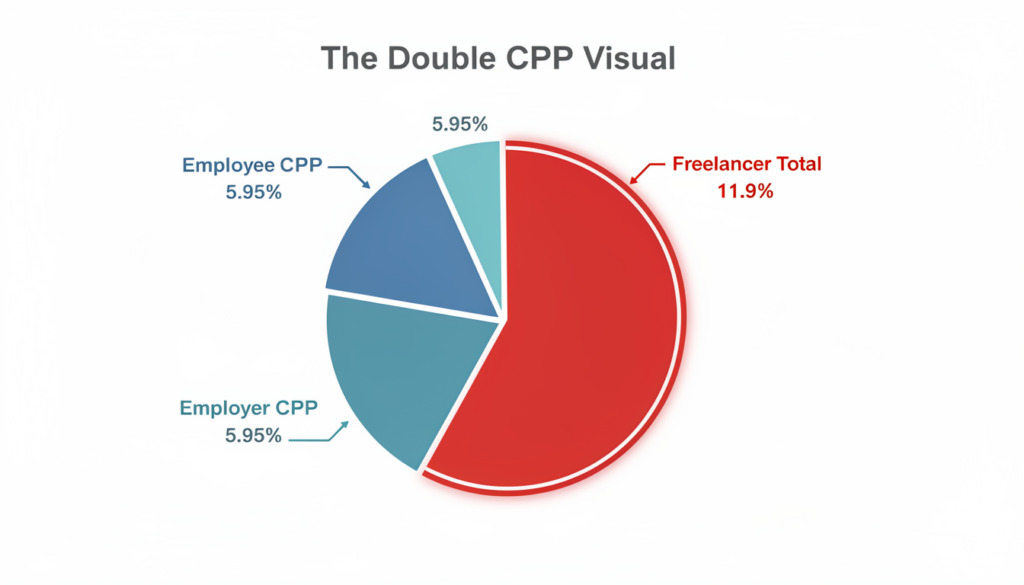

The “Double Tax” Shock: Canada Pension Plan (CPP)

This is the number one complaint I hear from new freelancers.

In Canada, the government pension (CPP) is funded by workers.

• Employees pay roughly 5.95% of their income.

• Employers match that 5.95%.

• Total: 11.9%.

When you are self-employed, you are both the employee and the employer. You must pay both halves.

For 2025, if you earn over $71,300, you will write a check to the CPP for over $8,000. This is mandatory; you cannot opt out. When you calculate your hourly rate, factor this “hidden tax” in.

The Fun Part: Write-Offs (Deductions)

Why do people do it? Because unlike employees, you can deduct business expenses to lower your taxable income.

- Home Office: If you use a spare room exclusively for work, you can deduct a portion of your rent/mortgage interest, electricity, heat, and internet. (Note: “Exclusively” is key. Working from your dining table doesn’t count).

- Equipment: That $3,000 MacBook Pro? That’s a business expense.

- Phone: The business percentage of your mobile bill.

- Accounting Fees: The money you pay your accountant to figure this out is deductible.

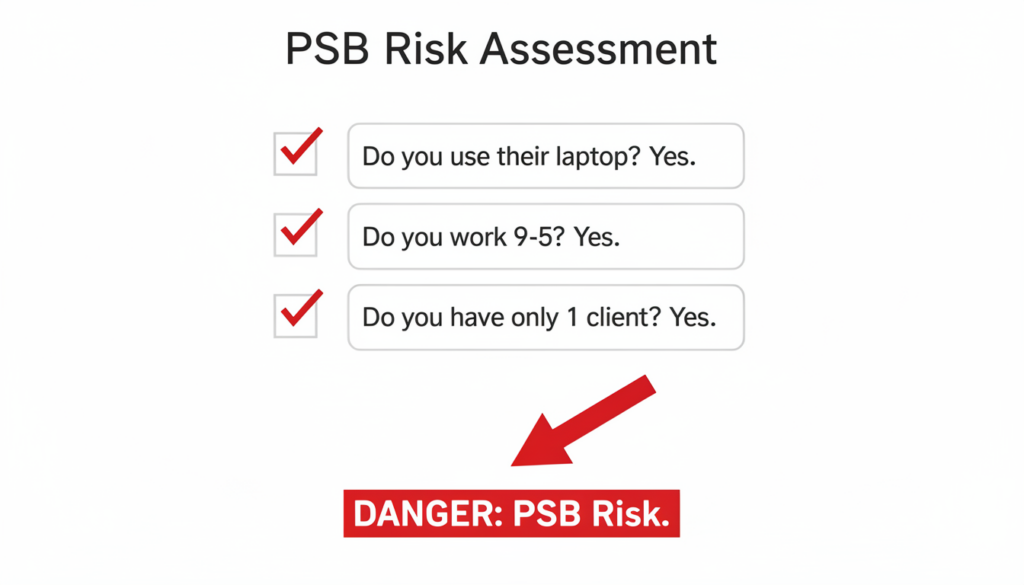

The Dangerous Trap: Personal Services Business (PSB)

Many Sri Lankan IT professionals incorporate a company to take contracts, thinking they can pay a low corporate tax rate (approx. 12%).

Warning: The CRA has a rule called Personal Services Business (PSB).

If you work for one client, use their laptop, work their hours (9-5), and attend their team meetings, the CRA says you are an “Incorporated Employee,” not a real business.

If they audit you and decide you are a PSB:

1. You lose the low tax rate (it jumps to ~44% or higher).

2. They deny your expense deductions.

3. You pay penalties.

Expert Advice: If you look like an employee, be an employee. Only incorporate if you have multiple clients or true independence.

Employment Insurance (EI): To Opt-In or Not?

As a freelancer, you generally don’t pay into Employment Insurance. This means if your contract ends, you cannot claim unemployment benefits.

The Exception: You can voluntarily pay into “EI Special Benefits” to get access to Maternity/Paternity leave or Sickness benefits.

The Catch: Once you opt in and claim a benefit, you are locked in forever. Most high-earning contractors skip this and self-insure by saving their own emergency fund.

The $30,000 HST Rule (Refresher)

We mentioned this in the business guide, but it bears repeating for freelancers.

Once you bill over $30,000 in any 12-month period, you must register for an HST number and start charging sales tax (e.g., 13% in Ontario) on top of your fee.

Do not forget this. If you bill a client $100 and don’t charge HST, the CRA will assume the $100 included the tax, and you will have to pay them $11.50 out of your own pocket.

Conclusion

Contracting offers freedom and a higher ceiling for earnings. It is fantastic for disciplined professionals who can manage their cash flow. But it requires a mindset shift.

In Sri Lanka, you might “settle up” your taxes loosely. In Canada, the CRA is a machine. My advice? Open a separate savings account. Every time a client pays you, immediately transfer 30% of it into that account and pretend it doesn’t exist. That money belongs to the Queen (or rather, the King). The rest is yours to enjoy.

References

- Canada Revenue Agency. (2025). Employee or Self-employed? RC4110 Guide.

- TurboTax Canada. (2025). What is a Personal Services Business (PSB)?

- CRA. (2025). Business Expenses for Self-Employed.

- CFIB. (2024). Employment Insurance for Self-Employed People.

- Government of Canada. (2025). CPP Contribution Rates.