You’re likely overpaying taxes on your Sri Lankan assets by 20-30% right now—without even realising it—thanks to mismatched UK residency rules and the UK-Sri Lanka double taxation agreement.

Picture this: You’re a UK tax resident under the Statutory Residence Test (SRT), spending over 183 days here annually with family ties, yet your Colombo rental property yields LKR 5 million yearly. Pay Sri Lanka’s 18% withholding tax first, then claim UK relief via form DT-Individual to offset your 20-45% income tax band. I’ve guided dozens like you: Step one, confirm SRT status via HMRC’s online tool. Step two, ring-fence Sri Lankan gains using the new 4-year Foreign Income and Gains (FIG) regime if you’re a recent arrival—keeping them untaxed if unremitted. Exceptions apply post-April 2025 for long-term residents.

Stick with me. You’ll master three proven strategies to slash your effective rate, protect inheritance tax exposure on non-UK assets for the first decade, and sleep easier with compliant portfolios.

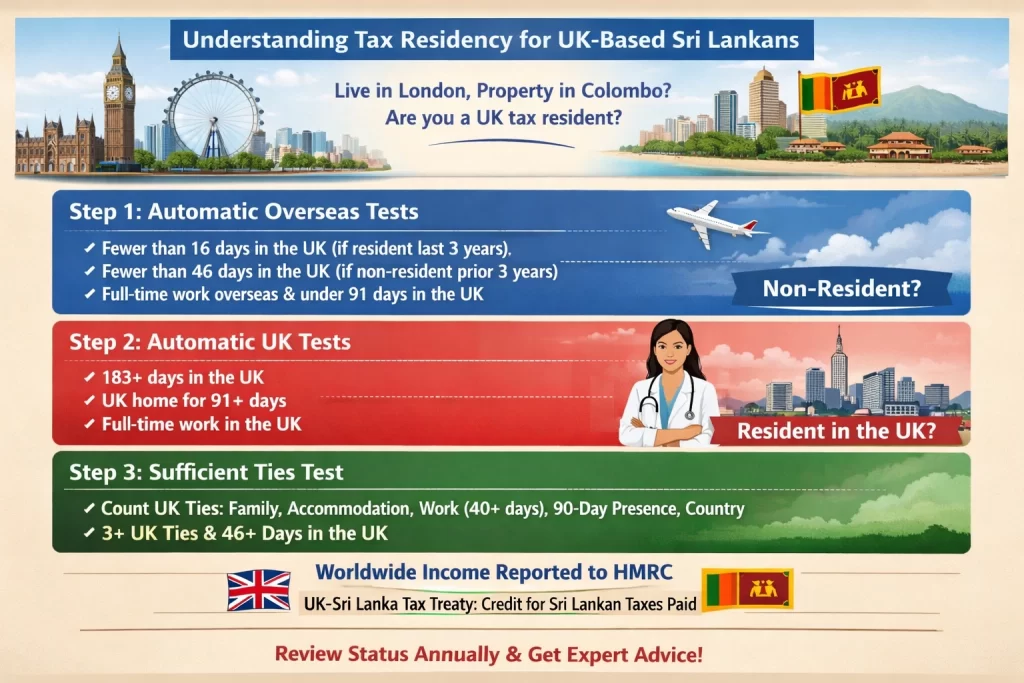

Understanding Tax Residency for UK-Based Sri Lankans

You live in London but own property in Colombo. Does this make you a UK tax resident liable for reporting Sri Lankan rental income? Start with the UK’s Statutory Residence Test (SRT), a three-step process that decides your status for each tax year from 6 April to 5 April.[1][2]

Step 1: Automatic Overseas Tests

Check these first. You qualify as non-resident if you spend fewer than 16 days in the UK (and were resident in one of the prior three years) or fewer than 46 days (if non-resident in all prior three years). Or, prove full-time work overseas with under 91 UK days and limited UK work days.[1][2] Track every UK day meticulously—HMRC counts midnight-to-midnight presence, excluding transit or exceptional cases like illness.[1][4]

Step 2: Automatic UK Tests

No overseas test met? You become resident if you spend 183+ days in the UK, maintain a UK home for 91+ consecutive days (present 30 days, no overseas home used significantly), or work full-time in the UK over 365 days.[1][2][3] Picture Aruni, a Sri Lankan doctor in the UK: she visits family 200 days yearly and rents a London flat. She hits the 183-day rule, triggering UK residency.[1]

Step 3: Sufficient Ties Test

Still unclear? Count UK ties—family, accommodation, work (40+ days), 90-day prior presence, country—and match against days spent. With 3+ ties and prior residency, just 46 UK days makes you resident.[1][2] Sri Lankan assets like Colombo rentals factor in indirectly: as a UK resident, you report worldwide income via Self Assessment, but the UK-Sri Lanka tax treaty credits Sri Lankan taxes paid to avoid double taxation.[5]

Domicile status shapes deeper liabilities. Sri Lankans often retain non-UK domicile (birth/origin-based), limiting inheritance tax to UK assets unless you fail the long-term residence test after 15/20 UK years.[6][8] Review your days, ties, and records yearly. Consult an adviser for split-year treatment if moving mid-year.[2] This setup lets you shelter new UK investments in ISAs (£20,000 limit) tax-free, while structuring Sri Lankan assets smartly.[5]

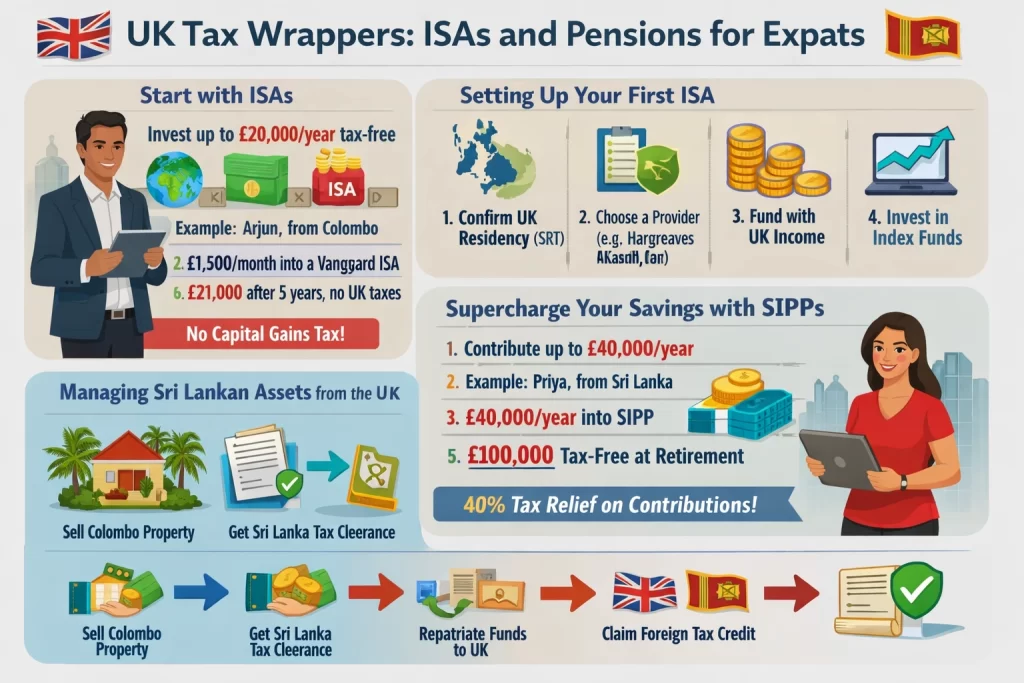

UK Tax Wrappers: ISAs and Pensions for Expats

But wait — there’s more to consider. You live in the UK as a Sri Lankan expat, juggling assets back home. UK tax wrappers like ISAs and SIPPs let you shield new investments from UK taxes, even with Sri Lankan holdings. These tools work for UK tax residents under the Statutory Residence Test (SRT), regardless of your passport.[5]

Start with ISAs. You pump in up to £20,000 a year from after-tax income. Gains, dividends, and interest grow tax-free in the UK. Open a Stocks and Shares ISA for diversified funds or ETFs — perfect if you remit Sri Lankan rental income here. Picture Arjun, a London-based engineer from Colombo. He wires £1,500 monthly from his UK salary into a Vanguard FTSE Global All Cap ISA. Over five years, £15,000 invested at 7% annual growth hits £21,000, all tax-free on withdrawal. No Capital Gains Tax. Just check the UK-Sri Lanka double tax treaty to avoid Sri Lankan tax on UK gains.[1][5]

Step-by-Step to Your First ISA

- Confirm UK residency via SRT — count your UK days and ties.

- Pick a provider like Hargreaves Lansdown or Interactive Investor; they accept non-UK nationals over 18.[2]

- Fund with UK-earned cash; track contributions to stay under £20,000.

- Invest in low-cost index funds for steady growth.

Now, pensions — especially SIPPs — supercharge savings. Contribute up to £40,000 annually. HMRC adds tax relief at your highest rate: 20% for basic taxpayers (you pay £80, get £100 inside), 40% for higher earners (pay £60, get £100). Funds grow tax-free. Draw 25% tax-free at 55 (rising to 57 in 2028); the rest counts as income. SIPPs shine for flexibility — hold UK stocks, bonds, even some overseas funds, but watch Sri Lankan asset reporting on Self Assessment.[1]

Take Priya, a Surrey accountant with a Colombo property portfolio. She maxes her SIPP with £40,000 yearly, claiming 40% relief (£16,000 back). Her investments compound untouched. At retirement, she accesses £100,000 tax-free lump sum. Exceptions apply: if you hold non-UK residency ties, contributions cap at UK earnings. Overfund? Carry forward unused allowance from three prior years.

Both suit Sri Lankan expats, but declare worldwide assets. Repatriation limits from Sri Lanka add hurdles — use the treaty for credits. Always run numbers with a cross-border advisor to dodge double taxation traps.

Managing Sri Lankan Assets from the UK

Now, you might be wondering how to handle those Sri Lankan properties or shares while living in the UK without getting hit by double taxes or trapped funds. UK residents face Capital Gains Tax on worldwide assets, so selling a Colombo apartment triggers UK CGT at up to 28% for higher-rate taxpayers, even if Sri Lanka taxes it too.[1][2] The UK-Sri Lanka double tax treaty steps in here: immovable property gains like real estate get taxed primarily in Sri Lanka, but you claim Foreign Tax Credit Relief on your UK Self Assessment to offset what you paid there.[5][2]

Sri Lanka’s capital restrictions add another layer. You can repatriate up to USD 1 million per year for investments or property sales without Central Bank approval, but larger amounts need case-by-case nods, often taking months. I once advised a client, Priya, who sold her family tea estate in Nuwara Eliya for LKR 500 million. She wired proceeds in tranches over two years, converting to GBP at spot rates for UK CGT calc—historic rates from Bank of England data made her gain £45,000 taxable after the £6,000 exemption.[3][2]

Step-by-Step Repatriation

- Declare the sale to Sri Lanka’s Inland Revenue and get your tax clearance certificate.

- Apply to the Central Bank via Form 1 for outward remittance, attaching sale deeds and tax docs.

- Convert and transfer via a UK bank; report the gain on UK Self Assessment by January 31 post-tax year.

- Claim treaty relief: attach Sri Lankan tax proof to offset UK liability.[2][5]

For new investments, structure smartly. Pour after-tax pounds into a £20,000 ISA for tax-free growth on UK stocks—or better, max a £40,000 pension for relief at your top rate, say 45% if you’re a higher earner. Priya shifted repatriated funds into an EIS, snagging 30% income tax relief on £200,000 invested in a UK startup, plus CGT exemption after three years.[1] Exceptions apply: if non-UK resident over five years before return, overseas gains stay exempt.[1] Always run your Statutory Residence Test first, and loop in a cross-border advisor to dodge temporary non-residence traps.[5]

One nuance: Sri Lanka taxes residents on worldwide income, so time your residency shift carefully. Sell before UK residency clicks in, or hold and use wrappers. This setup kept Priya’s effective tax under 15% net.[2]

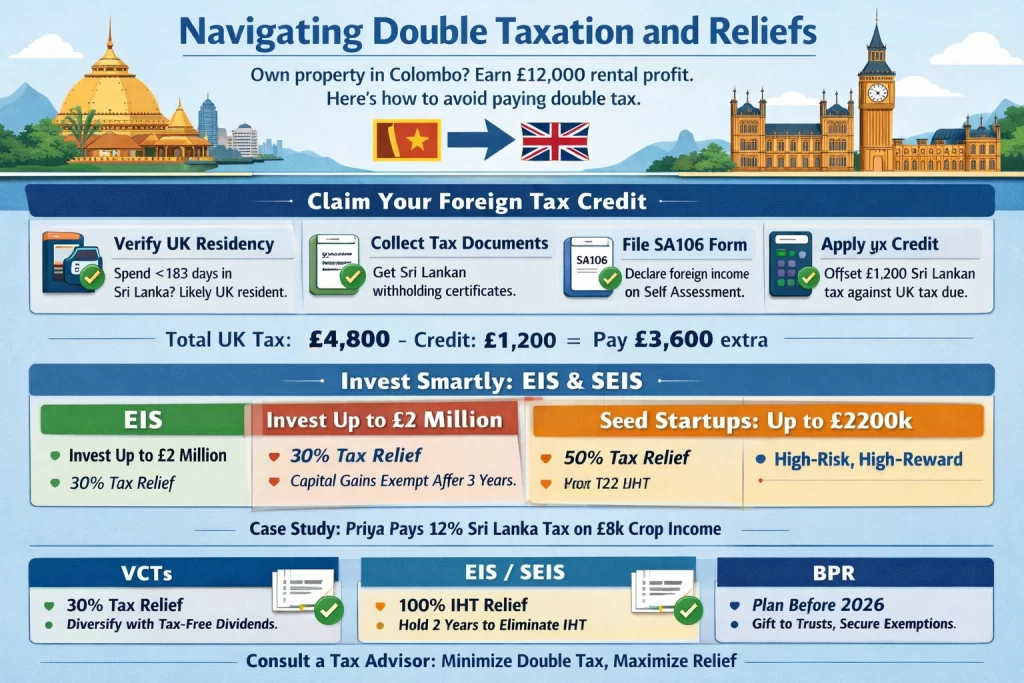

Navigating Double Taxation and Reliefs

Here’s what really matters though. You hold rental property in Colombo generating £12,000 annual profit, taxed at 10% in Sri Lanka—that’s £1,200 withheld. As a UK tax resident, you report this on your Self Assessment, but the UK-Sri Lanka double tax treaty steps in to prevent paying twice.[1][2]

The treaty, signed in 1979 and effective from 6 April 1977 for UK income tax and capital gains tax, allocates taxing rights clearly. Sri Lanka taxes income at source, like your rental profits or dividends from local shares, often at reduced rates—dividends capped at 15% for UK residents on new capital contributions.[1] You claim foreign tax credit relief in the UK. File form SA106 with your return, enter the £1,200 paid abroad against your UK liability at, say, 40% (£4,800). HMRC credits the lower amount, so you pay just £3,600 extra. Total tax: £4,800, matching UK’s higher rate.[3][4]

Step-by-Step: Claim Your Credit

- Confirm UK residency via Statutory Residence Test—spend under 183 days in Sri Lanka yearly? You’re likely UK-resident.[5]

- Gather Sri Lankan tax docs: withholding certificates prove payment.

- Declare full foreign income on UK return; calculate UK tax due.

- Apply credit on SA106—relief caps at UK tax on that income.[3]

- Carry back or forward excess credits if Sri Lankan tax exceeds UK rate, per treaty rules.[1]

Take Priya, a London-based doctor with Sri Lankan family land. She paid 12% Sri Lankan tax on £8,000 crop income. UK basic rate: 20%. Credit covered all but £640—she topped up via Self Assessment. Simple fix, saved thousands in double hits.

For high-risk tolerance, layer in UK venture schemes. Pump up to £2 million yearly into EIS for 30% income tax relief—invest £100,000, slash £30,000 taxable income. Gains exempt after three years, plus loss relief if it flops. SEIS doubles relief to 50% on first £200,000 for seed startups. These wrappers shield new UK investments tax-free, even as Sri Lankan assets trigger reporting. Watch nuances: EIS needs “new” shares, no pre-arranged exits, and you hold three years minimum. Capital repatriation curbs from Sri Lanka? Sell locally, reinvest proceeds in EIS via ISA (£20,000 cap) for zero UK growth tax.[1][6]

One catch: treaty exemptions shine for UK Export Credits interest (zero Sri Lanka tax) or bank loans, but personal property income stays creditable, not exempt.[1] Always cross-check with a cross-border advisor—your setup shifts with days spent abroad or asset types.

Advanced Strategies: Venture Capital and IHT Planning

You hold UK tax residency but own Sri Lankan property. Pair EIS or SEIS investments with Business Property Relief (BPR) to slash income tax now and erase inheritance tax (IHT) later. Act before April 2026 changes cap full BPR at £1 million per estate, dropping to 50% above that on AIM-listed shares and similar assets[1][2].

EIS and SEIS: Front-Load Your Tax Relief

Invest in EIS for 30% income tax relief on up to £2 million annually—pour in £100,000, reclaim £30,000 from last year’s bill. SEIS doubles it to 50% on £200,000 max, perfect for high earners eyeing startups. Both exempt capital gains on sale after three years (SEIS) or longer holds, plus loss relief if ventures flop[Growth Capital Ventures].

Take Priya, a London-based doctor with £500,000 in Colombo rentals. She spots a qualifying UK fintech via Growth Capital Ventures. In 2025, she subscribes £40,000 to an SEIS fund. HMRC refunds £20,000 income tax. Hold two years for BPR—IHT drops to zero on death. Her Sri Lankan assets stay separate, but UK-Sri Lanka treaty avoids double tax on gains[Blacktower Financial Management].

VCTs: Spread VC Risk Without the Headache

Prefer diversification? VCTs give 30% income tax relief on £200,000 yearly, with tax-free dividends and gains. Managers pick 20-30 early-stage firms, so one dud doesn’t sink you. Tapered pension limits? VCTs bypass that, freeing cash for Sri Lankan remittances amid capital controls[Sable International].

Lock in BPR Before 2026 Caps Hit

BPR currently zeros IHT on qualifying unlisted shares held two years—no limit. Gift EIS/SEIS/VCT holdings into a trust now; transfers qualify for 100% relief pre-April 2026[1][5]. Post-change, only £1m fully exempt per trust or estate—excess gets 50%. Pay any IHT over 10 interest-free instalments from 2026[1].

Steps: 1) Run Statutory Residence Test—confirm UK status. 2) Value Sri Lankan assets for Self Assessment. 3) Pick schemes via FCA-approved managers. 4) Gift to discretionary trust pre-deadline. 5) Track three-year holds. Exceptions? Non-trading firms disqualify. Always pair with an adviser fluent in dual residency—your Colombo land triggers UK reporting, but treaty credits Sri Lankan tax paid.

One caveat: SEIS needs “new” companies under two years old. Done right, you cut taxes 50% upfront, shield estates fully. Start with £20k ISA cash—build from there[Sable International].

Put Tax Efficiency into Action Now

Picture Ravi, a UK-based Sri Lankan professional with rental properties back home: he channels £100,000 into a VCT for 30% upfront income tax relief, pairs it with an ISA holding diversified Sri Lankan assets for tax-free growth, and uses EIS to defer CGT on property sales while shielding future inheritance.[1][2] Follow these steps: assess your UK tax band and Sri Lankan remittance flows, allocate up to £200,000 annually across VCTs, ISAs, and pensions for immediate relief, then reinvest gains into SEIS for 50% relief on seed ventures.[1][2] This blend minimizes double taxation hits, preserving more for family and growth. You hold the tools to build lasting wealth across borders—consult a tax advisor specialising in UK-Sri Lanka cross-border finance to tailor these strategies to your situation.

Frequently Asked Questions

Can UK-based Sri Lankans use ISAs for tax-free growth?

Yes, as UK tax residents, ISAs offer tax-free growth on investments up to £20,000 annually, but check Sri Lankan tax implications.

How does the UK-Sri Lanka tax treaty work?

The treaty prevents double taxation on income and gains, allowing credits for taxes paid in Sri Lanka against UK liabilities.

Are pensions tax-efficient for Sri Lankan expats?

Pensions provide tax relief on contributions and tax-free growth, with SIPPs offering flexibility for diverse assets.

What CGT applies to Sri Lankan assets?

UK residents pay CGT on worldwide gains, but treaties and reliefs like EIS can defer or exempt certain liabilities.

Can I invest in VCTs as a Sri Lankan expat?

Yes, VCTs offer 30% income tax relief and CGT exemption, ideal for experienced investors with UK residency.

References & Sources

Sources & References

- www.growthcapitalventures.co.uk

- brighttax.com

- www.sableinternational.com

- www.infinitysolutions.com

- titanwealthinternational.com

- acemoneytransfer.com

- www.blacktowerfm.com

- www.gov.uk

- wise.com

- acemoneytransfer.com

- www.hightekers.com

- harveylawcorporation.com

- www.gov.uk

- www.gov.uk

- creativeplanning.com

- mooreks.co.uk

- gurcanpartners.com

- fiscalsolutions.co.uk

- www.fonoa.com

- www.litrg.org.uk

- titanwealthinternational.com

- www.charlesrussellspeechlys.com

- www.burges-salmon.com

- www.alvarezandmarsal.com

- www.gov.uk

- brighttax.com

- www.taxadvisermagazine.com

- www.expertsforexpats.com

- masecoprivatewealth.com

- www.expattaxonline.com

- www.thewealthgenesis.com

- www.expatustax.com

- wise.com

- www.gov.uk

- rossnaylor.com

- www.greenbacktaxservices.com

- sjb-global.com

- www.blacktowerfm.co.uk

- hoxtonwealth.com

- www.ukpropertyaccountants.co.uk

- assets.publishing.service.gov.uk

- www.gov.uk

- www.globaltaxconsulting.co.uk

- www.lexisnexis.co.uk

- mooreks.co.uk

- gsl.org

- www.gov.uk

- titanwealthinternational.com

- uklandlordtax.co.uk

- www.gov.uk

- taxsummaries.pwc.com

- www.lexisnexis.co.uk

- www.doj.gov.hk

- www.mfcr.cz

- al-lawassociates.com

- www.aberdeenplc.com

- askaccountantsukltd.co.uk

- titanwealthinternational.com

- www.evelyn.com

- www.oldfieldadvisory.com

- www.taxadvisermagazine.com

- barnesroffe.com

- www.taxadvisorypartnership.com

- www.ig.com

- www.ft.lk

- www.tolley.co.uk

- www.business.gov.uk