If you have looked at university tuition rates lately, you might have felt a knot form in your stomach. It is expensive now, and by the time your toddler is eighteen, projections suggest a four-year degree in Canada could cost upwards of $100,000 when you factor in housing and books. That is a scary number.

But here is the reality: you don’t need to panic, and you definitely don’t need to fund the whole thing out of your monthly paycheck in 2040. Canada has one of the most generous education savings programs in the world, yet thousands of families leave free money on the table every year simply because the paperwork feels overwhelming or the rules seem confusing.

The Registered Education Savings Plan (RESP) is your best defense against rising tuition costs. It is not just a savings account; it is a vehicle that triggers government grants and shields your investment gains from taxes. Whether you can save $50 a month or $200, the system is designed to help you.

You are going to learn exactly how to set this up, how to maximize the “free money” from the government, and—perhaps most importantly—how to avoid the predatory “group plans” that trap well-meaning parents with high fees. Let’s get your child’s financial future sorted out, once and for all.

What Actually Is an RESP?

Think of an RESP as a tax-sheltered basket. You put after-tax money into this basket for your child’s education. While you don’t get a tax deduction for putting the money in (like you do with an RRSP), the magic happens inside the basket.

First, the money grows tax-free. As long as the funds stay in the account, you don’t pay a cent of tax on the interest, dividends, or capital gains. That compounding effect over 18 years is massive.

Second, and this is the headline feature, the government peeks into your basket and tosses in extra cash just for being a responsible parent. When your child eventually heads to post-secondary school, the money comes out. Your original contributions come back to you tax-free, and the investment growth plus the government grants are taxed in your child’s hands—usually resulting in zero tax owing because students have low incomes.

The “Free Money”: Understanding Grants

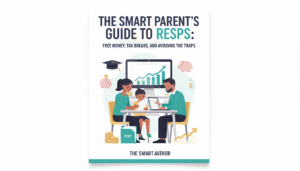

The Canada Education Savings Grant (CESG) is the primary reason to open an RESP. It effectively guarantees you a 20% return on your investment before you even buy a single stock or bond.

How the CESG Works

For every dollar you contribute, the government matches 20%, up to a maximum grant of $500 per year. To get the full $500, you need to contribute $2,500 annually. The lifetime limit for this grant is $7,200 per child.

The Math looks like this:

- You contribute: $2,500

- Government adds: $500

- Total invested: $3,000

The “Catch-Up” Rule

This is a detail many parents miss. If you didn’t start an RESP when your child was born, you haven’t lost that grant room forever. You can carry forward unused grant room from previous years.

However, there is a catch: you can only catch up on one previous year at a time. The maximum grant you can receive in a single calendar year is $1,000 (which requires a $5,000 contribution). You cannot dump $10,000 in at once and expect $2,000 in grants. You have to spread it out.

The Canada Learning Bond (CLB)

If your household income is modest (roughly under $53,000, though it changes slightly each year), the government offers the Canada Learning Bond. This requires zero contribution from you.

Just for opening the account, they deposit $500. They will add another $100 for every year your family remains eligible, up to a total of $2,000. I have seen many eligible families miss out on this simply because they thought they needed money to open an account. You don’t.

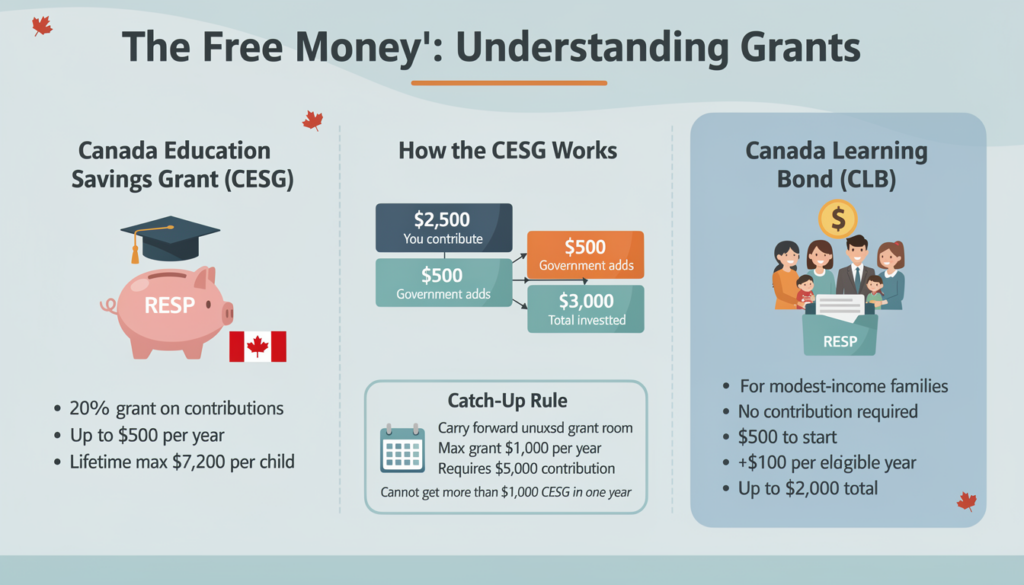

Choosing Your Provider: The Most Critical Decision

This is where I see parents make their most expensive mistakes. Not all RESPs are created equal. In Canada, you generally have three categories of providers, and one of them should be approached with extreme caution.

1. The Individual or Family Plan (The Best Choice)

You open this at a bank, a credit union, or an online brokerage (like Wealthsimple, Questrade, or your bank’s discount brokerage). These plans are “self-directed” or managed by a robo-advisor.

Why it wins: You have total control. If you lose your job and can’t contribute for a year, nothing bad happens. If you want to move the money to a different bank, you can. If you want to invest in low-cost ETFs to save on fees, you can do that too. If you have multiple kids, a Family Plan lets you pool the money, making it easier to manage and share funds if one child’s education costs more than the other’s.

2. The Group / Scholarship Trust Plan (The Danger Zone)

You may have received aggressive marketing from companies selling “Scholarship Trusts.” These are pooled funds where your money is grouped with other children the same age.

Why you should be wary: These plans often have high upfront “enrollment fees” (sometimes thousands of dollars) that you only get back at the very end if you follow strict rules. If you miss a payment, want to leave the plan early, or if your child takes a gap year, you can face severe penalties or lose your investment earnings entirely. While they are legal, they lack the flexibility most modern families need.

Expert Tip: Stick to a standard financial institution. Life is unpredictable; you want a plan that allows you to pause contributions without a penalty.

Investment Strategies: A Timeline Approach

Since you cannot touch this money for roughly 18 years, you should invest it differently than you would your emergency fund. The timeline dictates the strategy.

Age 0–8: Aggressive Growth

Time is on your side. During these early years, your portfolio should lean heavily toward equities (stocks). The market will go up and down, but over a 15-year period, stocks historically provide the best returns. A typical mix might be 80% equities and 20% fixed income (bonds). If the market dips when your child is four, it doesn’t matter—you have 14 years to recover.

Age 9–13: Balanced Approach

As your child finishes elementary school, you want to start protecting those gains. You might shift to a 60/40 or 50/50 split. You are still looking for growth, but you are introducing more stability.

Age 14–17: Safety First

This is the “preservation phase.” The last thing you want is a market crash the year before tuition is due (imagine having your college fund entirely in stocks in 2008). By the time your child is in high school, a significant portion of the money should be in GICs, high-interest savings accounts, or bonds. You aren’t trying to double your money anymore; you are ensuring it is there when the tuition bill arrives.

Withdrawal Strategy: How to Get Money Out

The day has arrived. Your child is enrolled in a qualifying post-secondary institution. This can be a university, college, trade school, or even certain apprenticeships. Now you need to withdraw the funds smartly.

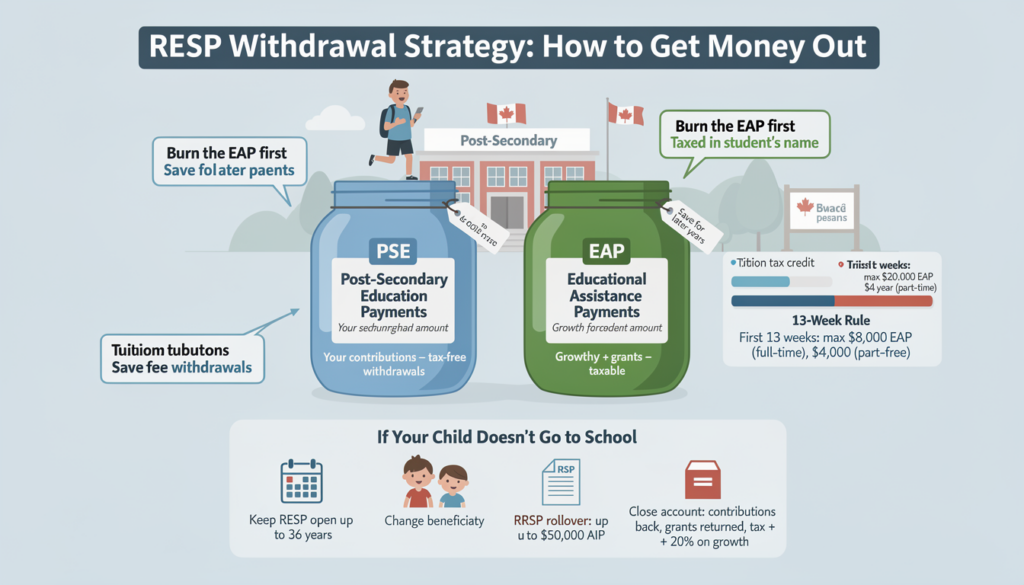

Your RESP balance is actually two different “piles” of money:

- PSE (Post-Secondary Education Payments): This is your contribution money. Since you paid tax on this before putting it in, you can withdraw it tax-free at any time.

- EAP (Educational Assistance Payments): This is the growth (interest/dividends) plus the government grants. This money is taxable.

The “Burn the EAP” Strategy

The golden rule of RESP withdrawals is to drain the taxable money (EAP) first. Why? Because the EAP is taxed in the student’s name, not yours.

A Canadian student likely has a tuition tax credit and a “basic personal amount” (the amount you can earn before paying federal tax, usually around $15,000). This means a student can withdraw roughly $20,000+ of EAP in a year and pay zero income tax.

If you leave the EAP for later years—when the student might be working a well-paid co-op job or starting their career—they will be in a higher tax bracket and will lose a chunk of that money to the CRA. Use the EAP while they are “poor” students, and save the tax-free PSE withdrawals for when they have higher income.

The 13-Week Rule

There is one restriction to note: In the first 13 weeks of enrollment, the government limits EAP withdrawals to $8,000 for full-time students (or $4,000 for part-time). This is to prevent people from enrolling, taking the cash, and dropping out immediately. Once the 13 weeks are up, the limit is lifted, and you can withdraw as much as you need.

What If My Child Doesn’t Go to School?

This is the most common hesitation I hear. “What if my kid wants to be a YouTuber or travel the world?”

First, take a breath. You have options.

- Keep it open: An RESP can stay open for 36 years. If your 18-year-old isn’t ready, let the account sit. They might decide to go to trade school at 24.

- Change the beneficiary: In a Family Plan, this is seamless. You just use the funds for a sibling. In an individual plan, you can usually name a new beneficiary, though some rules apply regarding the age of the new child.

- The RRSP Rollover: If the account has been open for at least 10 years and the beneficiary is over 21, you can transfer up to $50,000 of the accumulated profit (AIP) into your own RRSP (or your spouse’s), provided you have the contribution room. This keeps the money tax-sheltered.

- Close the account: Worst case scenario? You close the account. You get 100% of your contributions back tax-free. You have to return the government grants (fair is fair), and you will pay tax on the investment growth plus a 20% penalty tax. It sounds harsh, but you are still walking away with your principal intact.

Nuanced Traps to Avoid

Before you run off to the bank, here are two specific “gotchas” that experts know to watch for.

The US Dividend Tax

If you are a savvy investor, you might want to buy US stocks (like Apple or Microsoft) in the RESP. Be aware that the RESP is not recognized by the IRS as a retirement account. This means a 15% withholding tax will be applied to any dividends paid by US companies. You cannot claim this back. It is usually better to hold Canadian dividend stocks or pure growth stocks that don’t pay dividends inside an RESP.

The Over-Contribution Penalty

The lifetime contribution limit per child is $50,000. There is no annual limit (other than the grant logic), but there is a hard lifetime cap. If you go over $50,000, the CRA charges a penalty of 1% per month on the excess amount. If grandma and grandpa open a separate RESP for the same child, you need to coordinate. The limit applies to the child, not the account.

Key Takeaways

Setting up an RESP is one of the highest-ROI activities you can do as a parent. The combination of tax-free growth and 20% guaranteed returns is unbeatable.

- Prioritize the Match: Aim to contribute $2,500 annually to grab the full $500 grant.

- Avoid Group Plans: The flexibility of a self-directed Family Plan is almost always superior to a Scholarship Trust.

- Invest for Growth Early: Don’t leave the money in cash for 18 years. Use equities to beat inflation.

- Strategize Withdrawals: Use the taxable portion (EAP) when your child has the lowest income.

Here is your next step: If you haven’t started yet, just open the account. Even if you can only put in $25 a month right now, get the paperwork done. The compound interest clock is ticking, and the sooner you start, the less you will have to worry about that tuition bill in the future. Meta Title: Canada RESP Guide 2025: Rules, Limits & Maximizing Grants Meta Description: A complete guide to Registered Education Savings Plans (RESP) in Canada. Learn how to maximize the $7,200 CESG grant, avoid group plan fees, and withdraw funds tax-efficiently. Featured Image Prompt: A high-quality, realistic photo of a Canadian kitchen table setting. In the foreground, a calculator and a tablet displaying a rising graph. In the soft-focus background, a parent helping a young child with homework. The lighting is warm and natural, symbolizing future security. Inner Image Prompt 1: An infographic illustration comparing “Individual vs. Group Plans.” The Individual side shows icons of flexibility (unlocked padlock, low fees), while the Group side shows icons of restrictions (calendar with warning signs, high fee stack). Inner Image Prompt 2: A visual timeline bar chart titled “Investment Strategy by Age.” 0-8 years is colored green (Stocks/Growth), 9-13 years is yellow (Balanced), and 14-17 years is blue (Bonds/Safety).