UK lenders will happily take your money—but only if you’re willing to pay significantly more for it than British citizens do. Foreign-born residents face deposit requirements double or triple those of local buyers, interest rates that reflect “expat risk,” and a documentation process so thorough it feels designed to test your patience. Yet thousands successfully buy homes in the UK each year, and the gap between what you’ve heard and what’s actually possible is wider than you think.

The real frustration isn’t that mortgages are unavailable to you. It’s that the process feels opaque. Lenders apply different rules depending on your visa status, employment location, and whether you have indefinite leave to remain. One bank’s strict criteria becomes another’s standard practice. You’re left piecing together information from conflicting sources, unsure which requirements actually apply to your situation.

This guide cuts through that confusion. You’ll discover exactly how much deposit you actually need (it’s often less than you’ve been told), which income sources lenders will count toward your borrowing power, and the specific documentation that separates approved applications from rejected ones. More importantly, you’ll understand the framework lenders use to assess foreign applicants—so you can position yourself as the lowest-risk candidate in the room.

Understanding UK Mortgages for Foreign Nationals

You arrive in the UK full of excitement, ready to plant roots, only to hit a wall: lenders demand proof of residency, hefty deposits, and a credit history you don’t have yet. That frustration feels all too real—I’ve seen it countless times with clients fresh from abroad, staring down rejections from high-street banks.

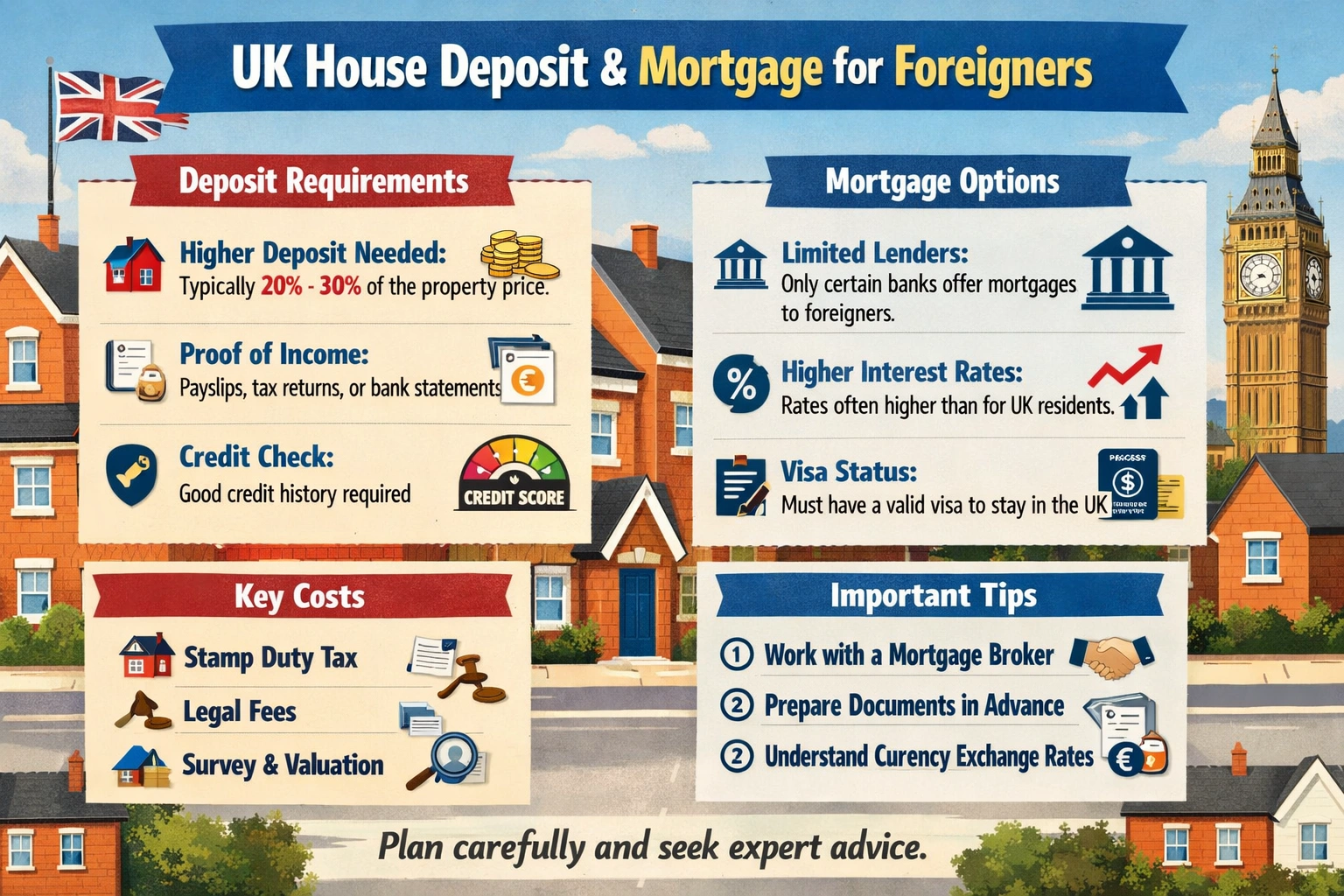

Take heart. Foreign nationals can secure UK mortgages, though terms differ sharply from those for UK residents.[1][2] You face higher deposits—typically 20-25% if you’ve been here less than 12 months or lack a thick credit file—compared to the 5-10% many locals snag after two years of residency.[1][2] Lenders view you as higher risk without indefinite leave to remain (ILR), so they protect themselves with bigger down payments and stricter checks.

Your visa status shapes everything. Pre-settled status works with some lenders, especially if you’re midway through your five-year EU settlement scheme path; others insist on settled status or ILR for better rates.[1] Skilled Worker visas (formerly Tier 2) open doors too—expect mainstream options like Barclays or HSBC at 15% deposit after 12-24 months here, provided you show payslips, bank statements, and right-to-work proof via passport or biometric card.[2][3] Non-residents? Possible with sky-high income or assets, but specialist brokers unlock niche lenders.[3] I’ve helped a Spanish engineer on pre-settled status buy in Manchester: after 18 months, a 20% deposit and UK payslips got her a HSBC deal at 4.2% fixed—far better than overseas options.

Build credibility fast. Open a UK bank account day one; reside 1-2 years to grow a credit score via utility bills and small loans.[1][2] Lenders verify foreign income with two years’ statements or accountant letters, but UK proof trumps all.[4] Exceptions exist—high-net-worth folks bypass residency rules—but most thrive by stacking time, deposit, and status.

Chat with a broker early. They match your profile to 200+ lenders, dodging mainstream pitfalls. You control this process. Stay put, save aggressively, document everything. Your UK home waits.

Saving Strategies for Your House Deposit

Speaking of which, staring at your UK bank balance as a foreign resident often feels like watching sand slip through your fingers—high rents in cities like London devour your salary, while exchange rate swings turn your overseas savings into a gamble. You moved here chasing stability, yet that house deposit seems miles away. Take heart. You can turn this around with targeted steps that fit your expat reality.

First, set a clear target: aim for 15-25% of the property value, as lenders demand more from foreign buyers to offset risks like currency volatility[2][5]. On a £200,000 home outside London, that’s £30,000 to £50,000. Push for 20% or higher to snag better rates—I’ve seen clients drop their interest from 5% to under 4% this way, saving thousands over 25 years.

If you’re 18-39 and a first-time buyer, open a Lifetime ISA right away. Stash up to £4,000 yearly; the government tacks on a 25% bonus (max £1,000)[1][3]. Keep it open 12 months before buying a home under £450,000. Not everyone qualifies—visa holders count if UK-resident, but check your status. Pair it with a high-yield easy-access or fixed-term account for extra interest; rates hover around 4-5% now from building societies like Hodge[3].

Next, craft a budget tuned to UK life. Use the 50/30/20 rule: 50% needs (rent, bills), 30% wants (nights out), 20% savings[1]. Track every expense via apps like Money Dashboard. Cut takeaways—swap Deliveroo for home cooking, saving £100 monthly easy. Automate transfers on payday to your deposit account; this “pay yourself first” trick keeps savings untouchable[1][3].

As an expat, transfer foreign funds smartly. Lenders accept overseas savings if proven yours via statements, but move them to a UK account pre-application[4]. Ditch banks’ 3-5% fees; services like Wise charge under 1%, preserving your pot. Boost income too—side gigs via Indeed fit around your job.

Picture this: on a £30,000 salary, save £500 monthly for two years. That’s £12,000, plus £1,000 LISA bonus and 4% interest—nearing £14,000. Tack on £16,000 from abroad, and you hit 15% on a £200,000 property[1]. One client, a Nigerian engineer in Manchester, did exactly this in 18 months by living with flatmates and skipping car ownership. Adjust for your city—London needs grit, but suburbs ease the load. Stay consistent. Your keys await.

Step-by-Step UK Mortgage Application Process

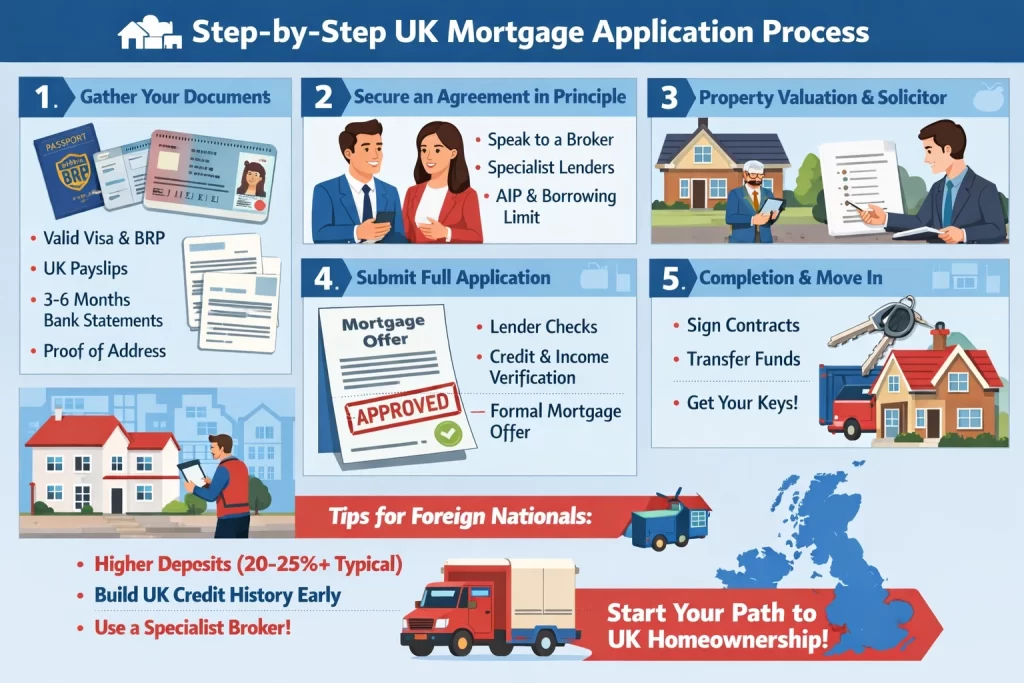

As a foreign-born resident, you stare at a stack of unfamiliar documents, wondering if your Tier 2 visa and overseas payslips will ever convince a UK lender you’re a safe bet. The uncertainty hits hard—will they demand a 25% deposit just because your credit file is blank? And this is where things get practical.

You start by gathering your documents. Pull together your valid visa (lenders want at least two years left on it), recent payslips showing GBP income, three to six months of UK bank statements, and proof of address like utility bills.[1][3] Self-employed? Add two to three years of tax returns and business accounts. I once guided a US engineer fresh on a Skilled Worker visa; he nearly missed submitting his biometric residence permit alongside his passport, which lenders treat as non-negotiable proof of right to work.[5]

Next, secure an Agreement in Principle (AIP). Speak to a broker first—they unlock specialist lenders like HSBC, which demands a minimum £75k income for foreign nationals, or Barclays with their flexible visa options.[3] The AIP gives you a borrowing limit based on affordability checks, often stricter for non-residents with debt-to-income ratios capped below 29%.[1][2] Expect questions on your time in the UK (many require 12 months minimum) and visa type—student visas get rejected outright, but spousal or ILR open more doors.[2][3]

With AIP in hand, find a solicitor experienced in cross-border deals; they handle searches and contracts while you arrange a valuation. Lenders dispatch a surveyor to appraise the property, confirming its worth matches your offer. Foreign applicants face extra scrutiny here—larger deposits (20-25% typical) and sometimes international credit reports if your UK file is thin.[1][4] In one case, a Brazilian doctor I advised waited three weeks for valuation approval because her foreign-earned income needed currency conversion verification.

Submit the full application. Your broker submits to the lender, who runs credit pulls, verifies income, and issues a formal offer if all aligns—usually valid for six months. Sign with your solicitor, and funds transfer on completion day. Exceptions pop up: new arrivals without a UK bank account might need to wait or pivot to buy-to-let options. Brokers shine here, matching you to the 50+ lenders who lend to foreigners despite high street banks’ pickiness.[2]

Stay proactive. Track every step with your solicitor and broker to dodge delays. You control this process more than you think.

Deposit Requirements and Borrowing Limits

You arrive in the UK full of excitement about your new chapter, only to hit a wall: lenders demand a hefty 25% deposit or more, plus proof of 12 months’ residency. That sting hits hard when savings from abroad feel just out of reach.

This brings us to something often overlooked. Your residency status shapes everything from deposit size to how much you can borrow. Lenders assess risk based on your visa type, time in the UK, and credit footprint. New arrivals without indefinite leave to remain face the steepest hurdles. Expect to front at least 25%—often translating to a maximum loan-to-value (LTV) ratio of 75%.[1][2] Many insist on 12 months here first, building a UK bank account and credit history. Without that, even solid income abroad raises flags on repayment enforceability.

Picture Maria, a skilled migrant from Brazil on a two-year visa, just six months into her UK stay. She eyes a £300,000 flat in Manchester. Standard high-street banks reject her outright. A specialist lender steps in, but only with her 25% deposit (£75,000) from seasoned UK savings—gifts from overseas family? Off the table due to money laundering checks.[1] She secures 75% LTV, borrowing £225,000 at a rate 0.5% above resident deals.

Fast-forward to permanent residency or indefinite leave to remain. You level up. Deposits drop to 5-10%, matching UK citizens, with LTV stretching to 95% on joint applications.[1][5] Banks treat you like locals, eyeing payslips and standard affordability checks under Financial Conduct Authority rules. I’ve seen clients with pre-settled status renewals multiple times hit this sweet spot early.

Non-residents play by stricter rules. High net worth helps—think proven liquid assets. Lenders like HSBC limit to specific countries: USA, Australia, Singapore, UAE, Hong Kong.[5] Deposits climb to 25-40%, LTV caps at 60-75%.[2][3] Source matters too: show bank statements tracing savings build-up, tax-paid status, no crypto windfalls.[2]

You gain ground with time and proof. Open a UK account day one for credit building. Aim beyond minimums—a 30% deposit unlocks better rates and more lenders.[2] Joint apps with a UK partner? Game on for 90-95% LTV. Chat a broker early; they match your profile to niche lenders willing to flex on visa expiry (minimum 12 months left).[4] Exceptions exist for high earners or buy-to-let, but always verify origin of funds meticulously. Your path clears with preparation.

Tips, Challenges, and Specialist Lenders

You’ve saved diligently for your deposit. You’ve found the perfect property. Then reality hits: lenders reject your application because you have no UK credit file, or they won’t accept your foreign income documentation. This is the frustration thousands of foreign-born residents face when applying for mortgages in the UK. The good news? These obstacles are surmountable with the right approach and support.

The absence of a UK credit history represents one of the biggest hurdles. Lenders can’t assess your reliability without a track record in the British financial system. Similarly, proving income earned abroad—whether as a salaried employee or self-employed professional—requires additional documentation that standard high street banks often find cumbersome to process. This is where specialist mortgage brokers become invaluable. Rather than applying directly to major lenders, brokers understand which institutions accept foreign income and can package your application to highlight your creditworthiness despite the missing UK credit file.

Building UK credit quickly matters more than you might think. Opening a UK bank account immediately and using a credit card responsibly for everyday purchases creates a visible payment history within months. Consider this scenario: a software engineer relocating from Germany starts with a UK current account and secured credit card in month one. By month four, she has sufficient credit history to strengthen her mortgage application alongside her employment contract and bank statements showing regular income deposits.

Several lenders actively work with foreign nationals. Major institutions like NatWest and Metro Bank have established processes for non-UK citizens, while specialist lenders focus exclusively on this market. If you’re partnering with a UK citizen, the application becomes considerably easier. Joint mortgages with UK-based partners are treated as resident applications, meaning you access standard rates and requirements rather than facing higher interest rates or stricter deposit demands.

Your strategy should combine three elements: engage a specialist broker early, build your UK credit file immediately upon arrival, and explore joint application options if applicable. These steps transform what feels like an impossible barrier into a manageable process with clear timelines and realistic outcomes.

Your Path to UK Homeownership Starts Now

Picture the frustration of watching UK property prices climb while your savings feel stuck, especially as a foreign-born resident facing extra hurdles like larger deposits and visa checks. You know the dream of owning a home here is real, yet the path seems tangled with lender rules and proof requirements. The good news? Building that deposit becomes straightforward when you focus on consistent saving in a UK account, tracking your residency timeline, and targeting 20-25% of the property value—more if needed early on, but potentially as low as 5% with indefinite leave to remain. Open a UK bank account today, document your income steadily, and watch barriers fade. You hold the power to turn eligibility into keys in hand. Consult a specialist broker today to check your eligibility and start saving for your UK home—what’s your first deposit goal?

Frequently Asked Questions

Can foreign nationals get a UK mortgage?

Yes, with right visa, UK residency proof, and often 20-25% deposit. Easier with 2+ years UK residence[1][2]

What deposit do I need as a foreigner?

Typically 25% if new to UK, down to 5-10% with permanent status or long residency[1][3]

Do I need a UK bank account?

Highly recommended to build credit; many lenders require 12 months UK history[2]

Can non-residents buy UK property?

Yes, but specialist mortgages with higher deposits and income proofs apply[4]

Joint mortgage with UK partner?

Yes, often treated as resident application up to 95% LTV[5]

References & Sources

Sources & References

- mortgagerepublic.co.uk

- www.expatica.com

- www.onlinemortgageadvisor.co.uk

- wise.com

- www.cliftonpf.co.uk

- holbornpass.com

- www.youtube.com

- www.mfsuk.com

- www.quickmortgages.com

- www.accordmortgages.com

- brighttax.com

- rawcapitalpartners.com

- www.mortgagebazaar.co.uk

- mymortgageinsider.com

- www.willowprivatefinance.co.uk

- www.century21uk.com

- www.themortgagecentres.co.uk

- www.youtube.com

- expatmortgages-uk.com

- hodgebank.co.uk

- www.suffolkbuildingsociety.co.uk

- wise.com

- www.hsbc.co.uk

- wismortgages.co.uk

- expatmortgages-uk.com

- strivemortgages.co.uk

- www.cliftonpf.co.uk

- www.cedar-crest.co.uk

- www.willowprivatefinance.co.uk

- expatmortgages-uk.com

- www.mdjmortgages.com

- wismortgages.co.uk

- www.expertsforexpats.com

- strivemortgages.co.uk

- www.tembomoney.com

- www.clsmoney.com

- better.co.uk

- londonmortgagesolutions.co.uk

- www.themortgagehut.co.uk

- www.skiptoninternational.com

- www.habito.com

- heronfinancial.co.uk

- www.nicheadvice.co.uk

- www.hsbc.co.uk

- liquidexpatmortgages.com

- advias.co.uk