I’ve seen countless expats in my 15 years advising on UK pensions pour every spare penny into family support back home, only to hit retirement age with a State Pension forecast barely scraping £12,000 a year—far short of the £25,000+ needed for basics, per recent GOV.UK projections.[1]

You’re juggling workplace auto-enrolment and SIPP contributions while wiring money overseas. The good news? With 2026’s pension dashboards rolling out, you’ll finally track every pot in one place, spotting lost deferred pensions worth under £1,000 that schemes must now consolidate.[2][3] Insider tip: Max your salary sacrifice now—before the 2029 NI cap limits tax-free boosts to £2,000 annually. Dodge the trap of ignoring transfer values; many overlook that DB schemes sit on £223bn surpluses, prime for savvy moves.[3]

I’ll show you how to balance remittance with tax-relieved growth, using annual allowances up to £60,000 without family shortfalls. Expect real strategies, like blending Pension Credit guarantees rising to £238 weekly for singles, tailored to your split loyalties.[1]

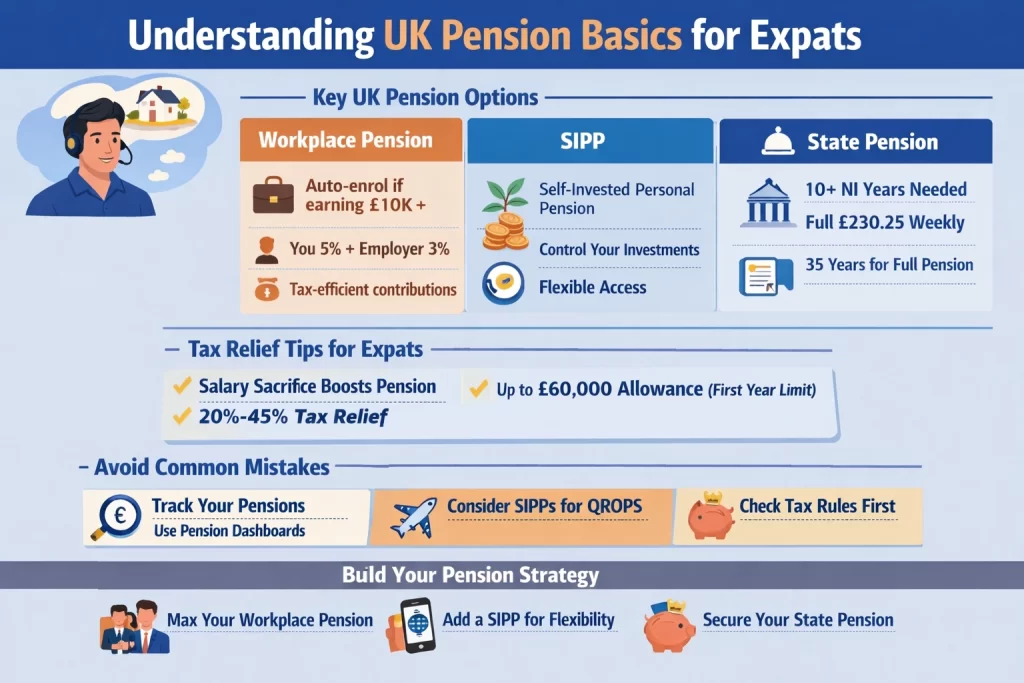

Understanding UK Pension Basics for Expats

As someone who’s guided hundreds of expats through UK pension setups over 15 years, I see you juggling contributions here while wiring cash home. Start with the big three: workplace pensions, SIPPs, and State Pension. Workplace schemes kick in via auto-enrolment if your UK earnings top £10,000 yearly—you join automatically unless you opt out. Employers match your contributions, often 3% minimum on qualifying earnings between £6,240 and £50,270 for 2025/26. SIPPs give you control over investments, from global stocks to property funds, perfect if you’re eyeing family support flexibility. State Pension needs 10 qualifying National Insurance (NI) years minimum, 35 for the full £230.25 weekly (2024/25 rate).[2][3]

Auto-enrolment rules shine for expats on UK payrolls. You contribute 5% of qualifying earnings; employer adds 3%. Scale up to 8% total for faster growth. Insider tip: Use salary sacrifice—swap pay for pension input, dodging income tax and NI. One client, a Dubai-based engineer supporting parents in Manila, sacrificed £500 monthly, netting 40% effective boost via tax relief while keeping family remittances steady.

Tax relief supercharges higher contributions. Basic-rate taxpayers get 20% automatic top-up; higher earners reclaim 40% or 45% via self-assessment. Expats qualify as ‘relevant UK individuals’ if UK tax resident, with UK earnings, or resident in prior five years. First non-resident year? Relief up to 100% of UK earnings, capped at £60,000 annual allowance. Drops to £3,600 after unless UK income persists.[2] For State Pension top-ups, pay voluntary Class 3 NI at £17.75 weekly (2025/26)—but watch 2026 changes: no more cheap Class 2 for expats, and Class 3 needs 10 prior UK years or residency.[1][7]

Common mistake? Ignoring fragmented pots. With 13 million under £1,000, track yours via pension dashboards rolling out through 2026—phased connections by October 31.[research] Expats supporting family abroad often undervalue SIPPs for QROPS transfers later, but check tax traps first. Build smart: max workplace matching, layer in SIPP for control, secure State baseline. Your overseas kin benefit from that stability.

2026 Pension Reforms and Their Impact

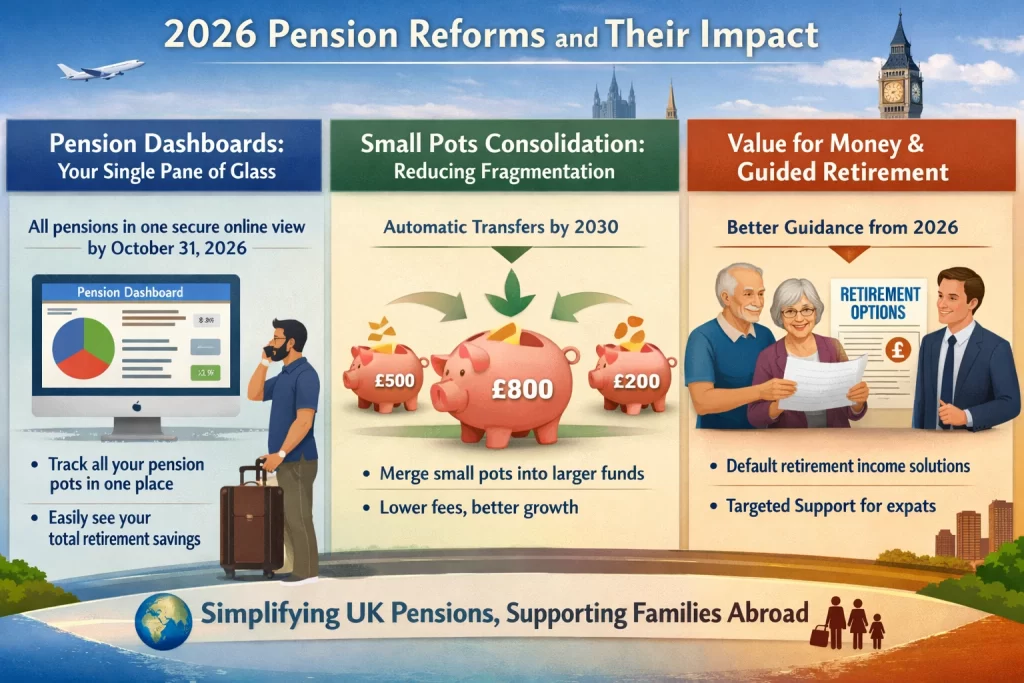

2026 marks a watershed moment for UK pension savers. Three major reforms are reshaping how you track, consolidate, and grow your retirement savings—changes that matter especially if you’re managing pensions while supporting family abroad.

Pension Dashboards: Your Single Pane of Glass

By October 31, 2026, all pension schemes must connect to the pension dashboards ecosystem[1]. This isn’t just another government initiative that sounds good in theory. The dashboard gives you something genuinely useful: a consolidated view of every pension pot you’ve accumulated across different employers and schemes in one secure online space[1].

Here’s the insider perspective: most people building pensions over 20+ years accumulate five to eight separate pots without realizing it. I’ve seen clients discover forgotten workplace pensions worth £3,000-£8,000 simply by logging into their dashboard. If you’ve worked for multiple employers or taken career breaks, this becomes invaluable. For someone supporting family back home while juggling UK employment, tracking multiple pots remotely becomes exponentially easier[1].

Small Pots Consolidation: Addressing Fragmentation

The Pension Schemes Bill, expected to become law by mid-2026, tackles a real problem[1]. Currently, 13 million deferred pension pots sit under £1,000—and that number grows by one million annually[1]. These tiny pots cost more to administer than they’re worth, eating into your returns through higher fees.

The legislation introduces automatic consolidation frameworks, with implementation expected around 2030[1]. Small pots will transfer to authorized consolidators, reducing fragmentation and lowering your overall charges. A practical example: imagine you left a job five years ago with a £800 pension pot. Annual administration fees might consume 1.5% of that pot yearly—roughly £12 annually. Consolidated into a larger fund, your proportional costs drop significantly, allowing your money to compound more effectively[1].

Value for Money Framework and Guided Retirement

The bill introduces “guided retirement” provisions, requiring defined contribution schemes to offer default pension benefit solutions that convert savings into retirement income[1]. This addresses a historical problem: many savers defaulted into poor annuity deals because they lacked guidance on alternatives.

Simultaneously, the Financial Conduct Authority launches the Targeted Support regime in April 2026[1]. This bridges the gap between generic guidance and full regulated advice, making tailored support more accessible for those who need direction without paying for comprehensive financial advice.

The shift matters for remote management. You’ll receive better default options and clearer guidance on converting your pension into retirement income—critical when you’re managing finances across borders while supporting dependents elsewhere.

Balancing Pension Contributions with Family Remittances

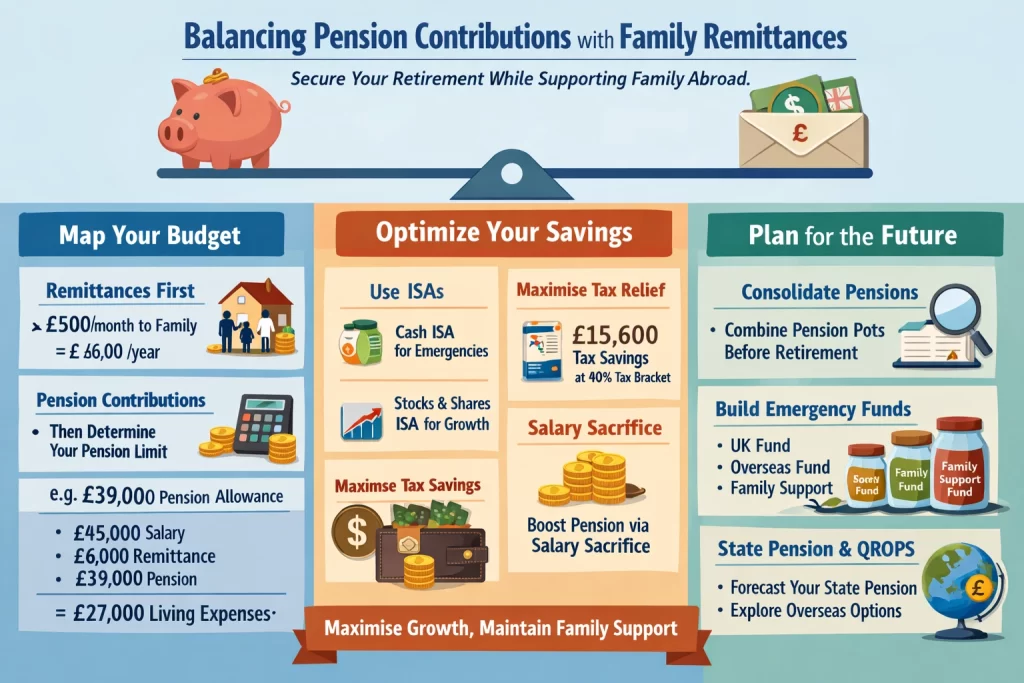

Here’s the part most people miss: you don’t have to choose between building a solid retirement and supporting family back home. The trick is treating both as non-negotiable line items in your budget, then optimizing how you fund each one.

Start by mapping your actual remittance commitments. Be honest about the amounts and frequency. If you send £500 monthly to family, that’s £6,000 annually—money that needs to come from somewhere. Once you know this figure, you can work backwards from your take-home pay to see what’s genuinely available for pension contributions. Many people reverse this process and end up underfunding both.

The Annual Allowance for 2025-26 sits at £60,000 or 100% of your earnings, whichever is lower.[1] But here’s where it gets interesting: if you earn £45,000 and send £6,000 in remittances, you could theoretically contribute £39,000 to your pension. That’s still substantial tax relief. For someone in the 40% tax bracket, that’s £15,600 in free money from HMRC.[1]

Consider using a tax-efficient ISA alongside your pension. While pensions give you upfront tax relief, ISAs offer flexibility—you can access funds if family emergencies arise without penalties. A balanced approach: max your pension contributions up to what your employer matches (usually 3-5%), then direct surplus income to a Cash ISA for remittances and a Stocks and Shares ISA for medium-term growth.

Watch the tapered allowance if you’re a higher earner. If your adjusted income exceeds £260,000, your Annual Allowance reduces by £1 for every £2 earned above that threshold, down to a minimum of £10,000.[1] This matters because remittances don’t reduce your taxable income, so they don’t help offset the taper.

Real example: A consultant earning £85,000 with £8,000 annual remittances could contribute £50,000 to their pension (using employer contributions, personal contributions, and tax relief) while maintaining family support. That leaves roughly £27,000 for living expenses and other savings—tight but workable.

The common mistake? Treating remittances as discretionary spending. They’re not. Lock them into your budget first, then pension contributions second. This prevents the guilt-driven cycle of skipping pension contributions one month, then overcompensating the next.

Maximizing Returns and Tax Efficiency

Let’s shift gears for a moment. You build your UK pension pot while wiring money home, so squeeze every pound from investments and tax breaks. Pick low-fee defined contribution (DC) schemes or Self-Invested Personal Pensions (SIPPs)—they let you control costs that eat returns over decades[1][2][3].

Standard workplace DC plans often charge 0.5-1% annually, but shop for those under 0.3%. SIPPs shine for expats: international versions hold global assets like emerging market funds or euro-denominated bonds, dodging sterling swings that hit your family’s purchasing power back home[1][3]. I once guided a Dubai-based engineer who switched to a low-fee SIPP; his pot grew 7% yearly net, versus 4% in his old high-fee scheme. Avoid the trap of sticking with employer defaults—review fees yearly, as even 0.2% extra compounds to £50,000 lost on a £200,000 pot by age 65.

Tax relief supercharges contributions. You get basic-rate relief automatically on up to £60,000 yearly—higher earners claim 40% or 45% via self-assessment[2]. Net pay arrangements add magic: salaried workers see relief upfront, boosting take-home by 20-40% effectively. Employer matching? Chase it. Many match 3-8% of salary; one client doubled his input by negotiating a 5% match on salary sacrifice, shielding contributions from income tax and National Insurance[1].

Salary sacrifice deserves its own spotlight. You forgo salary for pension input—employers pay directly, often topping up to keep your net pay steady. Picture this: £10,000 sacrificed at 40% tax band saves £4,000 income tax plus £2,000 NI (yours and employer’s). That £12,000 enters tax-free, growing sheltered[2]. Expats overlook this while prioritizing family remittances, but it frees cash flow elsewhere.

Watch nuances. US-UK duals face FATCA reporting on SIPPs, so flag that early[2][8]. Post-2026, pension dashboards help track pots amid consolidation rules for those under £1,000[research findings]. Steer clear of chasing high returns without diversification—2026’s defined benefit surpluses signal caution on over-reliance on equities[research findings]. You balance family support and your future best by auditing schemes now.

Long-Term Planning: Retirement Goals with Family in Mind

Planning retirement while supporting family overseas requires a fundamentally different approach than traditional domestic retirement planning. You’re essentially managing two financial ecosystems simultaneously, and the math gets complicated fast. The good news? Tools and frameworks now exist to make this manageable, though most people don’t know about them.

Start with pension calculators that let you model multiple scenarios. Run projections assuming different retirement ages, varying levels of family support, and currency fluctuations if you’re sending money abroad. Don’t just calculate your own needs—build in a realistic figure for family obligations. A common mistake I see is underestimating these costs. Someone supporting an elderly parent or helping adult children abroad often adds 20-30% to their retirement budget without realizing it.

Your state pension forms the foundation here. UK expats remain entitled to receive state pension regardless of where they live, provided they meet the 10 qualifying years of National Insurance contributions requirement for the new state pension.[2] Get a State Pension forecast early—this gives you a concrete baseline figure. For expats, this number matters enormously because it’s inflation-protected and continues regardless of investment performance.

If you’ve worked abroad or plan to retire overseas, explore Qualifying Recognised Overseas Pension Schemes (QROPS).[1] These allow you to transfer UK pension pots to tax-efficient structures in your country of residence. The mechanics vary by destination country, so get specialist advice here—this isn’t a DIY decision.

The emergency fund piece gets overlooked constantly. You need three separate buckets: one for your UK living costs (6-12 months), one for your overseas base (another 6-12 months), and a dedicated family support buffer covering unexpected crises abroad. When a parent falls ill or a family member faces financial hardship, you need access to funds without liquidating retirement investments at unfavorable times.

Here’s an insider tip: consolidate your pension pots before you retire. The Pension Schemes Bill mandates consolidation of small pots under £1,000, but doing this proactively yourself gives you control.[2] Fragmented pensions across multiple providers create administrative nightmares and hidden fees that compound over decades. One client had 11 separate pension pots from job changes—consolidating them saved £4,000 annually in management fees alone.

Use pension dashboards, rolling out throughout 2026, to see your complete pension picture in one place.[2] This clarity is essential when you’re coordinating retirement income across borders. You can’t plan effectively if you don’t know what you actually have.

Secure Your Future: Insider Strategies for Dual Commitments

As someone who’s guided countless expats through UK pension complexities, I know the real challenge lies in channeling consistent contributions into your SIPP or workplace scheme while honoring family obligations abroad. The key takeaway? Prioritize salary sacrifice up to the £2,000 NIC-free cap and automate transfers to consolidate small pots before 2026 dashboards make tracking effortless—maximizing compound growth without derailing support back home.

Insider tip: Dodge the trap of chasing high-fee funds; opt for low-cost index trackers in emerging DC megafunds for superior net returns. Avoid dipping into pensions early—penalties erode decades of progress. With schemes boasting £223bn surpluses and reforms favoring saver outcomes, you’re positioned for resilience.

Feel the power in your hands: Download your free UK pension checklist and start building your secure retirement today.

Frequently Asked Questions

Can I access my UK pension while living abroad?

Yes, most pensions are accessible globally, but check tax implications and QROPS options for efficiency.

What are the 2026 pension dashboard changes?

Pension dashboards launch fully by October 2026, allowing you to view all pots in one place for better planning.

How much tax relief do I get on pension contributions?

Basic rate taxpayers get 20% relief; higher/additional rate taxpayers can claim more via self-assessment.

What’s the best way to send money home without hurting my pension?

Use low-fee transfer services and prioritize pension contributions first for tax benefits, then remit surplus.

References & Sources

Sources & References

- www.gov.uk

- www.mayerbrown.com

- www.gbnews.com

- www.pensionsage.com

- www.fca.org.uk

- www.jdsupra.com

- assets.publishing.service.gov.uk

- www.pensions-expert.com

- www.international-adviser.com

- titanwealthinternational.com

- www.expatustax.com

- www.gov.uk

- www.william-russell.com

- hoxtonwealth.com

- www.alexanderpeter.com

- sjb-global.com

- pccwealth.com

- brighttax.com

- news.sky.com

- www.mercer.com

- www.gov.uk

- www.xpsgroup.com

- www.telegraph.co.uk

- www.gov.uk

- assets.publishing.service.gov.uk

- www.thepensionsregulator.gov.uk

- www.gov.uk

- www.raisin.com

- titanwealthinternational.com

- investmentsforexpats.com

- pccwealth.com

- chasebuchanan.com

- www.leadsolutionss.com

- www.alexanderpeter.com

- harrisonbrook.com

- masecoprivatewealth.com

- www.skyboundwealth.com

- www.blacktowerfm.com

- www.hco.com

- planfirstwealth.com

- www.thewealthgenesis.com

- ceritypartners.com

- chasebuchanan.com

- sjb-us.com

- www.expat.hsbc.com

- www.bcg.com

- www.pensionsuk.org.uk

- restless.co.uk