I think one of the biggest misconceptions about self-employment and freelancing in the UK is that it’s only for those with a strong network or a lot of capital. But I’ve seen many Sri Lankans successfully start and run their own businesses here, and I believe you can too.

What if I told you that with the right mindset and guidance, you can overcome the challenges of running a business in a foreign country? You’ll need to understand the UK’s tax system, visa requirements, and business regulations, but trust me, it’s doable.

As someone who’s worked with many entrepreneurs, I’ve learned that it’s all about understanding your strengths and weaknesses, and being willing to learn and adapt. In this article, I’ll share practical insights and specific examples to help you get started on your self-employment journey in the UK.

By the end of this, you’ll have a clear understanding of what it takes to run a successful business in the UK as a Sri Lankan, and you’ll be equipped with the knowledge to take your first steps towards turning your business idea into a reality.

Introduction to Self-employment in the UK

I think the concept of self-employment in the UK can be quite daunting for Sri Lankans, especially those who are new to the country. As someone who has experience with self-employment, I can tell you that it’s a journey that requires careful planning, dedication, and a willingness to learn. So, what exactly is self-employment in the UK? In simple terms, it means working for yourself, either as a freelancer or running your own business. There are several types of self-employment, including sole trading, partnerships, and limited companies.

When considering self-employment, I always think about the benefits and drawbacks. On the plus side, you have the freedom to choose your own projects, work at your own pace, and potentially earn more than you would in a traditional employment setup. For example, a friend of mine, who is a Sri Lankan freelance writer, was able to increase her earnings by 50% within a year of starting her own business. On the downside, you’ll need to handle all the administrative tasks, manage your own finances, and deal with the uncertainty of not having a regular income. You can mitigate these risks by creating a solid business plan, setting realistic goals, and staying organized.

Types of Self-employment and the Sri Lankan Community

The Sri Lankan community in the UK is quite large and diverse, with many individuals already running their own businesses or working as freelancers. I think this is because Sri Lankans are known for their entrepreneurial spirit and strong work ethic. You can find Sri Lankan-owned businesses in various sectors, such as food, retail, and healthcare. For instance, a Sri Lankan friend of mine started a small catering business, which has become quite popular in the UK. He was able to use his culinary skills to create traditional Sri Lankan dishes that are now in high demand.

As a Sri Lankan considering self-employment in the UK, you may wonder what kind of support is available to you. You can start by researching online resources, such as the UK government’s website, which provides guidance on starting and running a business. You can also reach out to organizations that support entrepreneurs from diverse backgrounds, such as the Federation of Small Businesses or the Prince’s Trust. These organizations often offer mentoring, training, and networking opportunities that can help you get started on your self-employment journey.

Setting Up a Freelance Business in the UK

Here’s what really matters though: getting the basics right when setting up your freelance business in the UK as a Sri Lankan. I think the first step is to register with HMRC, which is the UK’s tax authority. You’ll need to inform them that you’re self-employed and intend to work as a freelancer. This can be done online or by phone, and I recommend doing it as soon as possible to avoid any penalties. For instance, if you’re a writer or designer, you can register as a sole trader, which is the simplest and most common way to set up a business in the UK.

Another key aspect is obtaining the necessary visas. As a Sri Lankan, you’ll likely need a visa to work in the UK. I’ve seen many freelancers opt for a Tier 2 visa, which allows you to work in the UK for a specific employer. However, as a freelancer, you may be eligible for a Tier 1 visa, which is designed for entrepreneurs and self-employed individuals. You can check the UK government’s website for the most up-to-date information on visa requirements. I think it’s also a good idea to consult with an immigration lawyer to ensure you’re applying for the correct visa.

Once you’ve sorted out your visa and registered with HMRC, you’ll need to open a UK business bank account. This will make it easier to manage your finances and pay taxes. I recommend shopping around for a bank that offers a good deal for freelancers and small business owners. Some popular options include Barclays, HSBC, and Santander. You’ll typically need to provide proof of identity, address, and business registration to open an account. For example, I know a freelance developer who opened a business account with Barclays and was able to take advantage of their free accounting software and business support services.

You can also consider using online banking services, such as FreeAgent or Xero, which offer a range of tools and features specifically designed for freelancers and small business owners. These services can help you manage your invoices, expenses, and taxes, making it easier to run your business. I think it’s a good idea to explore these options and find the one that works best for you. What I’ve found is that having a solid financial system in place can make a big difference in the success of your freelance business.

Marketing and Finding Clients in the UK

And this is where things get practical. As a Sri Lankan freelancer in the UK, you’ll need to think strategically about marketing yourself and finding clients. I think a good starting point is building a professional website. You can use platforms like WordPress or Wix to create a site that showcases your skills, experience, and portfolio. For instance, if you’re a writer, you can include samples of your work, testimonials from previous clients, and a clear description of your services. A well-designed website will help you establish credibility and make it easy for potential clients to find and contact you.

Utilizing social media is another effective way to market yourself and find clients. You can use platforms like LinkedIn, Twitter, or Facebook to connect with other freelancers, join relevant groups, and share your work. I’ve seen many freelancers use social media to promote their services and attract new clients. For example, you can share a link to your latest blog post or a project you’ve completed, and ask for feedback or referrals. You can also use social media to network with other freelancers, which can lead to collaborations, referrals, or even new business opportunities.

Networking with other freelancers is also essential. You can attend events, join online communities, or participate in forums related to your field. I’ve found that networking with other freelancers can be incredibly valuable, as you can learn from their experiences, share your own knowledge, and get support when you need it. For example, you can join a group like the Freelance Writers’ Association or attend events like the London Freelance Fair. These events can help you connect with other freelancers, learn about new opportunities, and stay up-to-date with industry trends.

So, what’s the best way to get started? I think it’s a good idea to start by identifying your target market and creating a marketing plan that works for you. You can start by researching your competition, identifying your unique selling points, and developing a strategy that showcases your skills and services. With a solid plan in place, you can start building your professional website, utilizing social media, and networking with other freelancers. And, as you gain more experience and build your reputation, you’ll find it easier to attract new clients and grow your business.

Managing Finances and Taxes as a Sri Lankan Freelancer in the UK

Here’s the part most people miss. I think understanding UK tax laws is essential for any freelancer, especially when you’re from a different country like Sri Lanka. You see, the UK has a unique tax system, and as a freelancer, you’ll need to register as self-employed with HMRC. This means you’ll have to file a Self Assessment tax return every year, declaring your income and expenses. Now, I know what you’re thinking – how do you even get started with that?

You can begin by setting up a separate business bank account, which will help you keep your personal and business finances separate. This is a good practice, as it will make it easier to manage your invoices and payments. For instance, let’s say you’re a freelance writer, and you’ve just completed a project for a client. You can send them an invoice with your business details, and they can pay you directly into your business account. You can use online accounting software like QuickBooks or Xero to help you manage your finances and stay on top of your invoices.

Now, when it comes to saving for retirement, I think it’s easy to put it off, especially when you’re just starting out as a freelancer. But, you should consider setting up a pension scheme, like a Self-Invested Personal Pension (SIPP) or a Stakeholder Pension. These schemes allow you to save for retirement and receive tax relief on your contributions. For example, let’s say you’re 30 years old, and you start saving £100 per month into a SIPP. By the time you’re 60, you could have a significant pension pot, which will help you retire comfortably. You can also consider consulting a financial advisor who specializes in working with freelancers to get personalized advice on managing your finances and taxes.

To give you a better idea, let’s look at a real-life scenario. A friend of mine, who’s a Sri Lankan freelance designer in the UK, uses a cloud-based accounting system to manage her finances. She sets aside 25% of her income for taxes, and she also contributes to a SIPP each month. By doing so, she’s able to stay on top of her finances, and she’s also building a safety net for her retirement. You can do the same, by taking control of your finances and taxes, and seeking professional advice when you need it.

Overcoming Challenges and Achieving Success as a Sri Lankan Freelancer in the UK

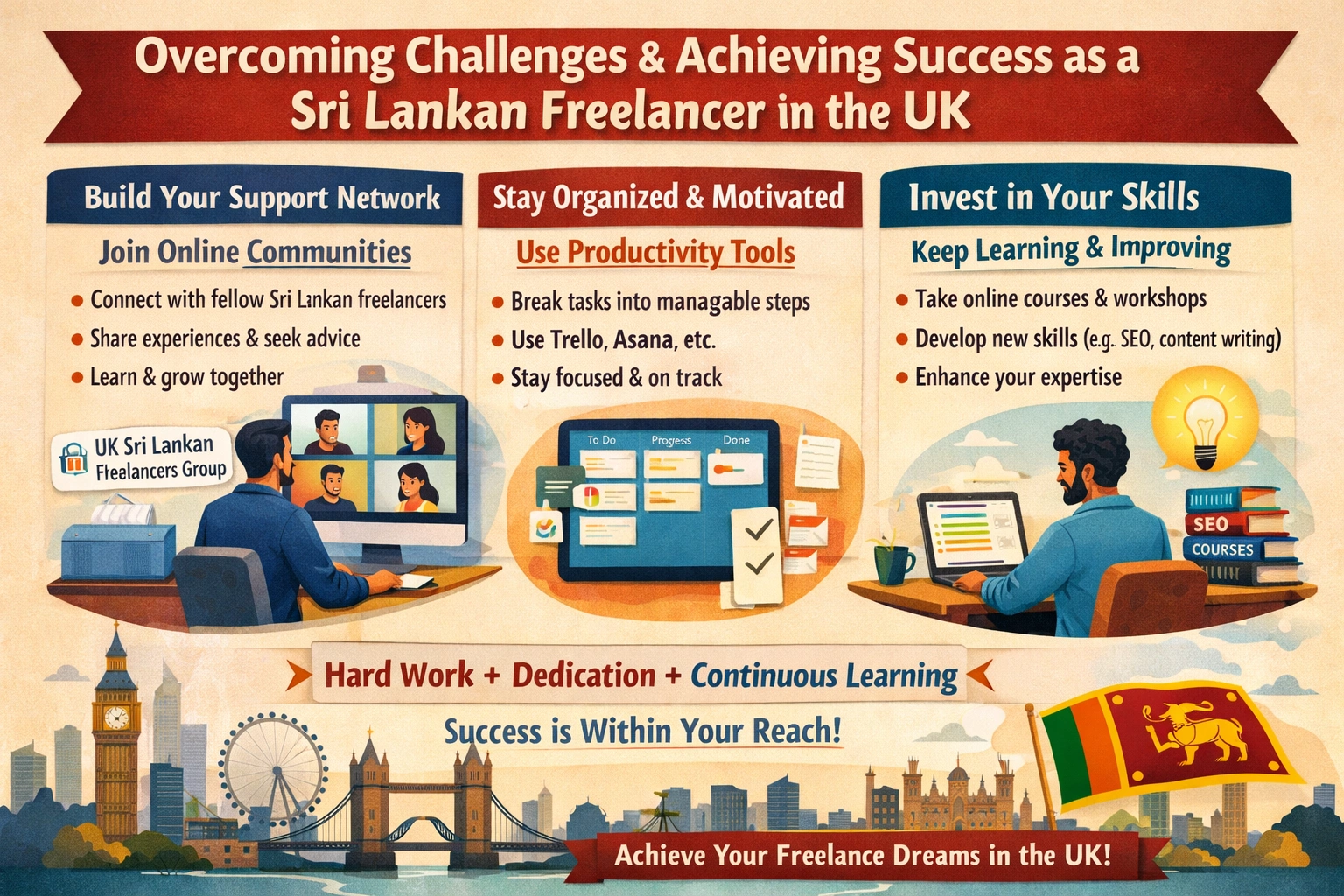

I think one of the biggest hurdles Sri Lankan freelancers face in the UK is building a support network. You can’t do it alone, and having people who understand the challenges you’re facing can make all the difference. For instance, I’ve seen many Sri Lankan freelancers join online communities, such as the UK Sri Lankan Freelancers group on Facebook, to connect with others who share similar experiences. These networks provide a platform to ask questions, share knowledge, and learn from others who have been in your shoes.

Staying organized and motivated is also key to success as a freelancer. You can use tools like Trello or Asana to manage your projects and deadlines. I’ve found that breaking down large tasks into smaller, manageable chunks helps to reduce stress and increase productivity. For example, if you’re working on a writing project, you can break it down into research, outlining, drafting, and editing phases. This approach helps you stay focused and ensure that you’re delivering high-quality work to your clients.

Continuously developing your skills is essential to staying competitive in the UK freelance market. You can take online courses or attend workshops to improve your skills and knowledge. I think it’s essential to identify the areas where you need improvement and create a plan to address them. For instance, if you’re a writer, you may want to take a course on content marketing or SEO to enhance your services and attract more clients. By investing in your skills and knowledge, you can increase your earning potential and achieve success as a Sri Lankan freelancer in the UK.

So, what does it take to succeed as a Sri Lankan freelancer in the UK? I think it’s a combination of hard work, dedication, and a willingness to learn and adapt. By building a support network, staying organized and motivated, and continuously developing your skills, you can overcome the challenges and achieve success in the UK freelance market. Can you imagine the sense of fulfillment and satisfaction you’ll get from running a successful freelance business in the UK?

Empowered to Succeed

I think the key to thriving as a Sri Lankan freelancer in the UK is understanding the local market and taking proactive steps to establish a strong foundation for your business. By registering with HMRC and building a professional online presence, you’ll be well on your way to attracting clients and growing your business. So, what’s holding you back from starting your freelancing journey in the UK today and turning your passions into a successful career?

Frequently Asked Questions

Do I need a visa to work as a freelancer in the UK?

It depends on your individual circumstances, but most Sri Lankans will need a visa to work in the UK

How do I register with HMRC as a freelancer?

You can register with HMRC online or by phone, and you will need to provide your personal and business details