So, you’re thinking of buying a house, and one question is probably haunting you: how much house can I afford? This is a great question to ask, and I think it’s essential to get it right. You don’t want to end up with a mortgage that’s too expensive, leaving you struggling to make ends meet. On the other hand, you don’t want to sell yourself short and miss out on your dream home. In this article, I’ll guide you through the process of determining how much house you can afford, and by the end of it, you’ll have a clear understanding of what you can afford and how to make your dream a reality.

I think it’s great that you’re taking the time to research and plan your home buying journey. It’s a significant investment, and getting it right can make all the difference. You’ll learn about the factors that affect house affordability, how to use a house affordability calculator, and the additional costs you need to consider. By the end of this article, you’ll be equipped with the knowledge to make an informed decision and find the perfect home that fits your budget and lifestyle.

Introduction to House Affordability

I think calculating house affordability is one of the most critical steps in the home buying process. It’s not just about finding a house you love; it’s about finding a house you can afford. If you overextend yourself, you might end up with a mortgage that’s too expensive, leading to financial stress and potentially even foreclosure. On the other hand, if you’re too conservative, you might miss out on your dream home. I’ve seen many people struggle with mortgage payments because they didn’t take the time to calculate their affordability properly.

So, why is calculating house affordability so important? Well, for starters, it helps you avoid financial stress. When you know how much house you can afford, you can make informed decisions about your budget and avoid overspending. Additionally, calculating house affordability helps you determine how much you can borrow, which is essential for getting pre-approved for a mortgage. I think it’s also worth noting that calculating house affordability is not a one-time task; it’s an ongoing process that requires regular review and adjustment.

For example, let’s say you’re considering buying a house that costs $300,000. You might think you can afford it, but after calculating your affordability, you realize that you can only afford a house that costs $250,000. This realization can save you from financial stress and help you find a more affordable option. I think it’s always better to be safe than sorry, and calculating house affordability is a crucial step in ensuring that you’re making a responsible financial decision.

Factors Affecting House Affordability

So, what factors affect house affordability? I think it’s essential to consider several key factors, including your income, credit score, and debt-to-income ratio. Your income is a critical factor in determining how much house you can afford. Lenders typically use a formula called the 28/36 rule, which states that your housing costs should not exceed 28% of your gross income, and your total debt payments should not exceed 36% of your gross income. For example, if you earn $50,000 per year, your housing costs should not exceed $1,167 per month.

Your credit score is another critical factor in determining house affordability. A good credit score can help you qualify for better interest rates and terms, while a poor credit score can limit your options. I think it’s worth noting that credit scores are not the only factor lenders consider, but they are an essential part of the mortgage application process. Your debt-to-income ratio is also crucial, as it shows lenders how much of your income is already committed to debt payments. A high debt-to-income ratio can make it challenging to qualify for a mortgage or may result in less favorable terms.

For instance, let’s say you have a credit score of 700 and a debt-to-income ratio of 30%. You might qualify for a mortgage with a competitive interest rate, but if your credit score is 600 and your debt-to-income ratio is 40%, you might struggle to qualify for a mortgage or face higher interest rates. I think it’s essential to understand how these factors interact and impact your ability to afford a house.

Using a House Affordability Calculator

So, how do you calculate house affordability? I think one of the most effective tools is a house affordability calculator. These calculators are widely available online and can help you determine how much house you can afford based on your income, credit score, debt, and other factors. To use a house affordability calculator, you’ll typically need to input your income, debt, credit score, and other financial information. The calculator will then provide you with an estimate of how much house you can afford.

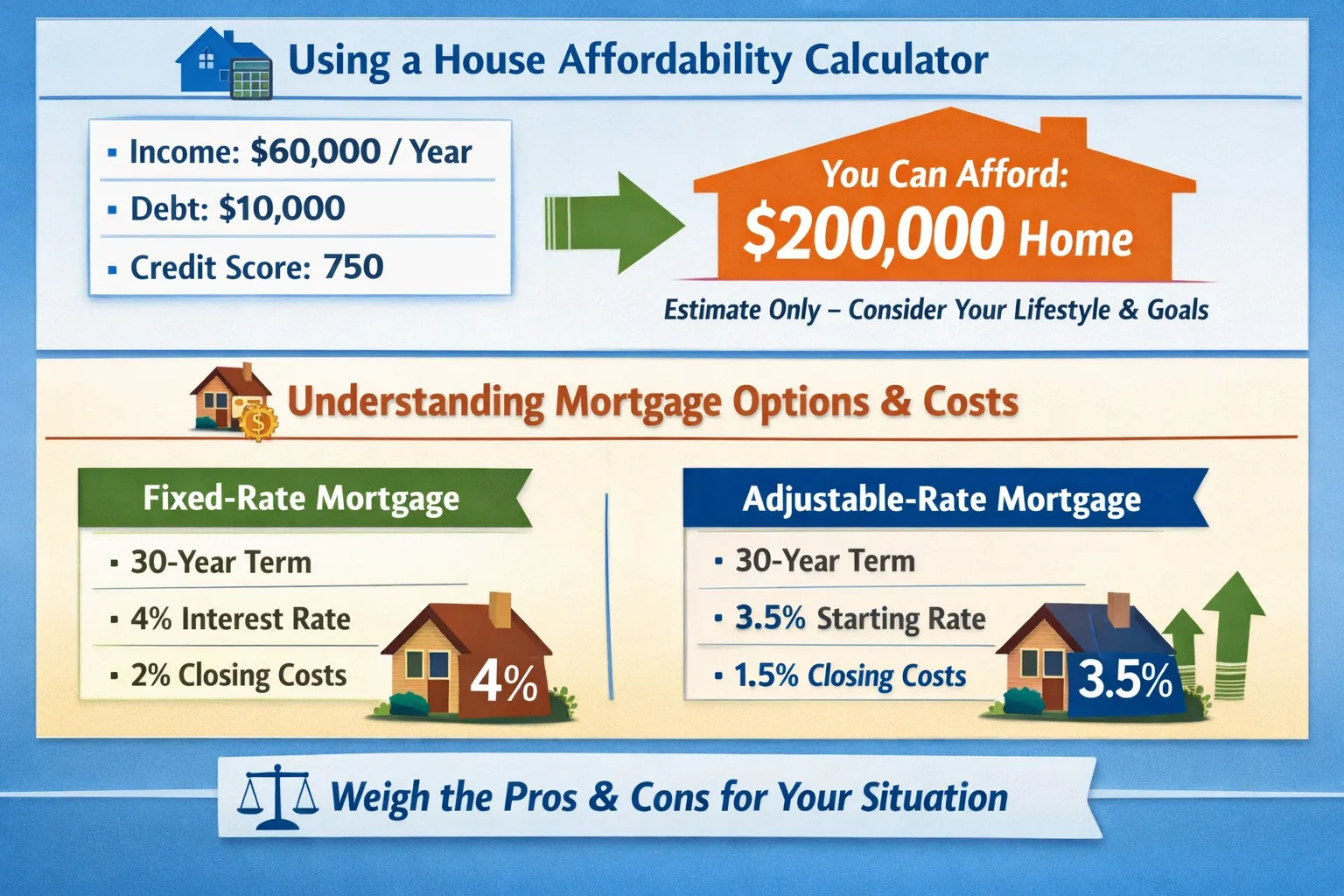

For example, let’s say you earn $60,000 per year, have a credit score of 750, and $10,000 in debt. You can input this information into a house affordability calculator, and it might tell you that you can afford a house that costs $200,000. However, I think it’s essential to remember that these calculators are only estimates, and you should consider other factors, such as your lifestyle, savings, and long-term financial goals, when determining how much house you can afford.

When interpreting the results of a house affordability calculator, I think it’s crucial to consider the assumptions and limitations of the calculator. For instance, some calculators might assume a 20% down payment or a 30-year mortgage. You should adjust the inputs to reflect your individual circumstances and goals. Additionally, you should use the calculator as a starting point for further research and discussion with a lender or financial advisor.

Understanding Mortgage Options and Costs

When it comes to buying a house, there are many mortgage options available, and I think it’s essential to understand the different types of mortgages and their associated costs. For example, you might consider a fixed-rate mortgage, which offers a fixed interest rate for the life of the loan, or an adjustable-rate mortgage, which offers a lower initial interest rate that may adjust over time. You should also consider the term of the mortgage, such as a 15-year or 30-year mortgage, and the associated costs, such as closing costs and origination fees.

I think it’s worth noting that interest rates can significantly impact your mortgage payments. For instance, a 1% difference in interest rate can result in thousands of dollars in savings over the life of the loan. You should also consider the pros and cons of different mortgage options, such as the benefits of a lower monthly payment versus the risks of an adjustable-rate mortgage. Additionally, you should factor in the costs associated with closing the loan, such as title insurance, appraisal fees, and credit report fees.

For example, let’s say you’re considering a $200,000 mortgage with a 30-year term. You might qualify for a fixed-rate mortgage with an interest rate of 4% and closing costs of 2% of the loan amount. Alternatively, you might consider an adjustable-rate mortgage with an initial interest rate of 3.5% and closing costs of 1.5% of the loan amount. I think it’s essential to weigh the pros and cons of each option and consider your individual circumstances and goals when making a decision.

Additional Costs to Consider

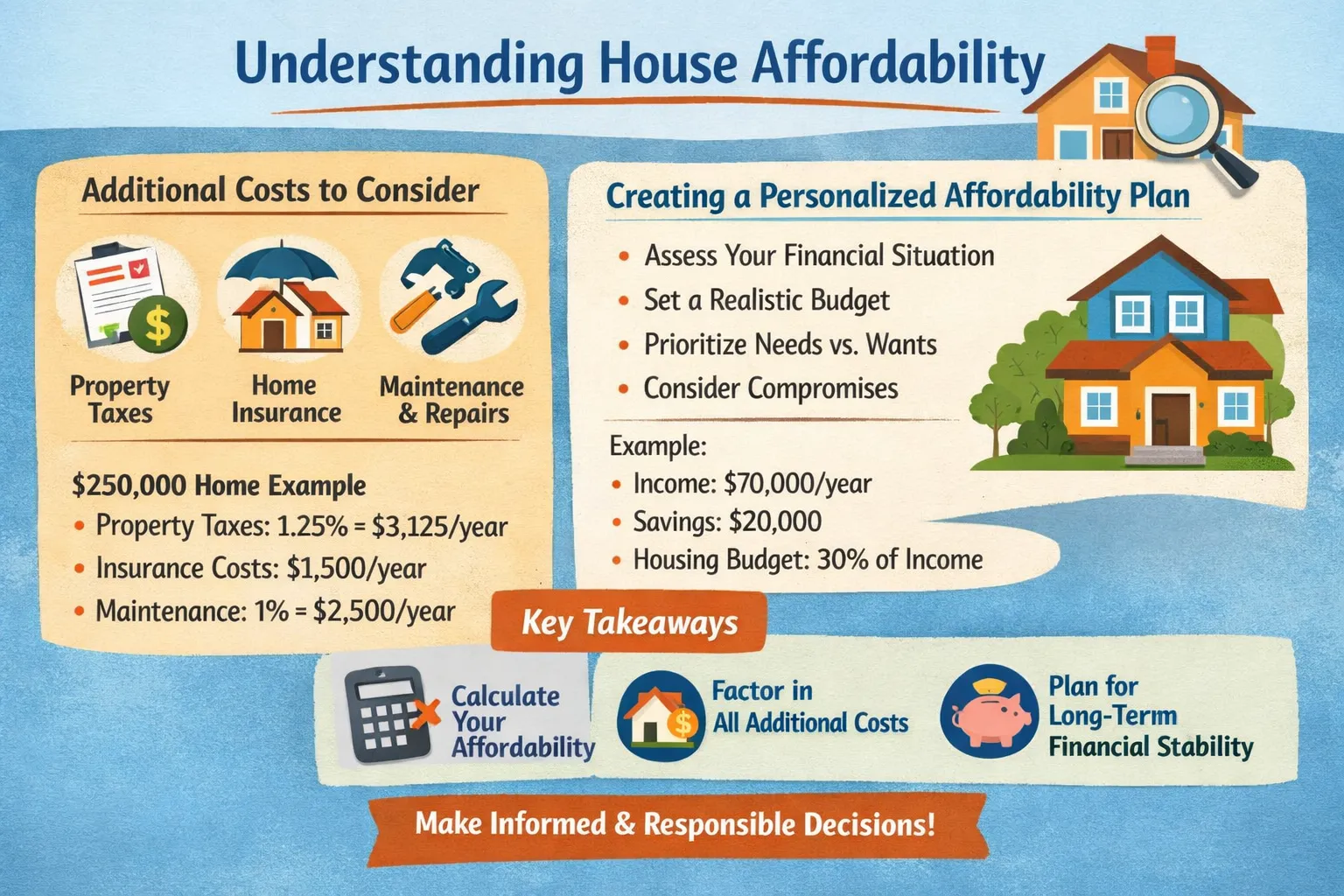

When calculating house affordability, I think it’s essential to consider additional costs beyond the mortgage payment. For example, you’ll need to factor in property taxes, which can vary significantly depending on the location and value of the property. You’ll also need to consider insurance costs, such as homeowner’s insurance and flood insurance, which can add hundreds or even thousands of dollars to your annual expenses.

Additionally, you should consider maintenance costs, such as repairs, replacements, and upgrades, which can be significant over time. I think it’s worth noting that these costs can be unpredictable and may require a significant budget. For instance, you might need to replace the roof or furnace, which can cost thousands of dollars. You should also consider the costs associated with homeowners association (HOA) fees, if applicable, and any other expenses related to owning a home.

For example, let’s say you’re considering a house that costs $250,000. You might estimate property taxes of 1.25% of the purchase price, insurance costs of $1,500 per year, and maintenance costs of 1% of the purchase price per year. These costs can add up quickly, and I think it’s essential to factor them into your calculations when determining how much house you can afford. By considering these additional costs, you can get a more accurate picture of your overall expenses and make a more informed decision about your home purchase.

Creating a Personalized Affordability Plan

So, how do you create a personalized affordability plan? I think it’s essential to start by assessing your financial readiness. You should consider your income, debt, credit score, and savings, as well as your long-term financial goals. You should also consider your lifestyle and priorities, such as whether you want to prioritize saving for retirement or paying off debt.

Once you have a clear understanding of your financial situation, you can start setting a budget and creating a plan for your home purchase. I think it’s essential to be realistic and conservative in your estimates, and to consider multiple scenarios and outcomes. You should also prioritize your needs and wants, and be willing to make compromises if necessary. For example, you might need to consider a smaller house or a longer commute to afford the home you want.

For instance, let’s say you earn $70,000 per year and have $20,000 in savings. You might aim to save 20% of your income each month and allocate 30% of your income towards housing costs. You should also consider your debt-to-income ratio and aim to keep it below 36%. By creating a personalized affordability plan, you can ensure that you’re making a responsible and sustainable decision when it comes to buying a house. I think it’s always better to err on the side of caution and prioritize your financial stability and security.

Key Takeaways

So, what’s the key takeaway from this article? I think it’s that calculating house affordability is a critical step in the home buying process. By considering your income, debt, credit score, and other factors, you can determine how much house you can afford and make informed decisions about your budget and lifestyle. Remember to use a house affordability calculator, consider additional costs, and create a personalized affordability plan to ensure that you’re making a responsible and sustainable decision.

As you move forward with your home buying journey, I think it’s essential to stay focused on your goals and priorities. Don’t be afraid to ask questions, seek advice, and explore different options. And always remember to prioritize your financial stability and security. Now, what’s the next step in your home buying journey? Will you start by calculating your affordability, researching mortgage options, or exploring different neighborhoods and communities? Whatever your next step, I think it’s essential to approach it with confidence, clarity, and a deep understanding of your financial situation and goals.

Frequently Asked Questions

What is the 28/36 rule in house affordability?

The 28/36 rule suggests that 28% of gross income should go towards housing costs and 36% towards total debt payments

How does credit score affect mortgage interest rates?

A higher credit score can lead to lower mortgage interest rates, while a lower credit score may result in higher rates