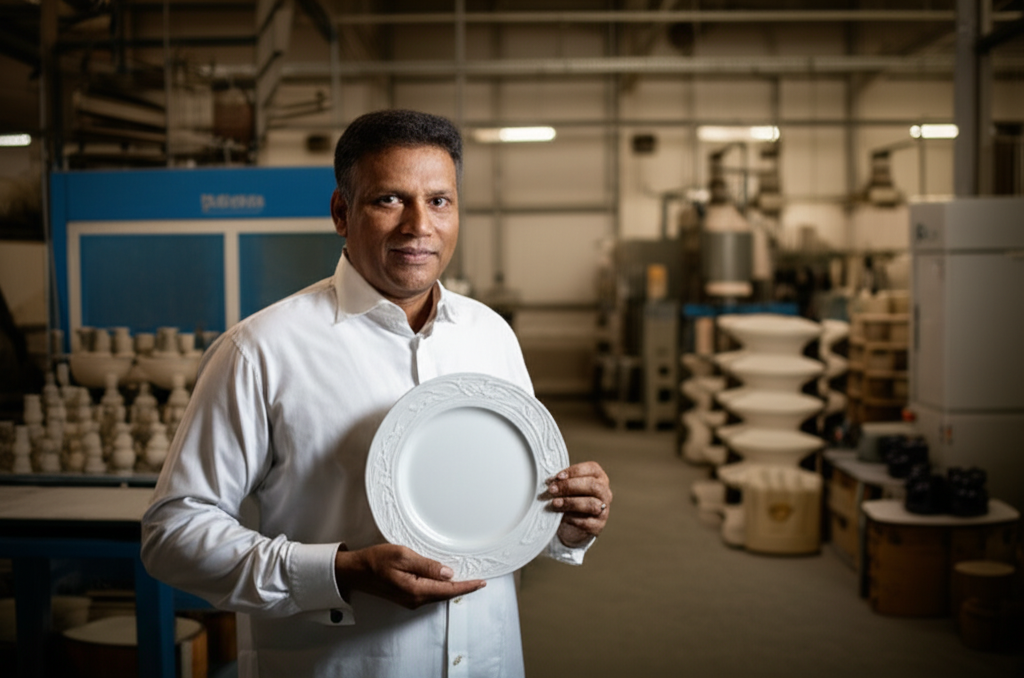

The Visionary Behind Sri Lanka’s Digital Payment Revolution

Every big change starts with someone who sees a problem that others ignore. For Sri Lanka’s online businesses, that person was Dhanika Perera. Before he created PayHere, selling goods and services online was a major challenge for many Sri Lankans. Big companies could handle it, but small sellers and freelancers were often left behind.

The main issue was getting paid. To accept credit card payments online, a business needed a payment gateway. Banks offered these, but the process was slow, expensive, and filled with paperwork. This created a barrier for new entrepreneurs wanting to start an online store. Many simply gave up and stuck to cash payments, limiting their growth. This was a roadblock for anyone thinking about how to register a small business in Sri Lanka and take it online.

Dhanika saw this gap clearly. He imagined a simple platform that could work like PayPal but was built just for Sri Lanka. His vision was to create a service that was easy for anyone to use. Whether you were a home baker, a freelance writer, or a small shop owner, you should be able to accept online payments without any trouble. This idea led to the birth of PayHere.

PayHere changed everything. It gave thousands of merchants the tools they needed to join the digital economy. By making online payments accessible, Dhanika didn’t just build a company; he built a foundation for Sri Lanka’s e-commerce growth. His work is now a key part of any good e-commerce website checklist for Sri Lanka, proving his vision has become an industry standard.

From Frustration to Innovation: The Genesis of PayHere

Every great invention often starts with a simple problem. For Dhanika Perera, that problem was getting paid. As a software developer in the early 2010s, he created products he wanted to sell online. However, he quickly discovered a major roadblock. While international platforms like PayPal existed, they did not fully support Sri Lankan businesses for receiving payments. This left local entrepreneurs in a difficult position.

Dhanika realised he was not alone. Thousands of freelancers, startups, and small business owners across the island faced the same challenge. Setting up an online payment system through a bank was a slow and costly process filled with paperwork. This barrier made it nearly impossible for new online stores to get started and grow. For many who were just learning how to register a small business in Sri Lanka, the complex payment setup was a discouraging hurdle.

Instead of accepting this frustrating reality, Dhanika saw an opportunity. With his background in technology, he decided to build the solution himself. His vision was to create a simple, secure, and affordable platform that could act as a bridge between businesses and banks. This service would allow anyone to accept online payments easily, without the high costs and long waits.

This idea became PayHere. Launched in 2016, it was designed to break down the barriers that held back Sri Lanka’s digital economy. By turning his personal frustration into a powerful tool for others, Dhanika created the “PayPal for Sri Lanka” that so many entrepreneurs needed. The platform simplified everything, providing a clear e-commerce website checklist item that was once missing: easy online payments.

Empowering Entrepreneurs: How PayHere Works

Before Dhanika Perera created PayHere, selling online was a major challenge for Sri Lankan small businesses. Getting approval from banks to accept credit card payments was a long and costly process. This meant many new companies and solo entrepreneurs could only accept cash on delivery, limiting their growth.

PayHere changed everything by acting as an all-in-one payment gateway. Think of it as a single, secure digital doorway that connects a business’s website to many different payment methods. Instead of dealing with multiple banks and payment services, an entrepreneur only needs to connect with PayHere.

The service allows businesses to easily accept payments from a wide range of sources. This includes major credit and debit cards like Visa, Mastercard, and American Express. It also supports popular mobile wallets and direct internet banking transfers. Offering these options is a key part of any good e-commerce website checklist for Sri Lanka, as it gives customers the freedom to pay how they prefer.

The biggest benefit for entrepreneurs is simplicity. With just one PayHere account, they can start accepting online payments in a matter of days, not months. This has opened up the digital marketplace for everyone, from home bakers and artists to freelancers with great side-hustle ideas. PayHere handles the complex security and banking rules, letting business owners focus on growing their brand and serving their customers.

Beyond Payments: The Bhasha and Helakuru Ecosystem

Dhanika Perera is famous for founding PayHere, but his vision for a digital Sri Lanka is much bigger than just one company. Before he solved online payments, he solved a communication problem for millions. His parent company, Bhasha Lanka (Pvt) Ltd, is the force behind Helakuru, the country’s most popular Sinhala keyboard app.

Helakuru was a game-changer. It allowed Sri Lankans to easily type in Sinhala on their smartphones, opening up the digital world in their native language. But Dhanika didn’t stop there. He transformed the simple keyboard into a powerful “super app.” Helakuru grew to include news updates, astrology services, and a dictionary. It created a massive, loyal user base that trusted the Bhasha brand for their daily digital needs.

This is where the genius of his ecosystem comes into play. With millions of people using Helakuru every day, the next logical step was to let them transact within the app. PayHere became the engine that powered these transactions. It allowed Helakuru to offer services like mobile reloads and a simple way to pay bills online in Sri Lanka, creating a seamless experience for users.

By building Helakuru first, Dhanika created the perfect audience for PayHere. The two platforms support each other perfectly. One builds the community, and the other provides the financial tools. This strategy proves that Dhanika is not just a payment pioneer; he is an ecosystem builder who understands the needs of the Sri Lankan people.

Navigating Hurdles and Scaling the Summit

Dhanika Perera’s journey with PayHere was not a simple path to success. He faced major challenges that could have stopped many entrepreneurs. In the beginning, Sri Lanka’s digital payment world was undeveloped. Most people trusted cash, and banks were slow to partner with new technology startups. Perera’s biggest hurdle was earning the trust of the Central Bank of Sri Lanka and other financial institutions. He spent years in meetings, proving that his platform was secure, reliable, and essential for the country’s future.

Another challenge was changing the mindset of local business owners. Many were comfortable with old methods and hesitated to move online. PayHere had to show them the benefits of accepting digital payments. For the thousands of entrepreneurs learning how to register a small business in Sri Lanka, PayHere became the key to unlocking a national customer base. The company offered simple tools that allowed even the smallest home-based business to start selling online in minutes.

The turning point came when PayHere received the official license from the Central Bank. This approval was a huge victory. It gave the company the credibility it needed to grow quickly. Soon, PayHere was no longer just a startup; it was a core part of Sri Lanka’s digital economy. The platform became a must-have feature on any e-commerce website checklist for Sri Lanka. By overcoming these obstacles, Dhanika Perera did more than build a company—he built the financial bridge that connected thousands of Sri Lankan businesses to the digital age.

The Future is Digital: Dhanika’s Vision for Sri Lanka

Dhanika Perera sees a future where every Sri Lankan can be part of the global digital economy. His vision is not just about new technology; it is about creating equal opportunities for everyone. For a long time, accepting online payments was a major challenge for small businesses in Sri Lanka. It was often too expensive or complicated, leaving many entrepreneurs behind.

PayHere was created to solve this problem. Dhanika’s goal was to build a simple and affordable platform that anyone could use. Today, a home baker selling cakes online or a freelance graphic designer has access to the same powerful payment tools as a large corporation. This levels the playing field and allows small businesses to grow and compete.

This empowerment has a huge impact. It encourages people to start their own ventures, from online stores to innovative side-hustle ideas. It also opens up the world for local talent. By making it easy to receive international payments, PayHere helps many Sri Lankans secure remote jobs with foreign companies, bringing valuable foreign income into the country.

Looking ahead, Dhanika’s vision continues to expand. He aims to bring more digital financial services to underserved communities and further simplify the process of doing business online. By building this critical digital infrastructure, Dhanika Perera is not just leading a company; he is helping to shape a more prosperous and connected future for Sri Lanka.

References

- PayHere (Official Website) – The official website for PayHere, detailing its services, features, and company information.

- Forbes 30 Under 30 Asia 2018: Dhanika Perera – Profile of Dhanika Perera on the official Forbes website, recognizing his impact on finance and venture capital in the region.

- “The Story of PayHere: Enabling Online Payments for all Sri Lankans” – An in-depth article by ReadMe Sri Lanka, a prominent local tech publication, covering the founding and mission of PayHere.

- “PayHere celebrates 5 years of empowering Sri Lankan entrepreneurs” – Daily Mirror – A news article from a major Sri Lankan newspaper covering a key milestone for the company and its impact on local businesses.