Why Colombo and Galle are Prime Spots for Overseas Property Investment

For those looking to invest in Sri Lankan real estate from overseas, Colombo and Galle offer two very different but equally strong opportunities. These cities are the top choices for foreign buyers because they cater to distinct markets, providing a range of investment strategies.

Colombo, as the nation’s commercial capital, is the engine of Sri Lanka’s economy. The city is home to major corporations, embassies, and a growing expatriate community. This creates a steady demand for modern apartments and houses, particularly for long-term rentals. Investing in a Colombo property means tapping into a reliable market of corporate tenants and professionals seeking convenience and high-end amenities. With ongoing projects like the Port City, Colombo’s potential for capital growth remains high.

In contrast, Galle offers a lifestyle and tourism-focused investment. Its main draw is the UNESCO World Heritage site, the Galle Fort, along with stunning beaches. This makes it a world-famous tourist destination. Property here, such as colonial-era villas and modern holiday homes, is perfect for the short-term rental market. Investors can earn high rental yields during the tourist season, which attracts visitors from Europe, Asia, and the Middle East. The appeal of Galle is its blend of history, culture, and coastal living.

Choosing between them depends on your goals. Colombo provides stable, year-round rental income, while Galle offers the potential for higher, seasonal returns. Both cities have a proven track record of attracting foreign investment. Before you begin, it is important to understand the legal framework and what is involved in the purchasing process. Learning about the visa restrictions and FDI rules for buying property from abroad is a crucial first step for any investor.

Analyzing Rental Yields: What Returns to Expect

When you invest in property, one of the most important numbers to understand is the rental yield. This figure tells you how much income your property generates each year as a percentage of its value. It helps you compare different investment options and see what return you can expect.

In Sri Lanka, rental yields vary greatly between Colombo and Galle, mainly due to their different markets.

Rental Yields in Colombo

Colombo’s rental market is driven by long-term tenants like corporate professionals, expatriates, and local families. This makes the income stream more stable and predictable.

- Average Yield: For modern apartments in prime locations (like Colombo 03, 05, or 07), you can generally expect a gross rental yield of 4% to 6% annually.

- Property Type: Apartments tend to offer better yields than standalone houses because of lower maintenance costs and higher demand from the corporate rental market.

Rental Yields in Galle

Galle’s market is heavily influenced by tourism. Properties here, especially villas and holiday homes near Galle Fort or popular beaches, are often used for short-term holiday lets.

- Average Yield: Due to higher nightly rates, short-term rentals in Galle can achieve gross yields of 7% to 10% or more.

- Seasonality: This higher return comes with a risk. Your income will likely be seasonal, with high earnings during the tourist peak (December to March) and lower occupancy in the off-season. These properties also require more hands-on management.

Calculating Your Potential Return

To calculate a basic gross yield, use this simple formula:

(Total Annual Rental Income / Property’s Purchase Price) x 100 = Gross Yield %

This number is a good starting point, but remember it doesn’t include your expenses like maintenance, insurance, and property management fees. Your final profit, or net yield, will be lower. It’s also crucial to understand your tax duties on rental income. For more details, see our guide on tax planning for Sri Lankan expats.

Before you invest, ensure you are familiar with the entire purchasing process by reading our guide on how to buy property in Sri Lanka from abroad.

The Legal Framework: How Foreigners Can Securely Own Property

Investing in Sri Lankan property from overseas is straightforward once you understand the legal rules. While the system has specific regulations for foreign nationals, it provides clear and secure pathways for ownership, especially in popular areas like Colombo and Galle.

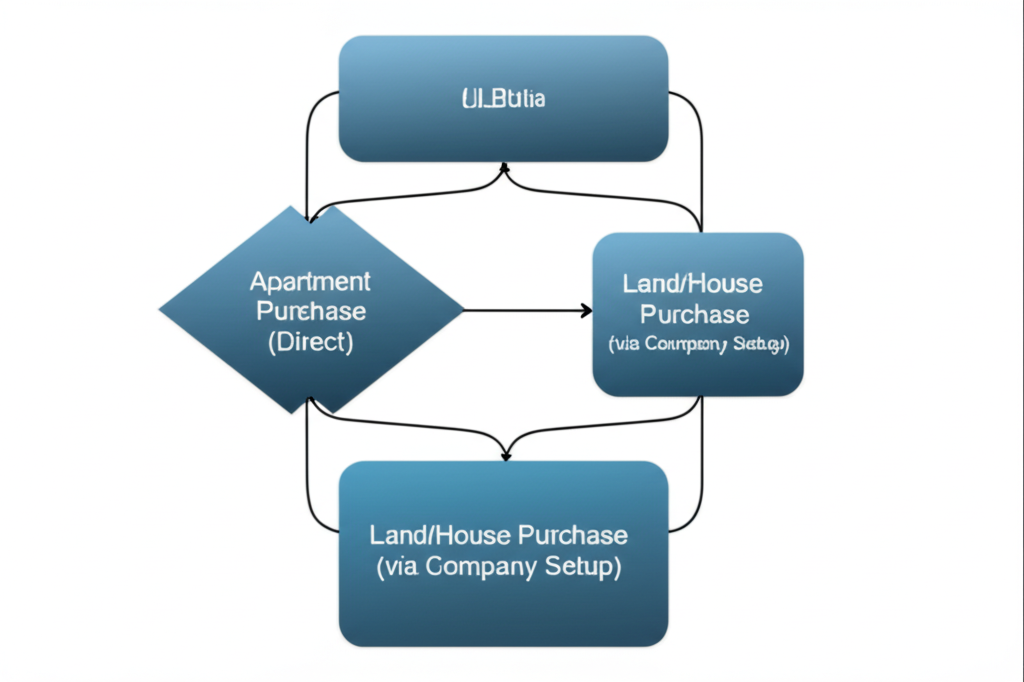

The rules depend on the type of property you want to buy. Here are the main options available to foreign investors:

- Buying Condominium Apartments: This is the simplest method. Foreigners can legally buy freehold condominium units directly in their name, as long as the apartment is on the fourth floor or higher. This makes investing in Colombo’s modern high-rises a popular and secure choice.

- Leasing Land or Villas: Foreign individuals cannot buy freehold land directly. However, you can secure a long-term lease for up to 99 years. A 99-year lease gives you full rights to use, develop, and live on the property for the entire term, making it a very safe and common option for buying villas or plots of land.

- Setting Up a Private Limited (Pvt) Ltd Company: For those who want full freehold ownership of land, the best route is to set up a Sri Lankan company. A 100% foreign-owned company can legally purchase land and property. While this involves more administrative work, it offers complete control and ownership.

Regardless of the method you choose, all funds for the purchase must be transferred into Sri Lanka through an Inward Investment Account (IIA) at a local bank. This ensures the transaction is transparent and allows you to repatriate your profits and initial investment when you decide to sell. To navigate the process smoothly, it is crucial to hire a reputable lawyer to conduct a title search and ensure all legal documents are in order. For a complete overview, see our guide on how to buy property in Sri Lanka from abroad.

Navigating Tax Obligations for Overseas Investors

Understanding taxes is a key part of making your real estate investment a success. For overseas investors, Sri Lanka’s tax system is straightforward but has important rules you need to follow. Handling these duties correctly will help you maximize your returns.

The main tax you will pay is on the rental income your property earns. Sri Lanka uses a progressive tax system, which means the tax rate increases as your income grows. These rates can change, but you can lower your taxable income by subtracting costs like property management fees, repairs, and utility bills. When you first purchase a property, you will also pay a one-time tax called Stamp Duty.

A major concern for foreign investors is being taxed twice—once in Sri Lanka and again in their home country. Luckily, Sri Lanka has special tax agreements with over 40 countries to prevent this. This is where good tax planning for Sri Lankan expats becomes essential to ensure you are not overpaying. These agreements allow you to credit the tax paid in Sri Lanka against the taxes you owe at home.

To bring money into the country for your purchase and to send your profits back home, you must use a special bank account called an Inward Investment Account (IIA). This process is part of the legal framework covered in our guide on how to buy property in Sri Lanka from abroad. Because tax laws can change, it is always wise to get advice from a qualified tax advisor in Sri Lanka to help manage your obligations.

References & Further Reading

- Board of Investment of Sri Lanka (BOI) – The official government agency for promoting and facilitating foreign direct investment, providing guidelines on legal structures and regulations for foreign property ownership.

- Inland Revenue Department (IRD) of Sri Lanka – The primary source for all information regarding national taxes, including Stamp Duty, Capital Gains Tax, and income tax on rental earnings.

- LankaPropertyWeb House Price Index – A leading real estate portal in Sri Lanka that provides periodic market analysis, price trends, and data relevant for estimating rental yields in Colombo, Galle, and other areas.

- Wikipedia: Land Reform in Sri Lanka – Provides historical and legislative context on land ownership laws in the country, including regulations that affect foreign nationals.